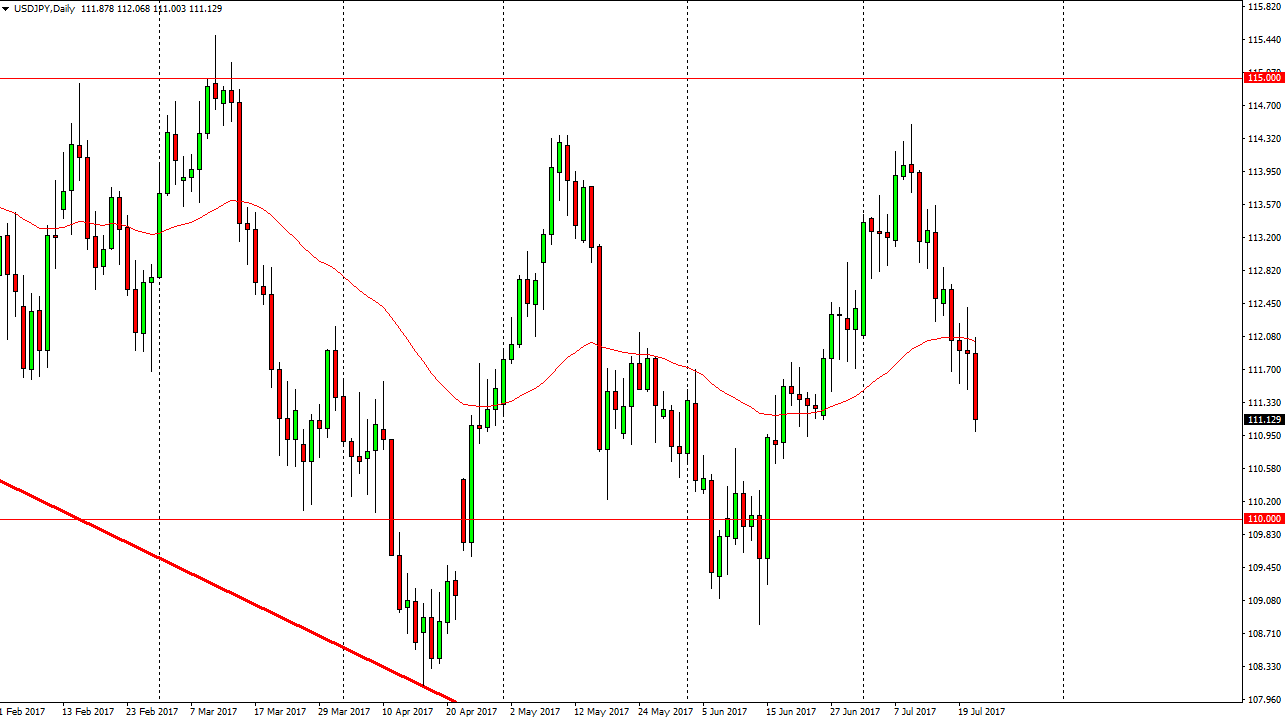

USD/JPY

The US dollar struggle during the Friday session again, as we dropped towards the 111 level against the Japanese yen. I believe there is a significant amount of support at the 110 level, so it makes sense that we will continue to grind down towards that level. I do not have any interest in trying to bind this market until we get down there, and even then, I will be waiting for some type of supportive candle to start going long. I believe that the weakness in the US dollar will continue, but overall it still looks to be very consolidated more than anything else. I don’t think this is the beginning of a major meltdown, I think it’s just a continuation of the last several months. Because of this, look to the longer-term charts for guidance as short-term traders tend to be blinded to these obvious moves.

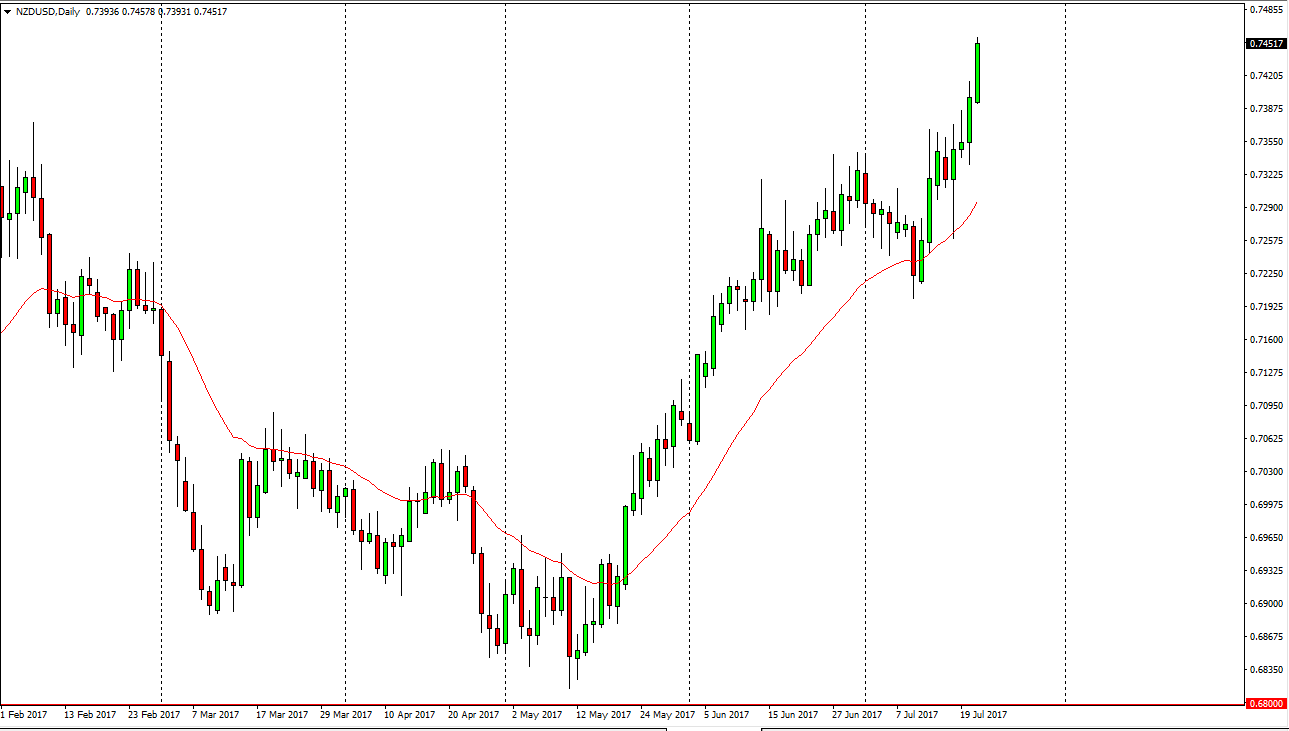

NZD/USD

The New Zealand dollar rallied during the day on Friday, reaching towards the 0.7450 level. I believe that the market is going to go to the 0.75 handle, as the US dollar continues to struggle. Pullbacks offer support, and I believe that at the 0.7350 level, the buyers will return. I have no interest in shorting the New Zealand dollar, although I do realize that we are overbought. Somewhere near the 0.7350 level, I would anticipate that a lot of bullish pressure must be built. Obviously, the 0.75 level will offer a significant amount of resistance, given enough time I think we did break above there and continue to go much higher. The market probably looks towards the 0.80 level over the longer term, but obviously we will need to pull back from time to time in order to build up enough momentum to go higher.