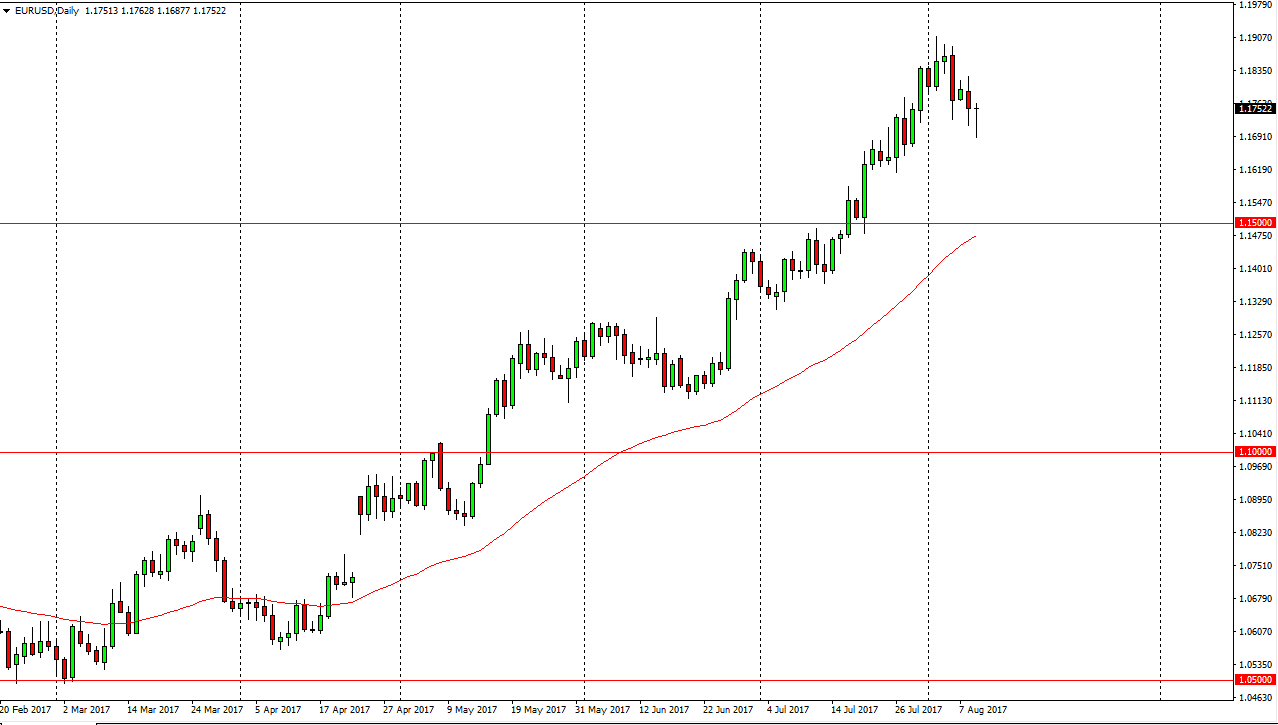

EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, but found enough support underneath the 1.17 level to bounce and form a nice-looking hammer. If we can break above the top of the hammer, the market should then go to the 1.19 level. I don’t have any interest in shorting this market, and if we were to break down below the hammer during the session on Wednesday, I think we will go looking for support at the 1.16 level, and then eventually the 1.15 level. Ultimately, I do think that we go higher, but it’s very unlikely that it’s possible to sell this market until we break down below the 1.15 level, as there is so much in the way of support at that level as it was massively resistive. I believe that this is more or less a “buy on the dips” type of market.

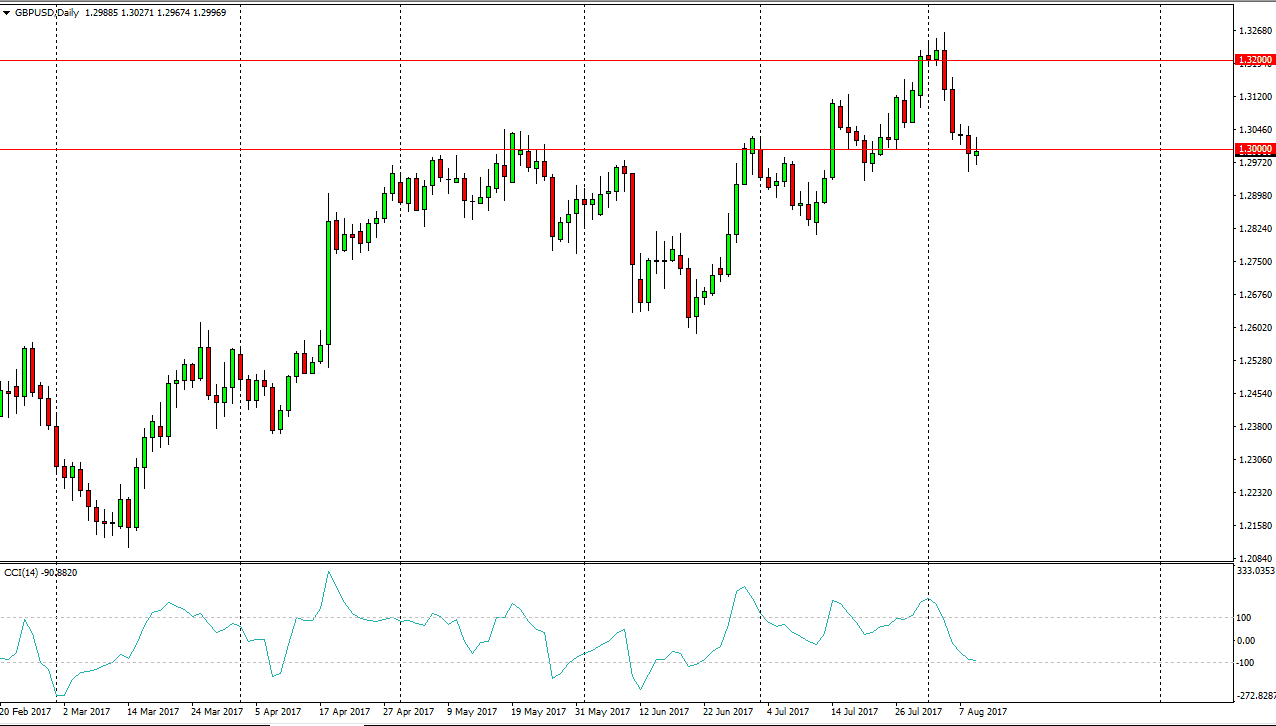

GBP/USD

The British pound had a choppy session during the Wednesday session as well, testing the 1.30 level. That’s an area that has previously been resistive, and should hold as support. If we can break above the 1.3050 level, the market should then go looking for the 1.32 handle after that. Alternately, if we break down below the bottom of the hammer like candle on Tuesday, this market could drop down to the 1.2850 level. That’s an area that should continue to offer support though, and I think it would be a nice short-term selling opportunity. Currently though, I think that there is likely going to be more bullish pressure than bearish, but I will have to wait for some type of confirmation in order to place my trade. We will continue to have headline risk, due to the negotiations between the European Union and the United Kingdom.