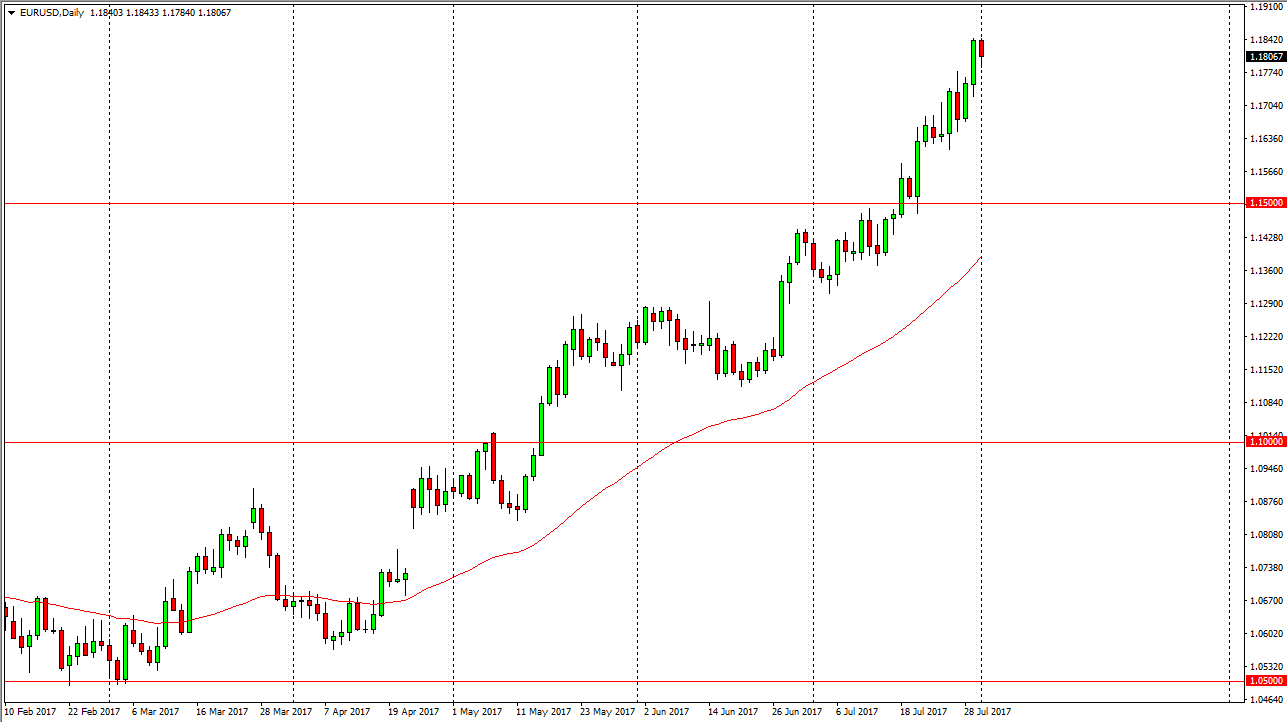

EUR/USD

The EUR/USD pair fell during the session on Tuesday, as we had gotten a bit of a head of ourselves. The market being overextended should have sellers jumping back in, or at the very least profit-taking. I believe that the 1.15 level underneath should continue to be the “floor” in the market, and with this being the case I think that it’s only a matter of time before the buyers return on that pullback. I am not willing to buy this market, because quite frankly the bullish pressure is intense. However, we are overbought so what I’m going to do is look for some type of supportive candle at lower levels to take advantage of the longer-term uptrend that we have seen. I believe that given enough time we should find value in this market, but we certainly don’t find it near the 1.18 handle.

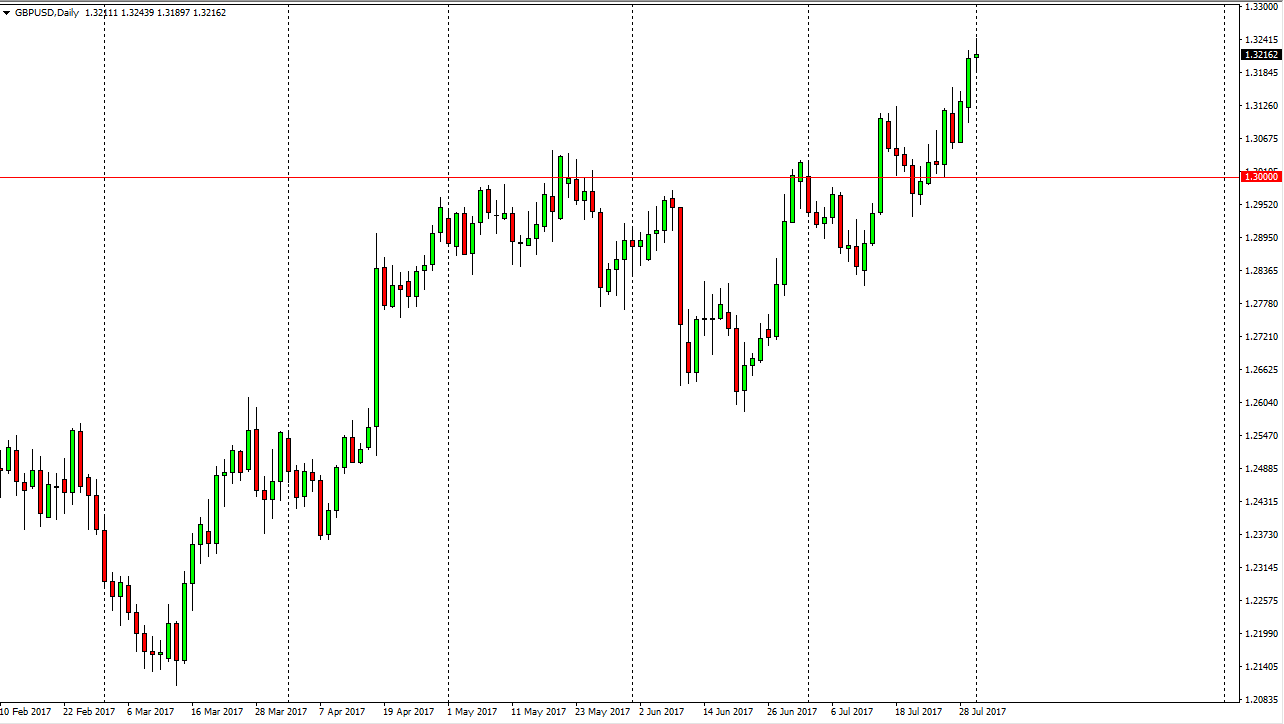

GBP/USD

The British pound initially tried to rally but ended up forming a neutral candle. In fact, the candle looks somewhat like a shooting star so I think that the sellers may return. This pullback should find plenty of support near the 1.31 handle, as we continue to stare step higher. I have no interest in shorting this market until we break down below the 1.2950 level, and although it looks like we’re going to fall from here, I don’t have any interest in trying to front run that move. I think there should be plenty of support underneath, so I’m waiting to form a daily candle that look supportive that I can take advantage of. Longer-term, I still believe that this market is going to go to the 1.3450 level above, which is the top of the previous consolidation area. Ultimately, I’m a buyer.