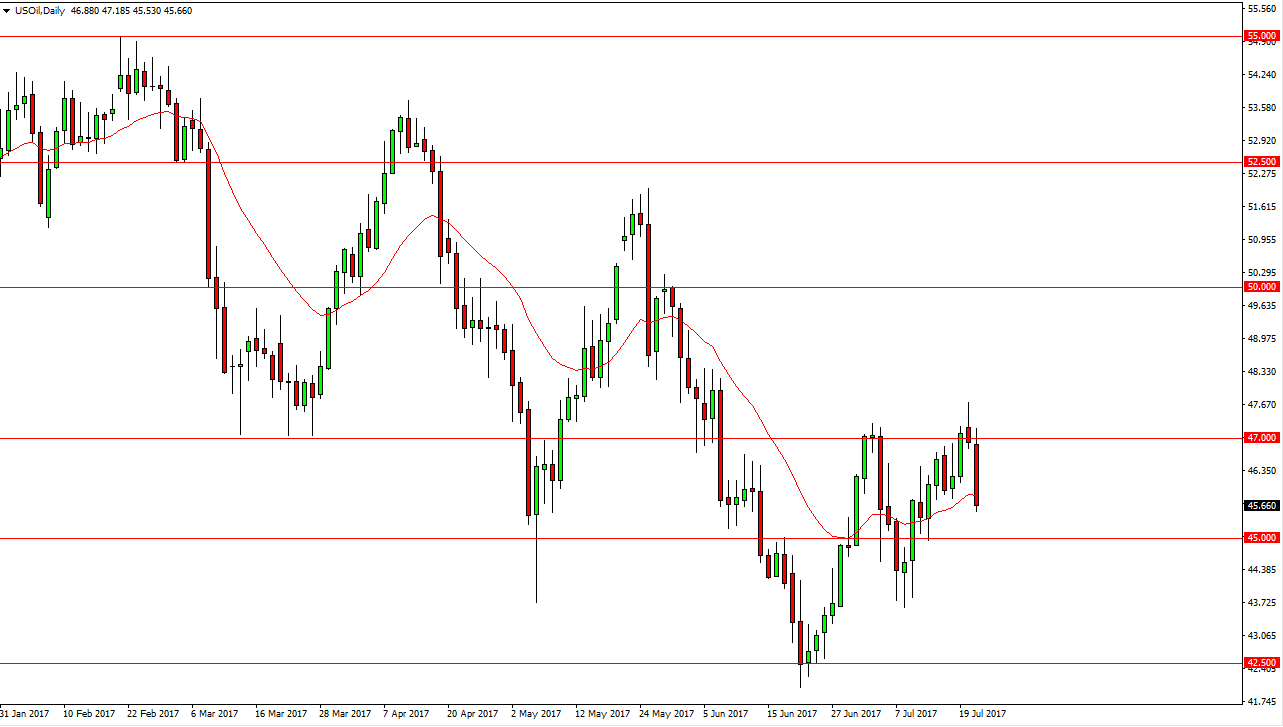

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Friday but found enough resistance at the $47 level. We fell significantly from there, slicing through the $46 handle. It looks very likely that we are going to continue to grind lower, although I recognize that the $45 level underneath will probably cause a bit of support. Once we get below there, I think that the market probably goes towards the $43.50 level. This market continues to have an overhang of supply, even though we have seen some fight back from the OPEC and other players in the market that continues to dominate the headlines. I don’t think that the market can be bought, I look for reasons to sell this market and signs of exhaustion. Longer-term, I suspect the crude oil is going much lower.

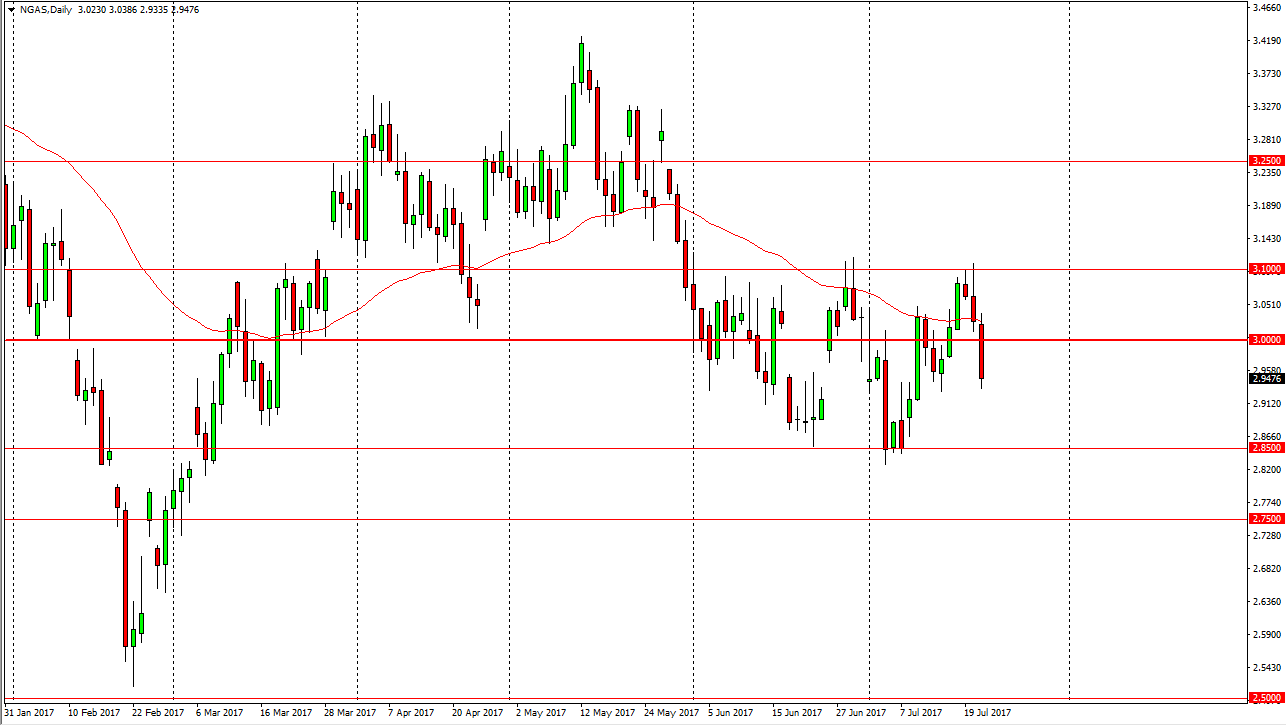

Natural Gas

Natural gas markets slicing through the $3.00 level during the day suggests to me that we are ready to go back towards the bottom of the recent consolidation which I see as the $2.85 level. I think that short-term rallies or selling opportunities, as the oversupply natural gas is well documented. I live in an area that does a lot of fracking for natural gas, and quite frankly I can tell you from personal experience we have more than enough. Every time this market rallies, I look for a selling opportunity which so far has worked quite well during the year. I think the given enough time we will not only go towards the $2.85 level, but I think we will break down below that level and reach towards $2.50. I have absolutely no interest whatsoever in trying to buy this market, because quite frankly the oversupply of natural gas continues to get worse, not better.