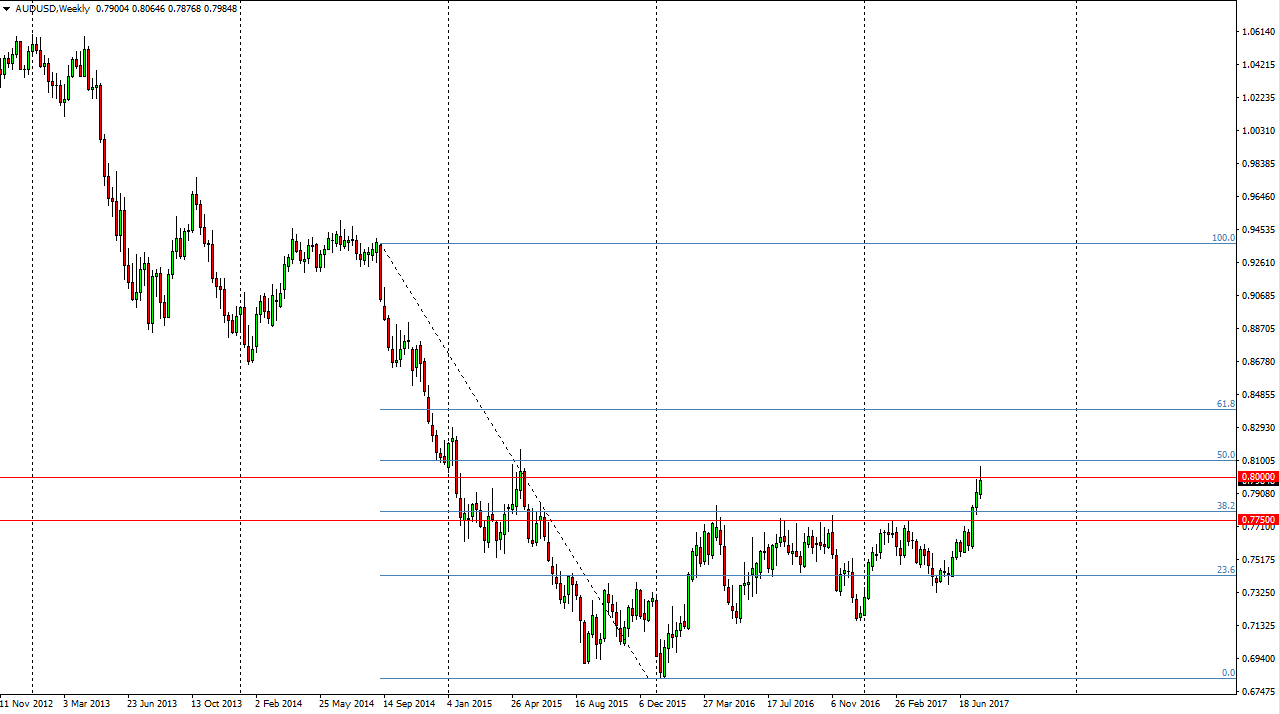

The Australian dollar had a very bullish July, as we have sliced through the 0.7750 level, and then broke above the 0.80 level. We did pull back a bit at the end of the month, but having said that it’s likely that this exhaustive candle will eventually be broken to the upside. You can see that just above the 0.81 handle, we have the 50% Fibonacci retracement level from the most recent selloff in this market. I recognize that the Australian dollar continues to benefit from several different situations, as the gold markets rally, due to a softening Federal Reserve. That should continue to lift gold, and by proxy, the Aussie. I don’t have any interest in shorting, as I believe that the market underneath is well supported.

Buying dips above the 0.7750 level

I believe that every time this market dips, and will offer value. Looking at short-term charts should give you opportunities to go long, as I believe that the gold markets are going to go looking for the $1300 level. If we were to break above there, the market should continue to go straight out. I think that the 0.7750 level underneath is the “floor” in the market, and as long as we stay above there I think we go higher. On top of that, when you look at the last couple of years, and almost looks like we are going to form an ascending triangle. Because of this, if we break above the 50% Fibonacci retracement level, I think we will then go to the 61.8% Fibonacci retracement level, and then eventually retrace the entire selloff. Pay attention to Asia, the Chinese demand for commodities has been accelerating, and as you may or may not know, Copper markets have rallied significantly. The Australian dollar is also influenced by that market as well.