By: DailyForex.com

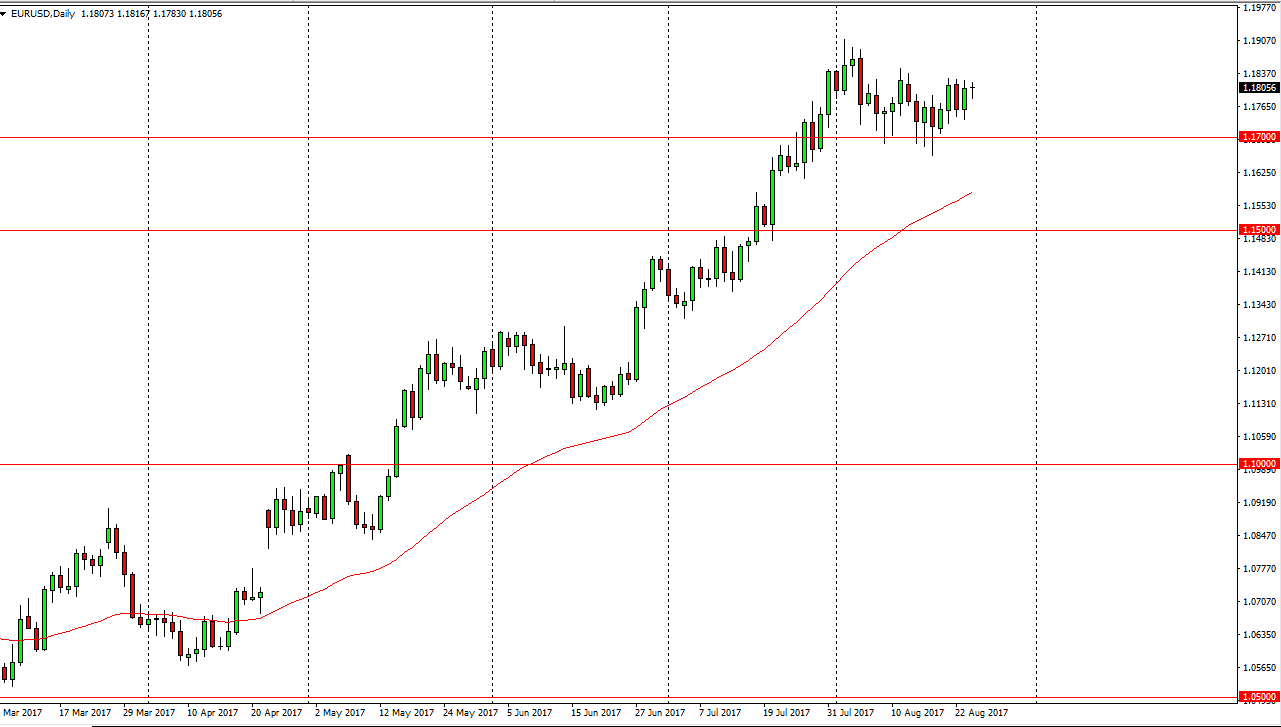

EUR/USD

The EUR/USD pair had a very quiet session on Thursday, as we continue to see this market offer buyers underneath. With the speeches by both Janet Yellen and Mario Draghi during the day, it’s likely that this will be the focus of the Forex world. When you look at this chart, I believe that this market is forming a bullish flag, and it’s likely that we will break out to the upside after the statements during the day, especially if Mario Draghi does not mention the value of the currency itself. The 1.17 level underneath should be supportive, and I think it based upon the bullish flag, we should probably go looking towards the 1.20 level above. Longer-term, I still think we go to the 1.25 handle based upon the breakout of a massive consolidation area that went back 3 years recently.

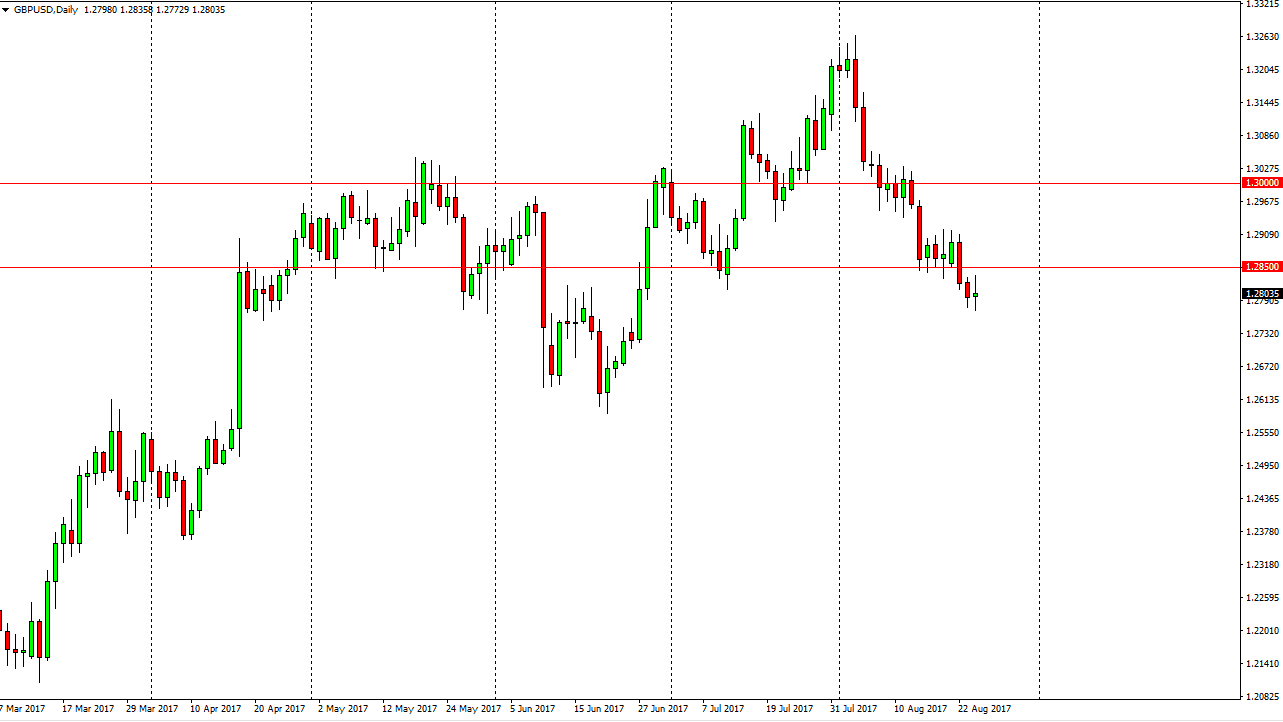

GBP/USD

The British pound had a choppy yet neutral day during the session on Thursday, as the 1.2850 level has held as resistance. Because of this, I believe that this market continues to go lower from here, perhaps reaching towards the 1.2650 level underneath. Given enough time, the market probably breaks down below there and reaches towards the 1.25 handle after that. As far as buying this market is concerned, I don’t have much in the way of interest until we break above the 1.3050 level, something that I do not anticipate seeing anytime soon. There are still a lot of concerns when it comes to the United Kingdom leaving the European Union, so it’s not to take much to get traders afraid of owning the British pound going forward. Because of this, I believe that this market will lag the EUR/USD, even if it does rally from here.