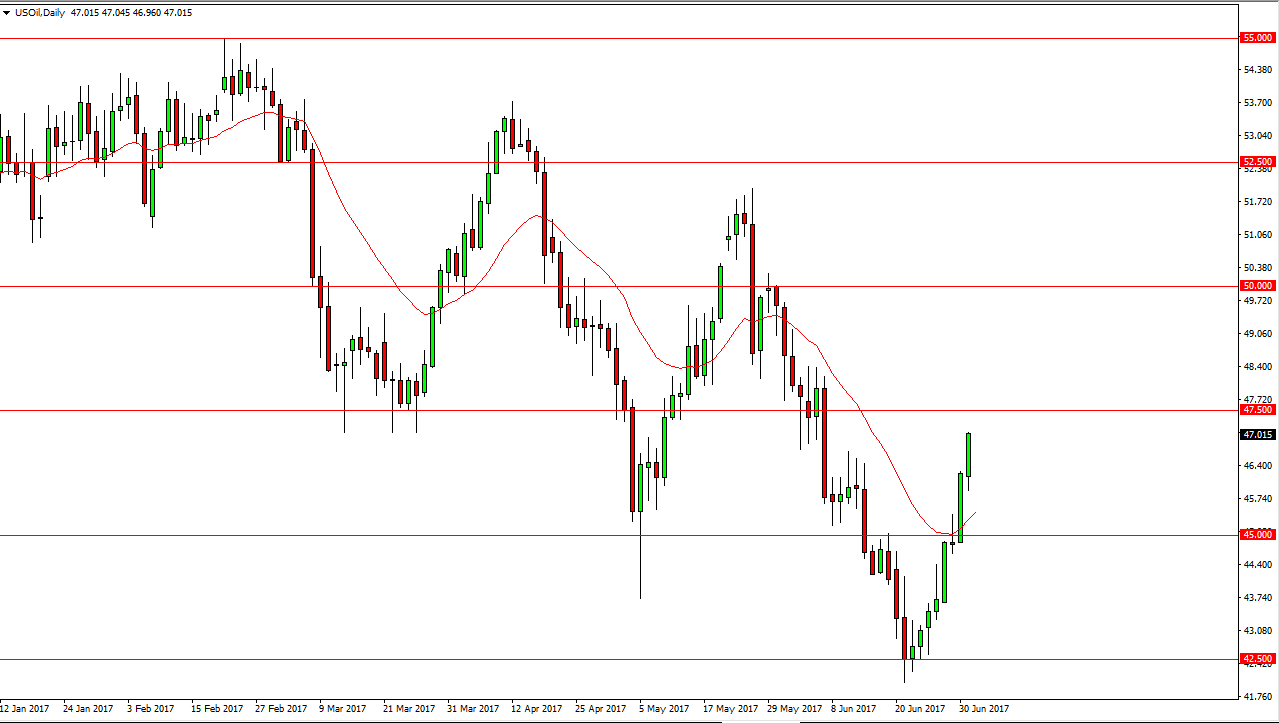

WTI Crude Oil

The WTI Crude Oil market initially fell on Monday, but found buyers below to turn things around and closed towards the top of the range. Because of this, looks as if there is going to be a bit of follow-through, but I think that the $47.50 level will offer significant resistance. I am waiting on and exhaustive candle to start selling off the daily chart. Ultimately, I believe that the market will find itself being overbought and overextended, so I think that the buyers will start to become very aggressive. Ultimately, the $45 level will be targeted if we do roll over. Given enough time, I think we not only do that, but eventually break down below there as well. The $50 level above would be the next target if we continue to break to the upside.

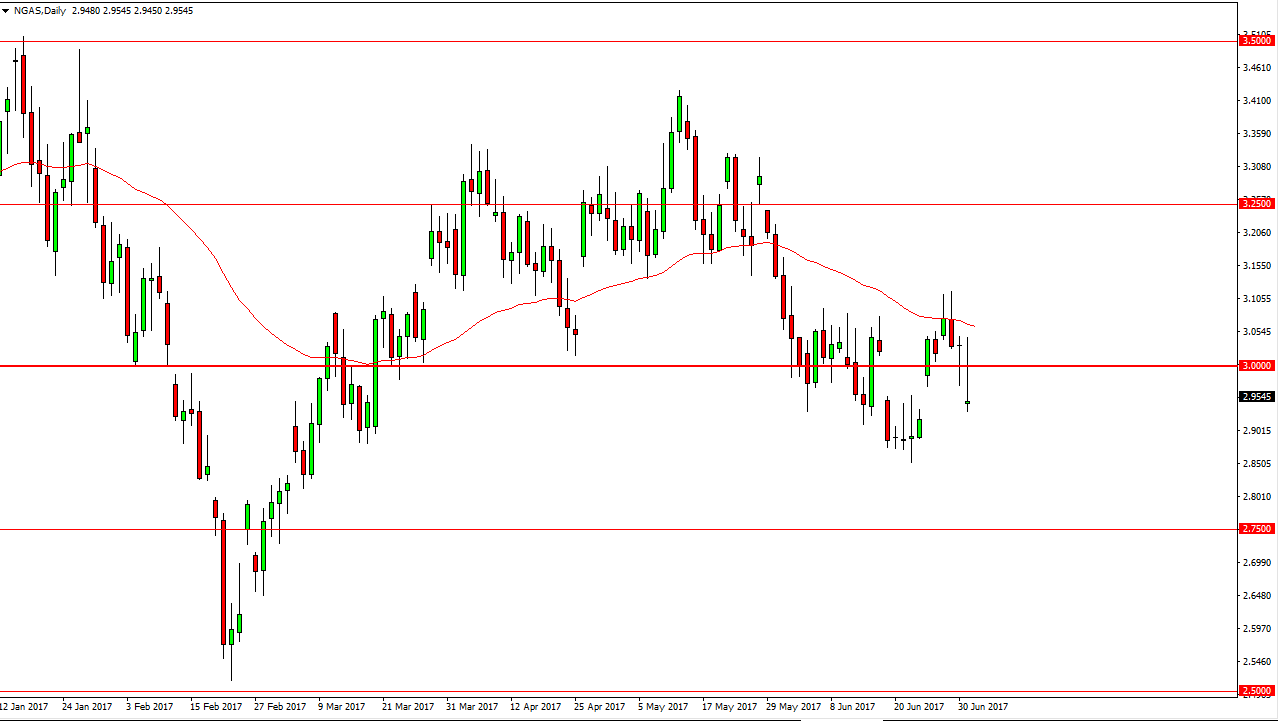

Natural Gas

The natural gas markets tried to rally during the day on Monday, but turned around to form a shooting star. Because of this, I believe that the bearish pressure and the natural gas markets will take over again, and this should send the natural gas markets looking for the $2.85 level, and then eventually the $2.75 level after that. Rallies should continue to be selling opportunities as we are oversupplied, and there is no sign of that changing anytime soon. With this being the case, I am a “so only” trader, and have no interest in buying this market as I believe eventually the overall bearish fundamentals will take over. I also recognize that the Americans will be gone for Independence Day during the session today, and that should keep the markets very thin, and very dangerous to deal with. I am a seller, and don’t see anything changing anytime soon.