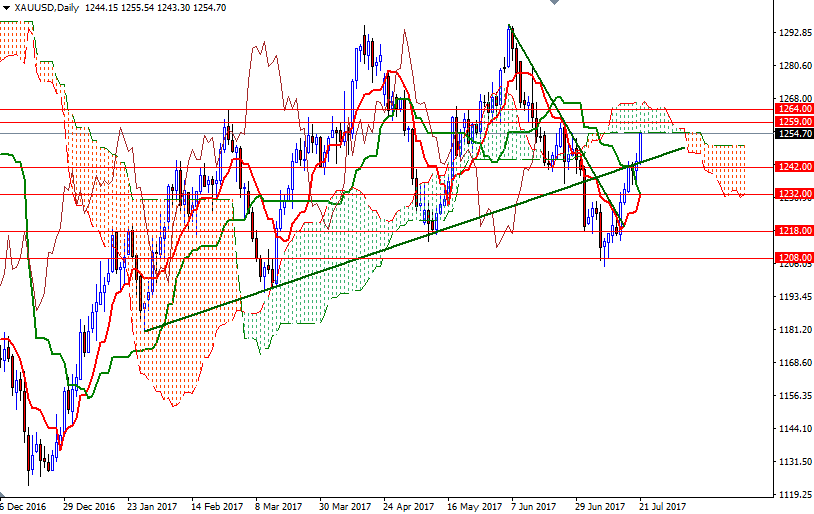

Gold prices settled at $1254.70 an ounce on Friday, gaining 2.07% on the week, as recent volatility in global equity markets and new worries about U.S. politics lent support to the precious metal. Fluctuations in the wider markets usually give a temporary boost to safe-haven gold but continued weakness in the dollar may have stronger impact on gold in the long run. A breach of some key technical levels also pushed gold higher. XAU/USD was able to successfully break through $1232 and $1250.30-$1248. Consequently, the market reached the daily Ichimoku cloud as anticipated.

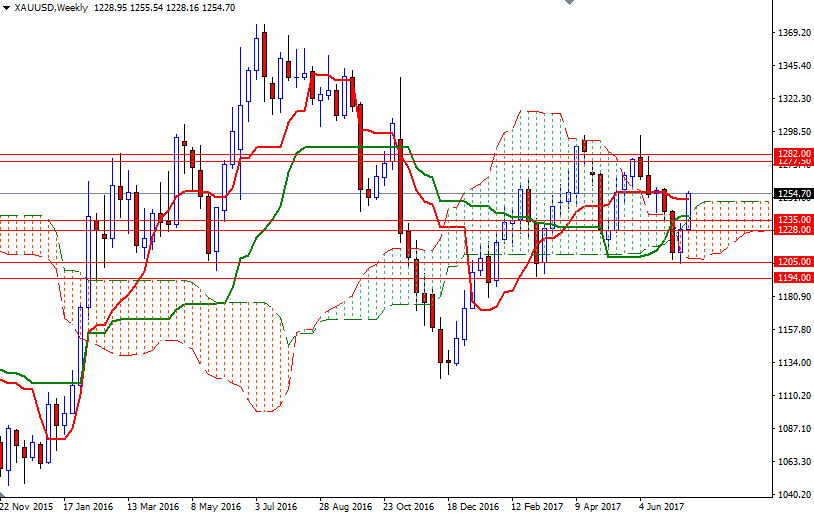

Friday’s price action produced a technically bullish weekly close, which suggests that the recent upswing may remain intact as long as the market can hold above the 4-hourly cloud. Trading above the cloud on the weekly time frame also supports this theory. XAU/USD has been moving upwards ever since it reversed at 1205 but the area occupied by the daily Ichimoku cloud may trigger some long-side profit taking. If the bulls manage to lift prices above the 1264 level, the top of the daily cloud, on a daily basis, then the 1270 level will probably be the next stop. Beyond there the first significant resistance is located in the 1282-1277.50 region.

A failure to penetrate the daily could, on the other hand, could encourage sellers and increase the possibility of an attempt to pull back towards the hourly cloud. In that case, keep an eye on the 1247 and the 1242/1 supports. Breaking down below 1241 opens up the risk of a fall to 1235/2. Not too far from there, the 1228/6 zone stands out and the bears will have to capture this strategic camp so that they can test 1221.90-1218.