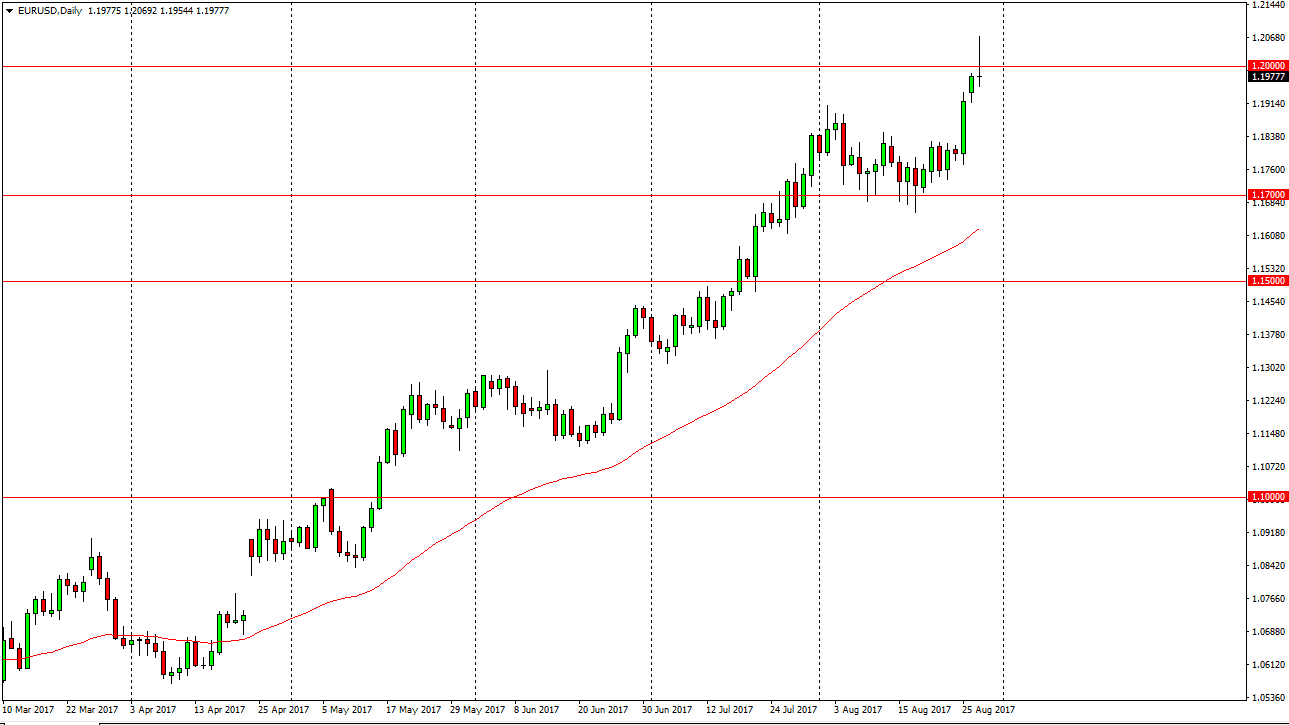

EUR/USD

The EUR/USD pair initially shot through the 1.20 level, but pulled back rather rapidly during the day. Because of this, it’s likely that the buyers will look at this as an opportunity for value, as the EUR/USD pair has been massively bullish lately. Because of this, it’s likely that the markets will continue to the upside, and based upon the recent breakout of the three-year consolidation area, I believe that this market goes to the 1.25 handle above. These pullbacks should be useful, and that being the case, I think that we are looking likely to see value hunters soon. I like buying this market, but I would add slowly, I don’t have any interest in trying to build up a huge position in one spot. Ultimately, I have no interest in shorting, because the move higher has been so aggressive. While looking at the start, you can see that there is a massive shooting star, but I still believe that the buyers are involved.

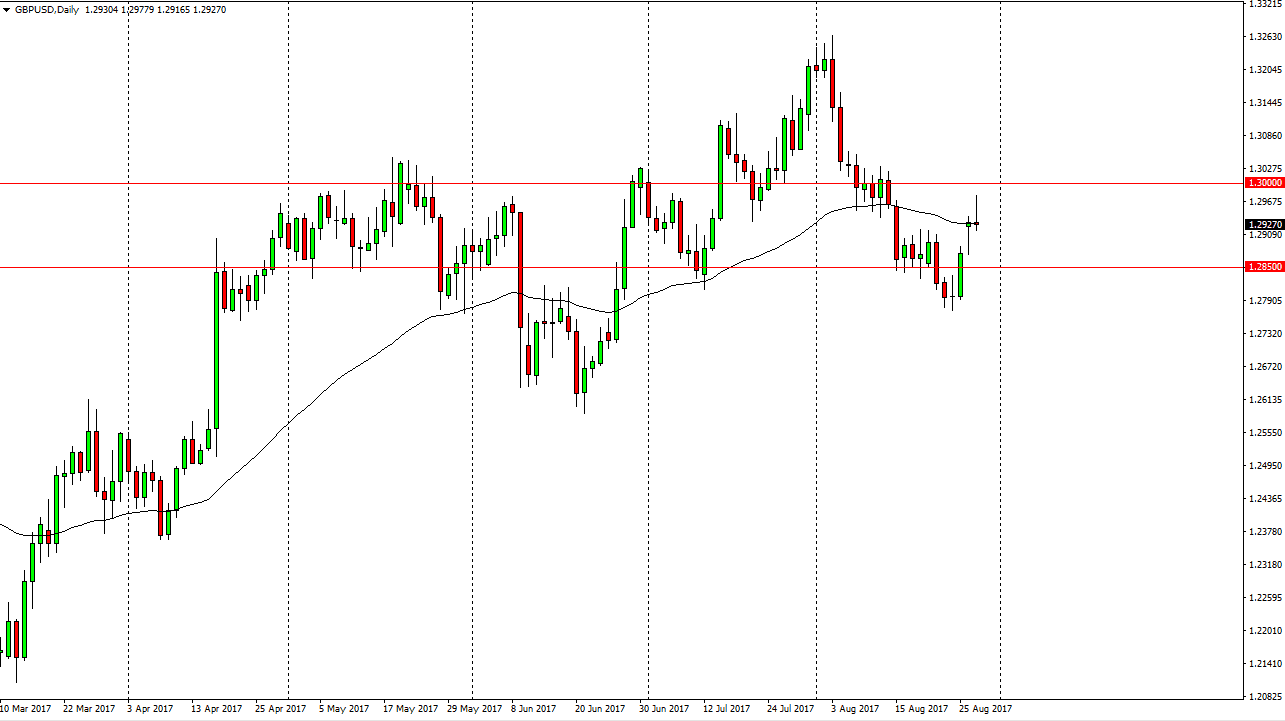

GBP/USD

The British pound initially tried to rally as well, but turned around to form a shooting star as well. I think that this market continues to bounce around in the area between 1.2850 and 1.30 going forward, as this looks like a serious conflict of momentum. Ultimately, given enough time I think that we will have to make a larger move, but this time a year is difficult to make the market move. A break above the 1.3050 level would be very bullish, but a breakdown below the 1.2850 level should have this market looking for the 1.26 level next, and then possibly the 1.25 handle. There is still a lot of concern when it comes to the British pound, as the exiting of the European Union ways upon that economy.