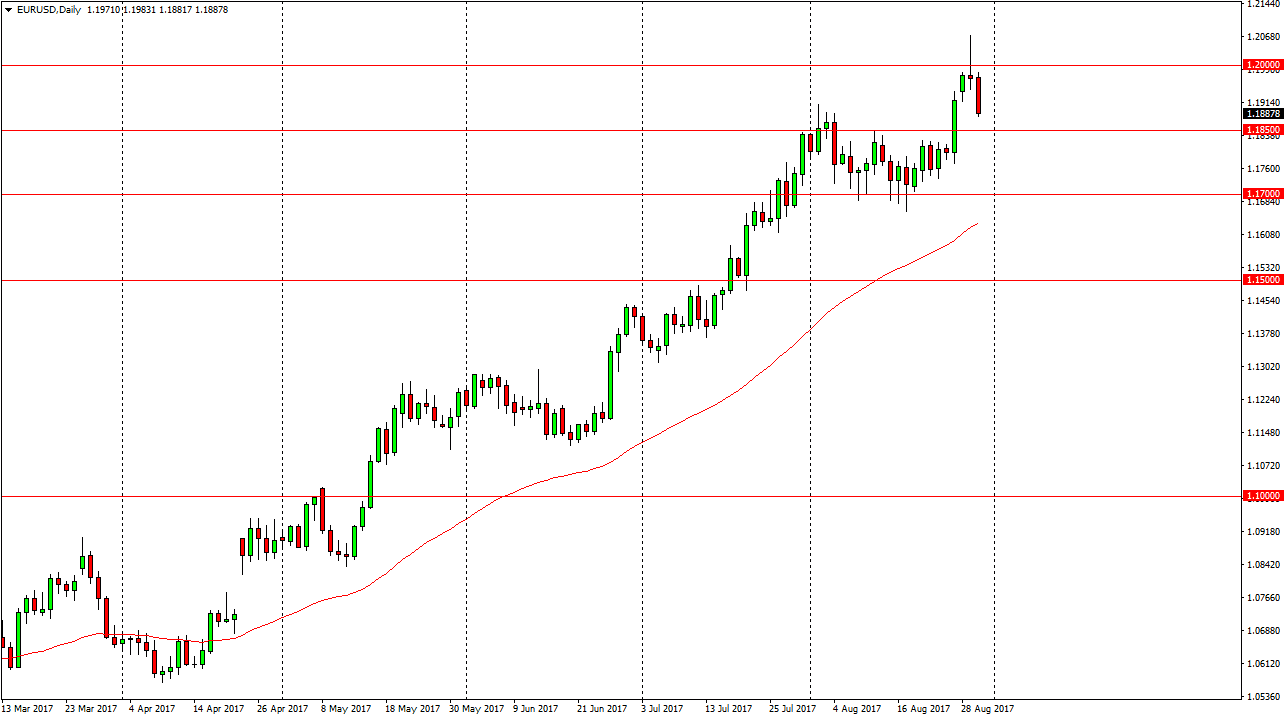

EUR/USD

The EUR/USD pair broke down on Wednesday, slicing through the bottom of the shooting star from Tuesday. That’s a very negative sign, but I see a significant amount of support below, and I think it’s only a matter of time before the buyers return. This will also be exacerbated by the Nonfarm Payroll numbers coming out on Friday, so I think the next couple of sessions might be a good opportunity to sit on the sidelines and simply wait for either the reaction to the jobs number, or some type of supportive candle to start going long based upon. I still believe that we go higher, and the pullback is due to the 1.20 level more than anything else. That’s a large, round, psychologically significant number, so it does not surprise me that the sellers came in at that point as we had gotten a bit overextended.

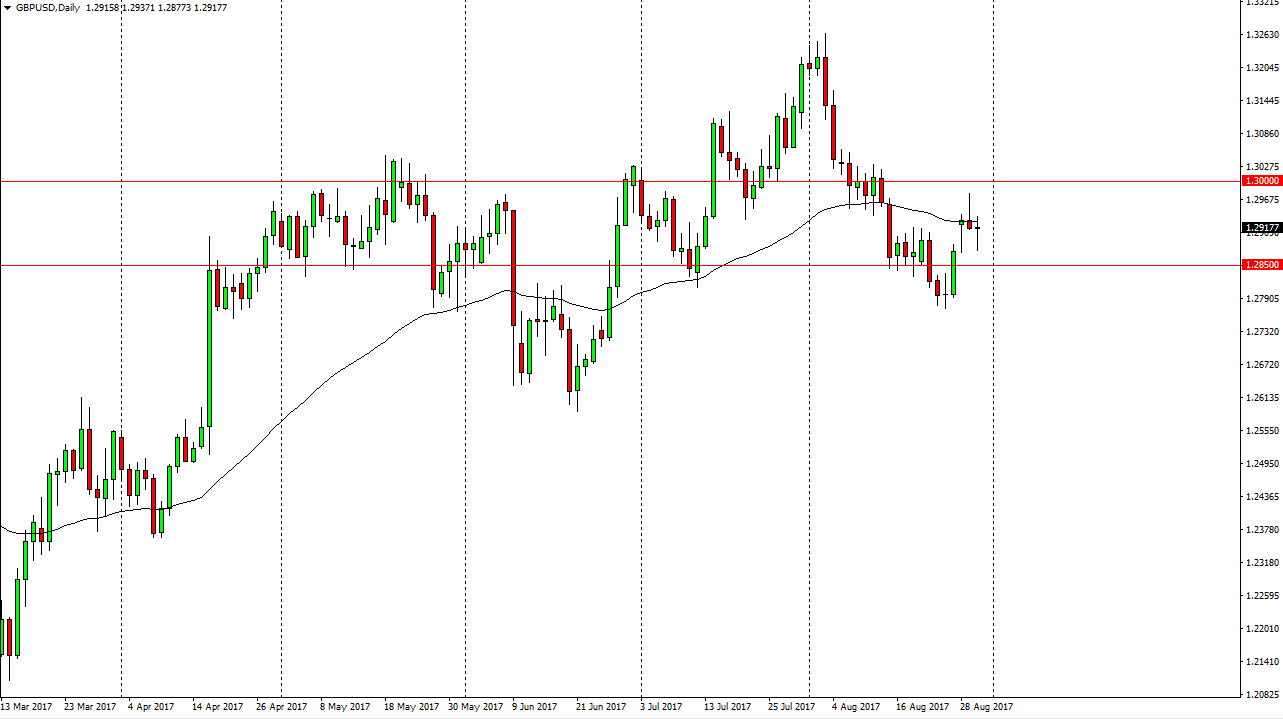

GBP/USD

I said yesterday that the British pound by go sideways, between the 1.2850 level on the bottom and the 1.30 level on the top. You can see that’s exactly what’s going on, and I think we will have very little in the way of motion between now and the jobs number. I look at this market is a binary trade though, selling if we break down below the support, and buying if we break above the resistance that I have marked on the chart. Ultimately, I think that short-term traders may bounce this market back and forth, but I don’t look for much between now and the jobs number as it will be so important. Because of this, it’s very possible I may not place a trade until Monday, after I get the complete reaction of the Friday session. If you are treating this market, I would recommend a smaller position in the next couple of sessions.