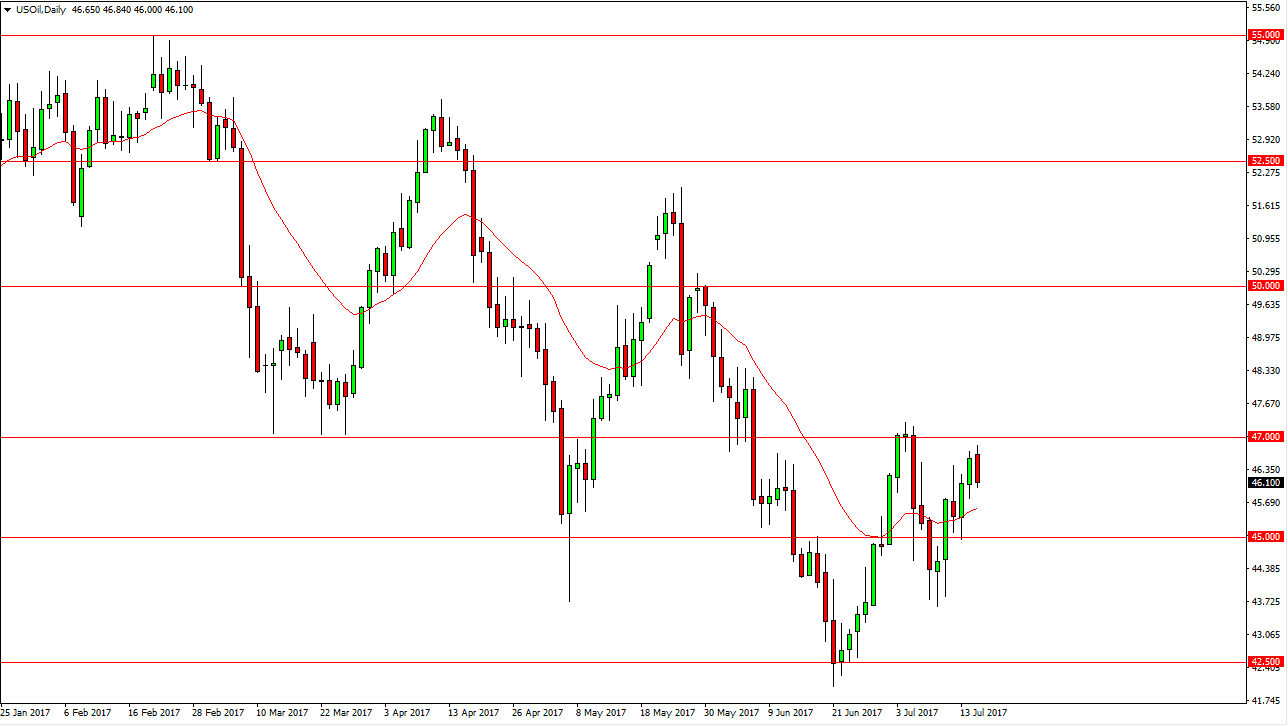

WTI Crude Oil

The WTI Crude Oil market rallied at the beginning of the session on Monday, but found the area near the $47 level to be far too resistive. Because of this, we pulled back to the $46 level, and I think that the market will probably go down to the $45 level which I believe is much more important. If we cannot break above the $47 level, it looks likely that the market will start to roll over and start reaching towards $45 as it is a “lower high.” Alternately, if we were to break above $47, I think that the market could continue to go higher, perhaps $48.50. Ultimately, I think that there is a massive oversupply of crude oil the market, so it’s very unlikely that any rally will be sustained.

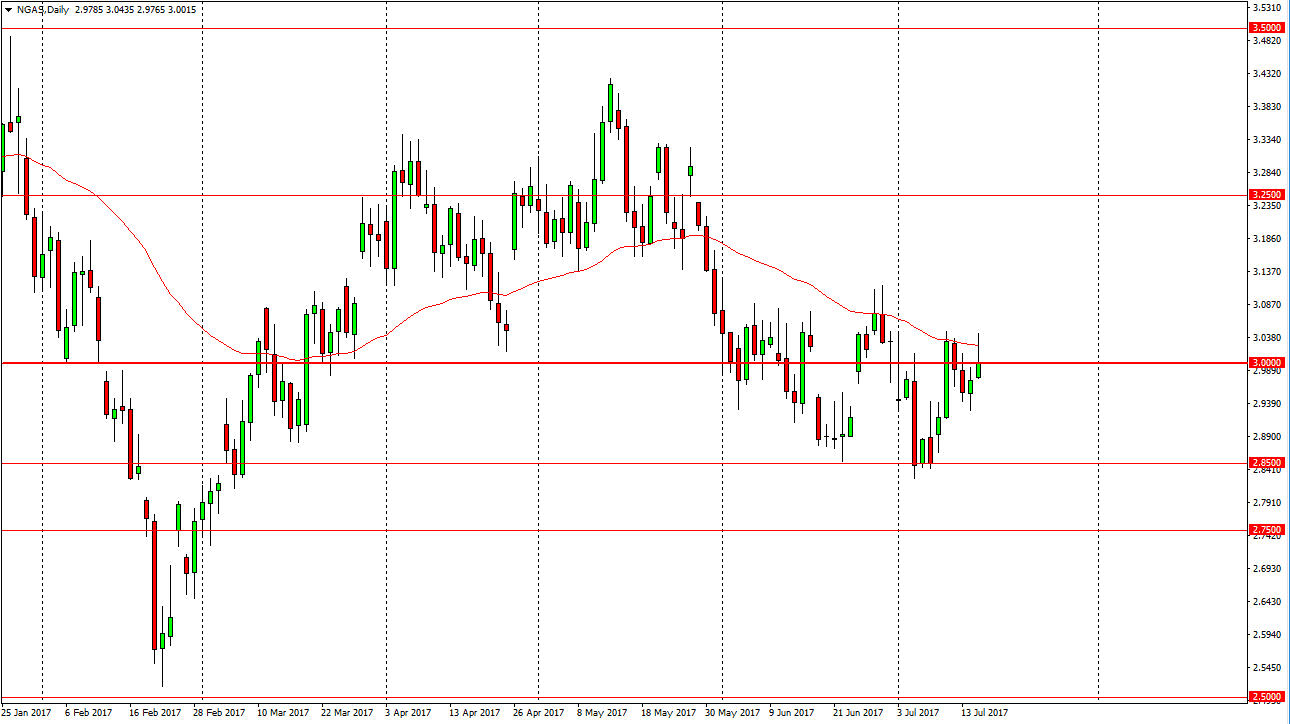

Natural Gas

The natural gas markets initially tried to rally on Monday, but as you can see the 50-day exponential moving average formed a shooting star. Ultimately, this is a selling opportunity, and a breakdown below the bottom of the range for the day it would be an opportunity to reach down to the $2.85 level. That’s my target and the short-term, but I believe we will break down below there as well. Natural gas is oversupplied, and a massive amount of natural gas continues to be the biggest issue. I think that the market is a “sell the rallies” type of situation, and therefore have no interest in buying. I believe there is a massive amount of resistance at the $3.12 level. Ultimately, this market I think is a long-term “sell rallies” situation overall, just as gold was in the 1980s. Even if we were to break above the $3.12 level, there is even more resistance near the $3.25 level above.