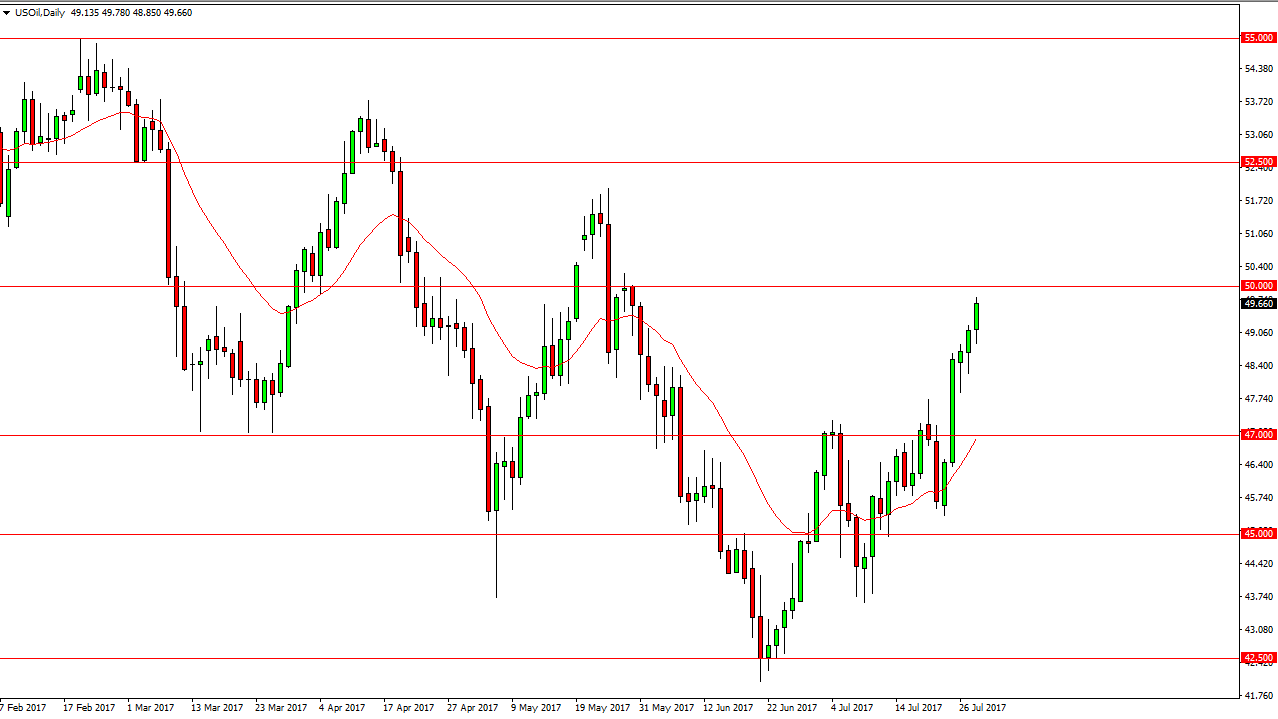

WTI Crude Oil

The WTI Crude Oil market fell slightly during the day on Friday, but turned around to show signs of support. Ultimately, this market looks as if it is going to reach towards the $50 level, as it is a large, round, psychologically significant number. This is an interesting turn of events, because I believe a lot will be decided at the $50 handle. If we can break above there, the market probably goes looking towards the $52.50 level. Alternately, and exhaustive candle could be a nice selling opportunity as we have gotten a bit overbought. Longer-term, I am bearish but I also recognize that there are a lot of noises out there in the market that will continue to move oil.

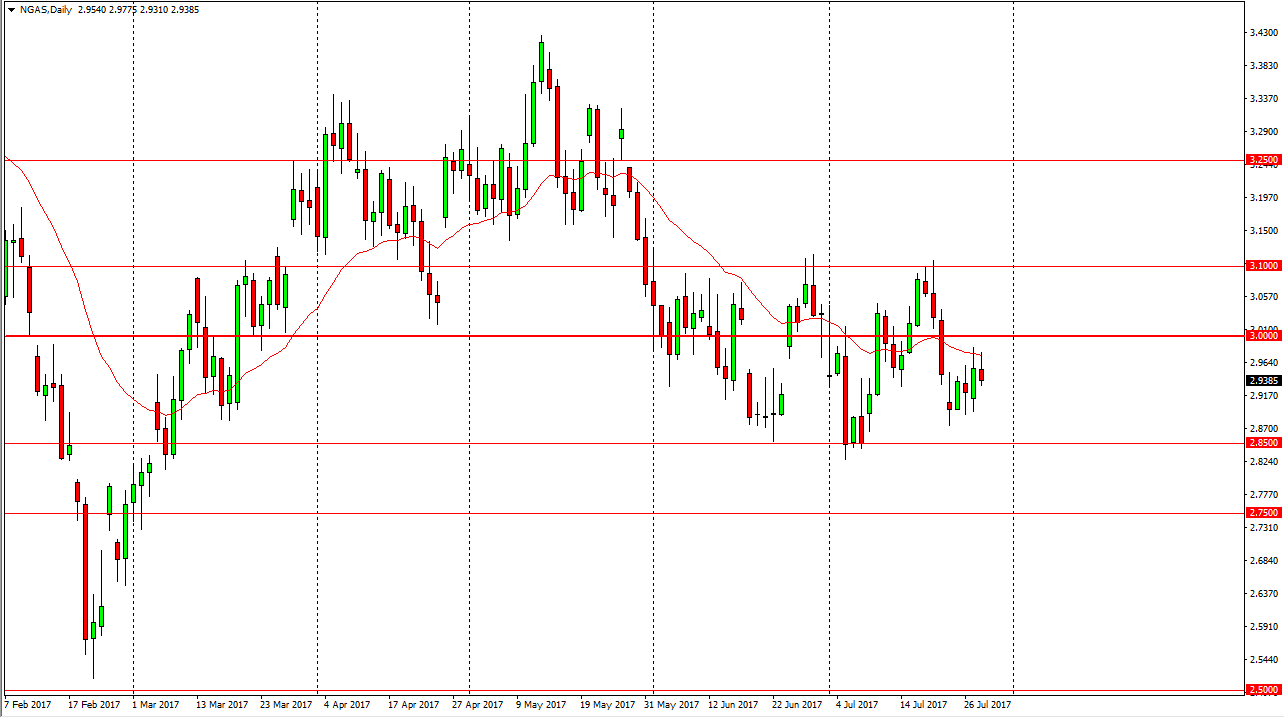

Natural Gas

The natural gas markets initially tried to rally during the day, but then turned around to form and exhaustive candle. The market looks as if it is ready to fall from here, perhaps reaching down towards the $2.85 level. If we can break down below there, I think that the market should then go to the $2.85 level, and then eventually the $2.75 level after that. I don’t have any interest in buying, I believe that the $3 level is significantly resistive, and it extends all the way to the $3.10 level. Selling rallies continues to be the best way to trade this market as far as I can see, and I don’t see that changing anytime soon. Quite frankly, I don’t like natural gas as we are oversupplied, and that should continue to be the case for years, if not decades. Eventually, I think that we can break down to the $2.50 level, which was the ultimate low on 2017. If we did break above the $3.10 level, I think the market could go looking towards the $3.25 level above, which is even more resistive.