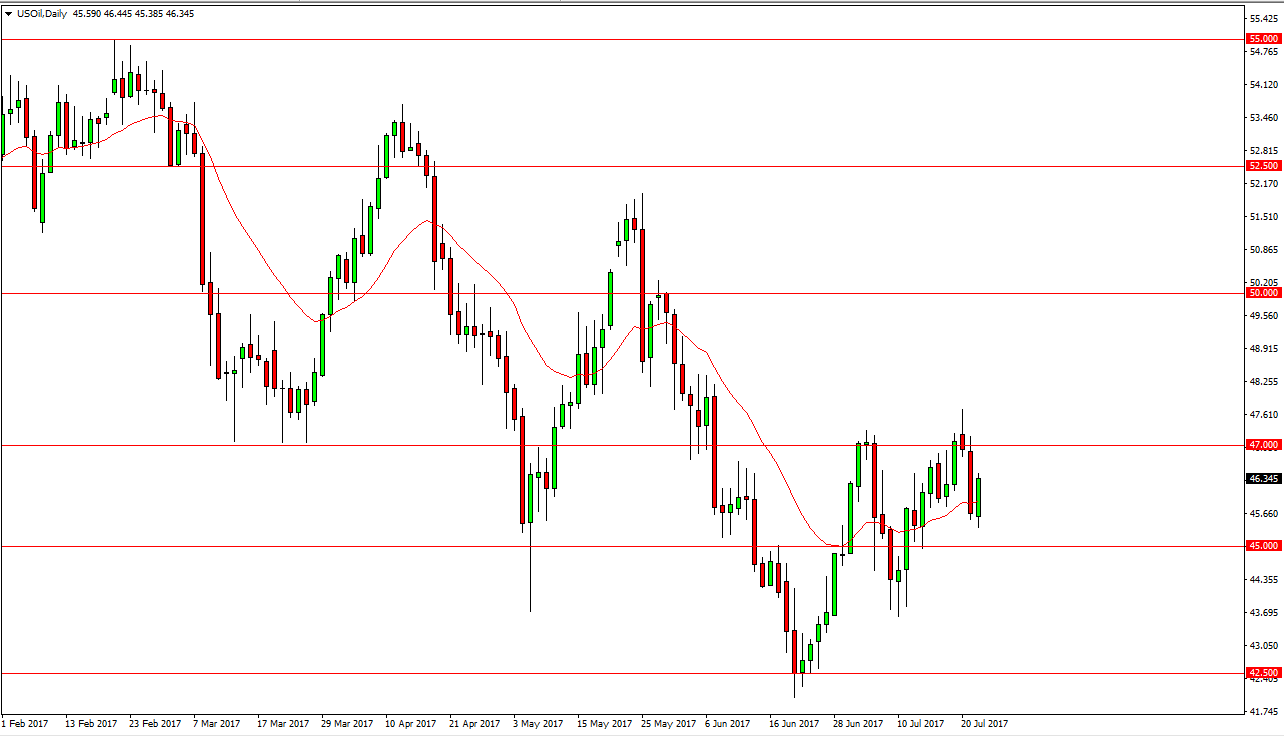

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Monday, showing signs of resiliency again after the Saudi Arabian ministers suggested that they are willing to cut production even further. However, I see a significant amount of resistance at the $47 level, and therefore I think that it’s difficult that the market will continue to rally with any significance. If we can break above the $41.75 level, then the upward motion in the market will only accelerate. Given enough time, I believe that there are sellers coming back and reach towards the $45 level underneath. A breakdown below there could send this market much lower, and I do think that enough time goes by that we will see sellers take over again. Even if the market does rally, I believe that the Americans are more than willing to fill the gap left by the salaries when it comes to production. Because of this, I believe any rally is short-lived.

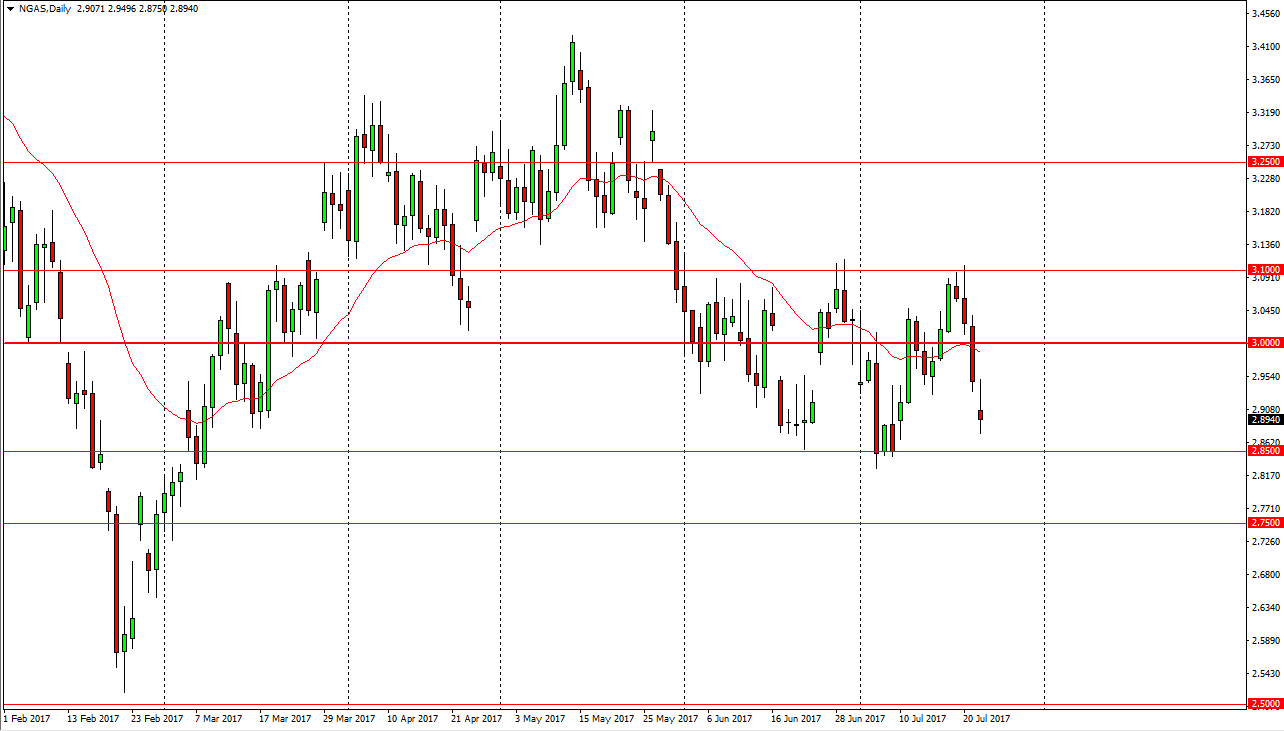

Natural Gas

Natural gas markets gapped lower at the open on Monday, but then bounced enough to fill the gap. The shooting star that formed for the day suggests that we are going to go looking for the $2.85 level, and I think that it’s only a matter of time before we get there. Ultimately, the market should break down below the $2.85 level and go looking towards the $2.75 level. I have no interest in buying, as the $3.00 level above should be massively resistive. That is an area that I think Sirs a significant amount of psychological resistance, but even if we break above there I think the top of that resistance is closer to the $3.10 level. There is for too much in the way of oversupply, and I think that will continue to work against the value of this market.