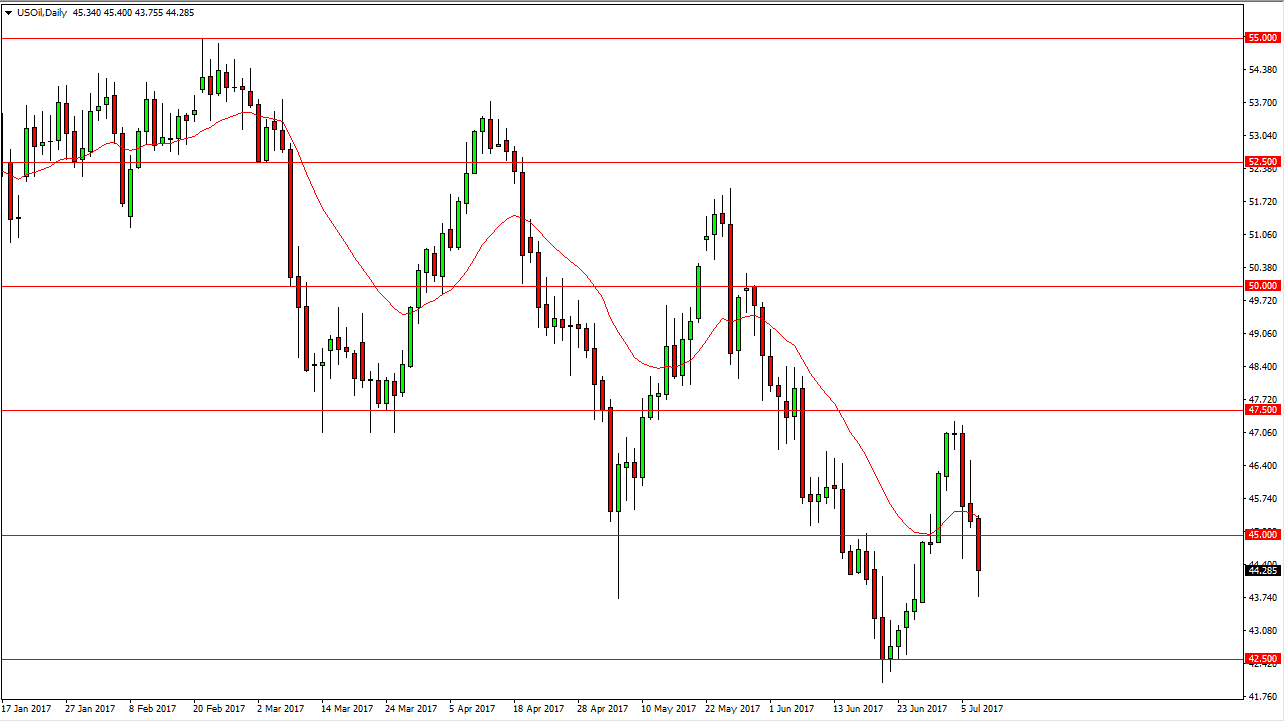

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Friday, as the US dollar strengthened a bit, but quite frankly continuation of bearish pressure is something that can be expected looking at the charts anyway. After all, the Russians have said that they are not going to cut further or even extend production cuts. OPEC has lost the ability to control pricing in the oil market, and therefore think that we continue to go lower. The next obvious areas the $42.50 level which extends down to the $42 level. A breakdown below the $42 level as this market breaking down rather significantly. Currently, I think the best way to deal with this market is to simply sell rallies that show signs of exhaustion on shorter-term charts.

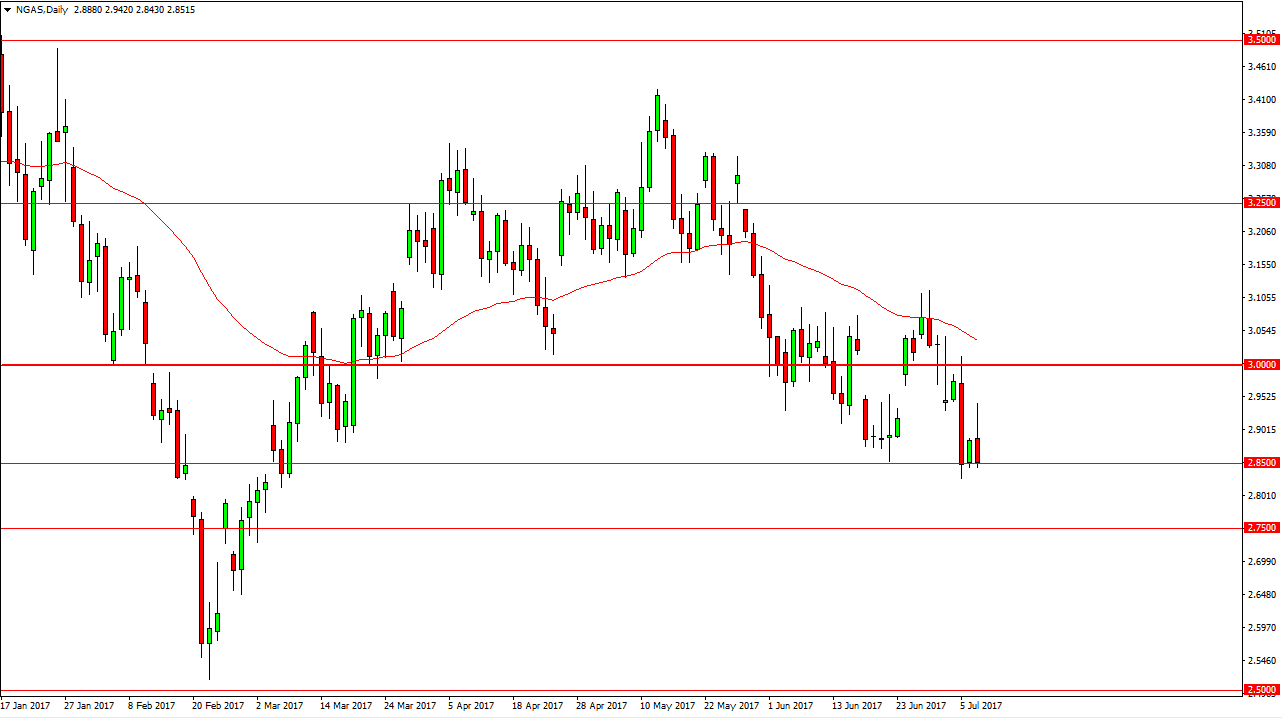

Natural Gas

Natural gas markets initially shot higher during the day after we had a bullish inventory number. However, you can see that we turned around at the $2.95 level has offered enough resistance, and we turned around to form a shooting star. A breakdown below the bottom of the shooting star, extensively the $2.85 level, the market should then go down to the $2.75 level after that. A breakdown below that level is even more negative, and I think will happen given enough time. The $2.50 level underneath will happen given enough time, as the bearish pressure continues. If we cannot rally on signs of consumption, I don’t really know what can happen to turn this market around. The strengthening US dollar should continue to weigh upon this market as well, and of course the massive amount of oversupply that we have seen longer term. The $3 level above should continue to be massive resistance, and I think essentially the beginning of the “ceiling” of the market.