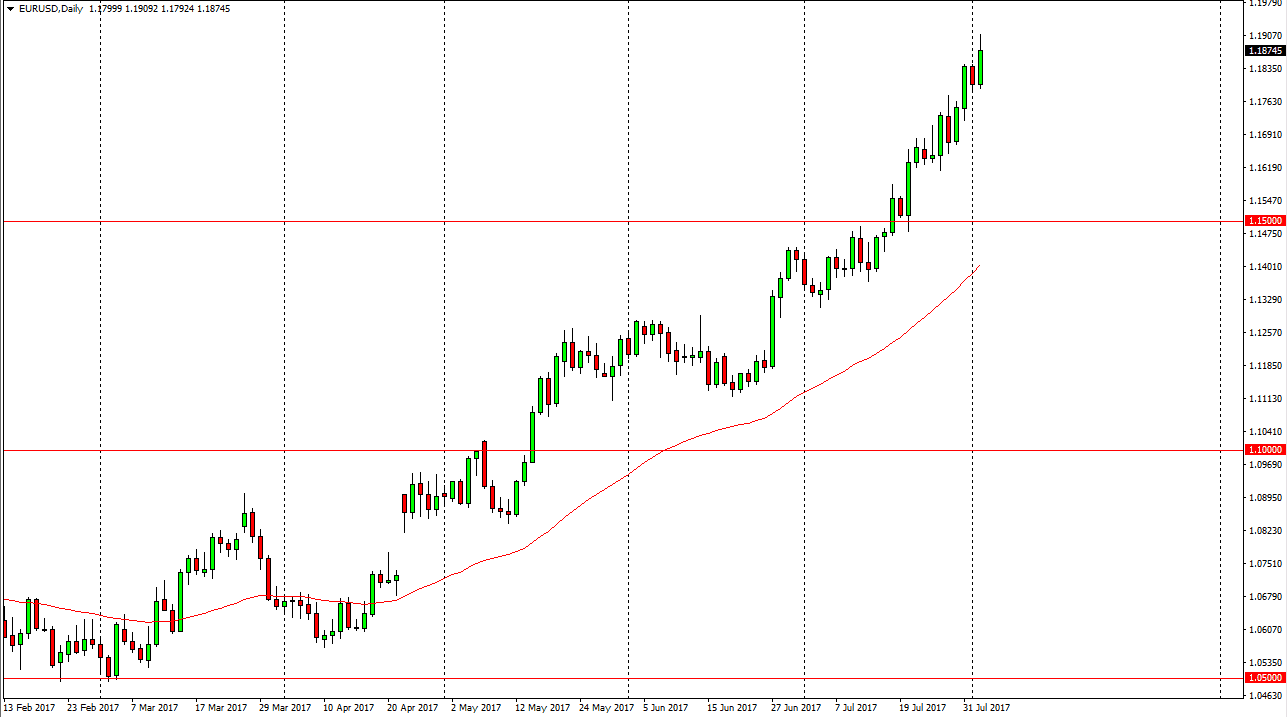

EUR/USD

The EUR/USD pair rallied during the day on Wednesday, as we broke towards the 1.19 level. However, we did pull back a little bit later in the day, and by any metric that I measure this pair, we are overbought. I think the given enough time we should see buying opportunities underneath on supportive candles, and quite frankly if you are not involved in this market currently, it’s probably best to simply wait for pullbacks so that you can pick up some value. With the jobs number coming out tomorrow, it’s likely that we will see volatility as well, so therefore I am hoping for a significant pullback. The 1.20 level above is massively resistive of course, as it is a large, round, psychologically significant number. Because of this, I am patiently awaiting some type of support a pullback that I can take advantage of.

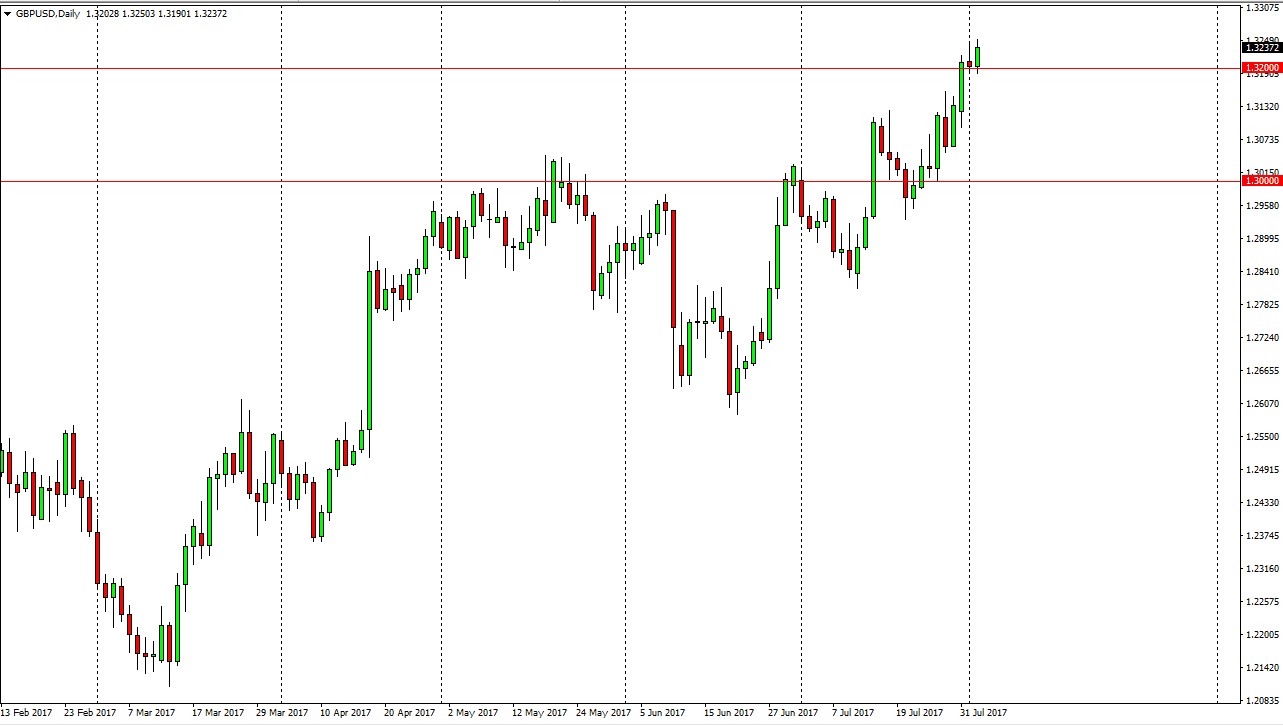

GBP/USD

Alternately, I believe that the British pound isn’t nearly as overbought as the EUR/USD pair is. Because of this, I am looking for pullbacks as buying opportunities but I also recognize that a break above the top of the daily range could be bullish as well. However, today features the Bank of England Interest Rate decision, so we could get a bit of noise due to either the announcement, or more likely, the accompanying statement. I think that there is significant support at the 1.32 handle, and most certainly significant support at the 1.30 level below. I believe that the market is going to the 1.3450 level, so I’m a buyer of dips as it should give us plenty of opportunities to pick up value going forward. The jobs number comes out tomorrow, so that of course makes quite a bit of volatility in the markets, so therefore we may have to wait a couple of days to get value.