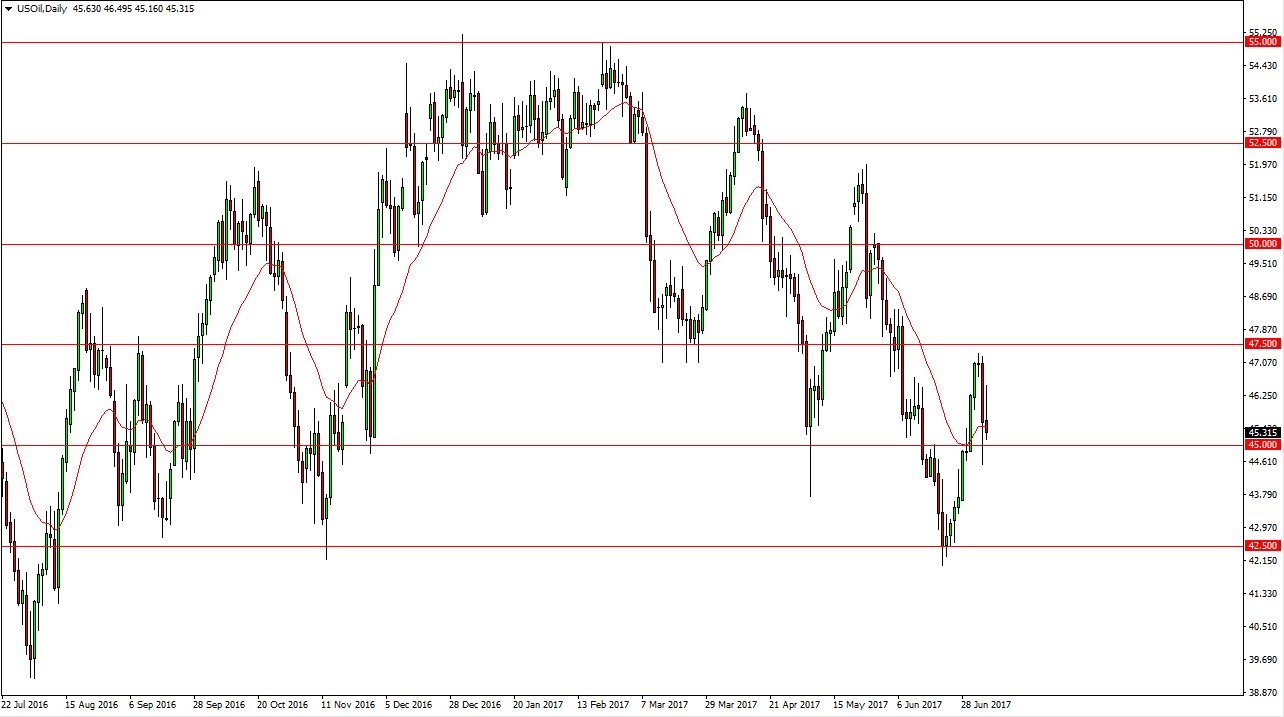

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the session on Thursday, as we had a stronger than anticipated withdrawal of crude oil inventory announced. However, I think that the market will eventually break down below the $45 level, and when it does it’s time to start selling again. The jobs number of course will have an influence on what happens with the oil markets as it influences on the US dollar. The stronger the US dollar, typically the more pressure that we see in this market. The $42.50 level is my next target, and if we rally from here, I think that signs of exhaustion should be selling opportunities as well. I have no interest in buying this market, and I believe that the $47.50 level above is massive resistance.

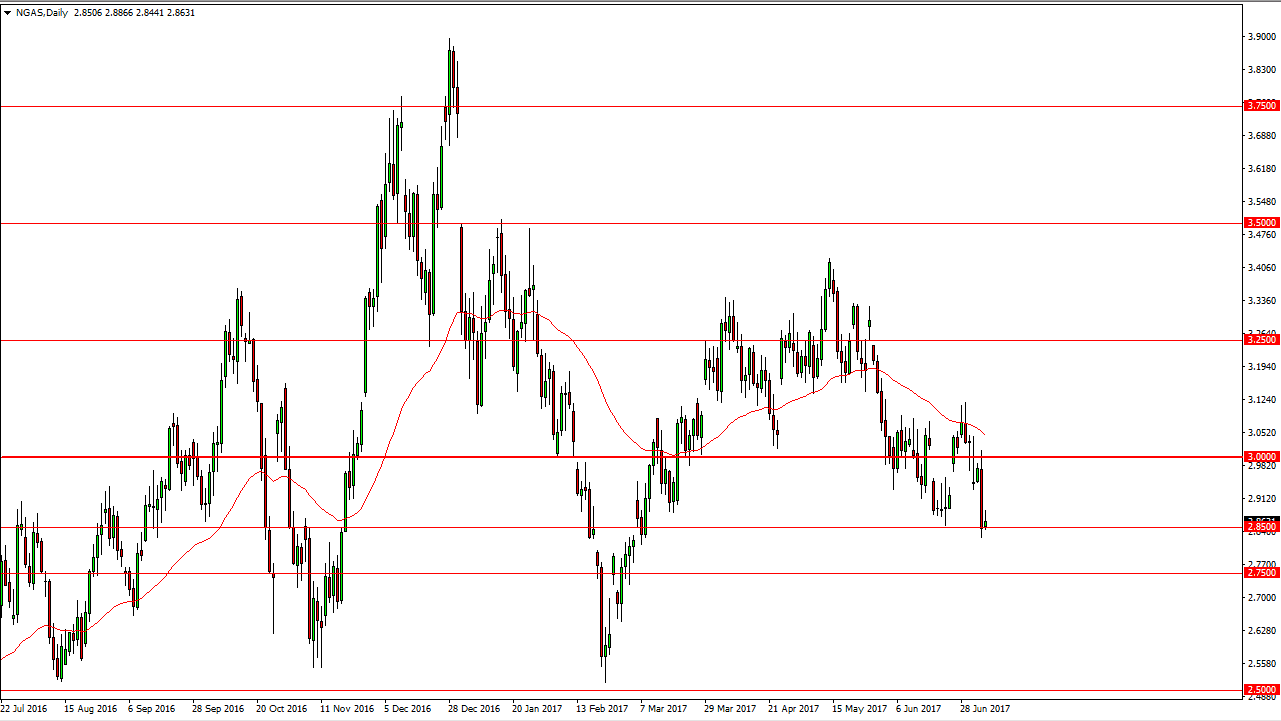

Natural Gas

Natural gas markets rallied during the day on Thursday, but turned around to form a bit of a shooting star as we sit upon the $2.85 level. A breakdown below the market lows for the session on Thursday would send this market much lower, perhaps reaching towards the $2.75 level. Below there, the market should then go to the $2.50 level underneath. A breakdown below that is an absolute catastrophe for natural gas markets. Alternately, if we rally from here, I believe that the $3.00 level is massively resistant, and then of course should continue to bring in selling pressure. The oversupply of natural gas is a systemic issue, and that being the case I think it’s only a matter of time before the sellers jump in every time we do try to rally. I prefer selling, and I believe that every time the market sells, it’s an opportunity to start adding to this downward move.