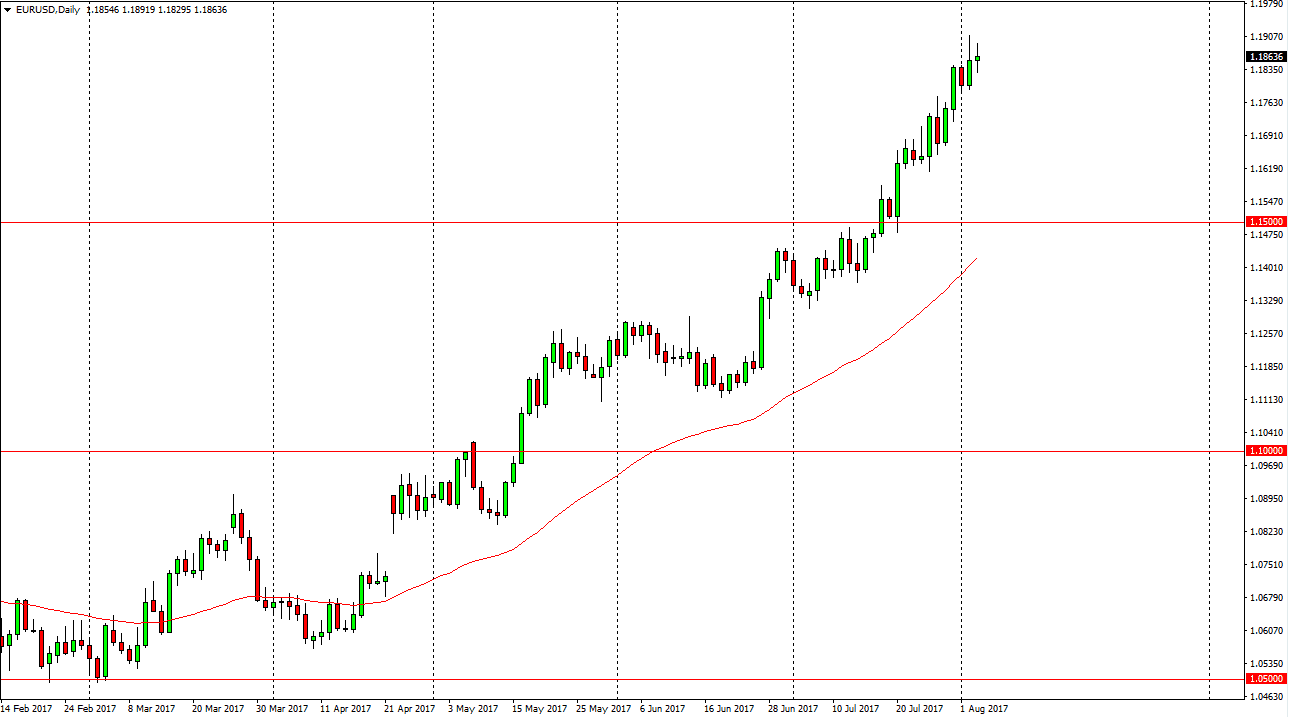

EUR/USD

The EUR/USD went back and forth during the course of the session on Thursday, as we have gotten a bit ahead of ourselves. We have the jobs number coming out today, and that of course will have a significant amount of influence on the market. I believe that pullbacks of this point in time should be looked at as buying opportunities though, so having said that I think it’s a market that’s more than likely going to offer value from time to time. I believe that the 1.15 level underneath is essentially the “floor” in the uptrend, and the jobs number today could create a pullback. That would be excellent, as I believe that we are overextended. If we rallied from here, I think that the market could go to the 1.20 level above. I do prefer buying dips though, because it offers value that can’t be found right now.

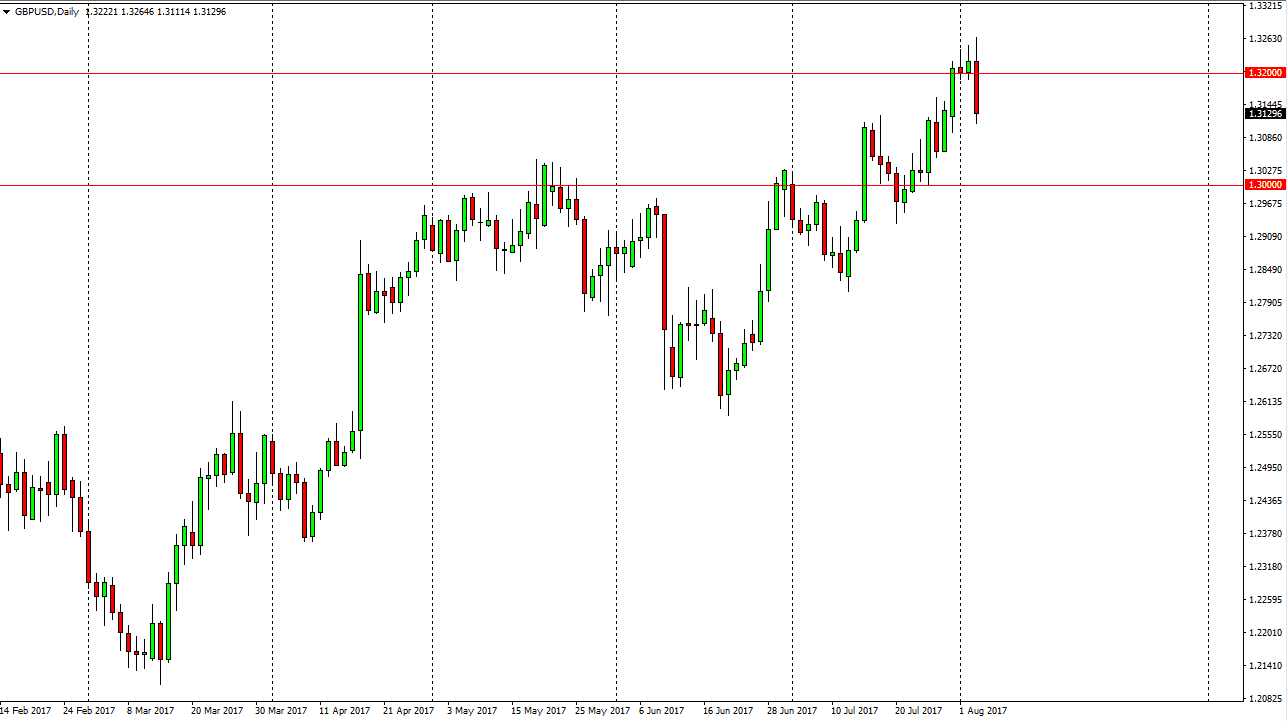

GBP/USD

The British pound initially tried to rally during the day on Thursday but then fell apart as the Bank of England suggested that interest rate hikes are coming until 2018 at the earliest. I believe that if we pull back from here, the market should find buyers, especially near the 1.30 level underneath. I’d like to see that, as it gives us an opportunity to pick up a little bit of value in this pair as well, but if we break down below the 1.30 level, the market should continue to go lower. It will be interesting, but I think that the biggest factor in this market is going to be the jobs number. Because of this, I’m hoping that the number is enough to bring us back down. All ultimately, I believe that the market is probably going to the 1.3450 level above, but will take a while to get there.