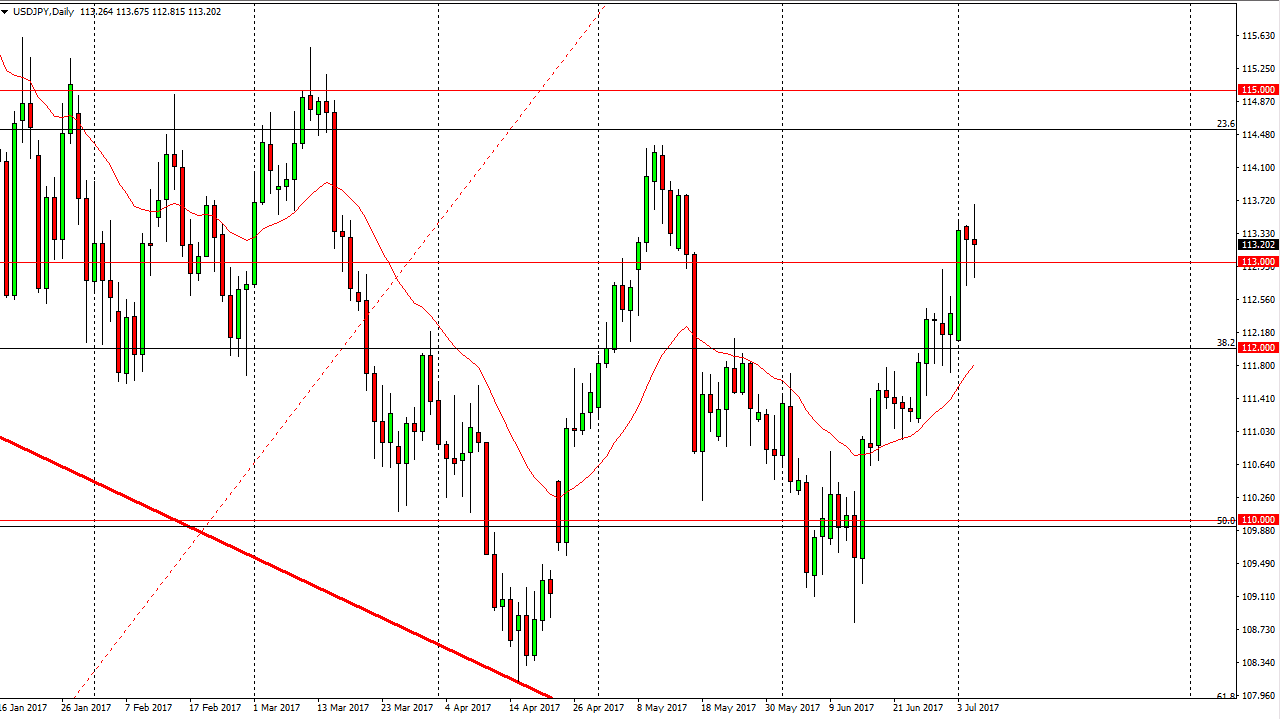

USD/JPY

The USD/JPY pair went back and forth during the day on Wednesday, as the FOMC Meeting Minutes essentially told us nothing. That being the case, looks as if the 113 level continues to be massively supportive, and I believe that short-term pullbacks are buying opportunities, and then the market will probably go to the 114 area. A break above there should then send the market to the 115 handle after that. The markets showed an extreme amount of resiliency in the wake of volatility, so I believe that longer-term, the market should continue to go higher and once we break above the 115 handle, the market should then go to the 118 handle, and then the 120 handle after that. It is not until we break below the 112 level that I would be interested in shorting, and even then, I would have to think about it.

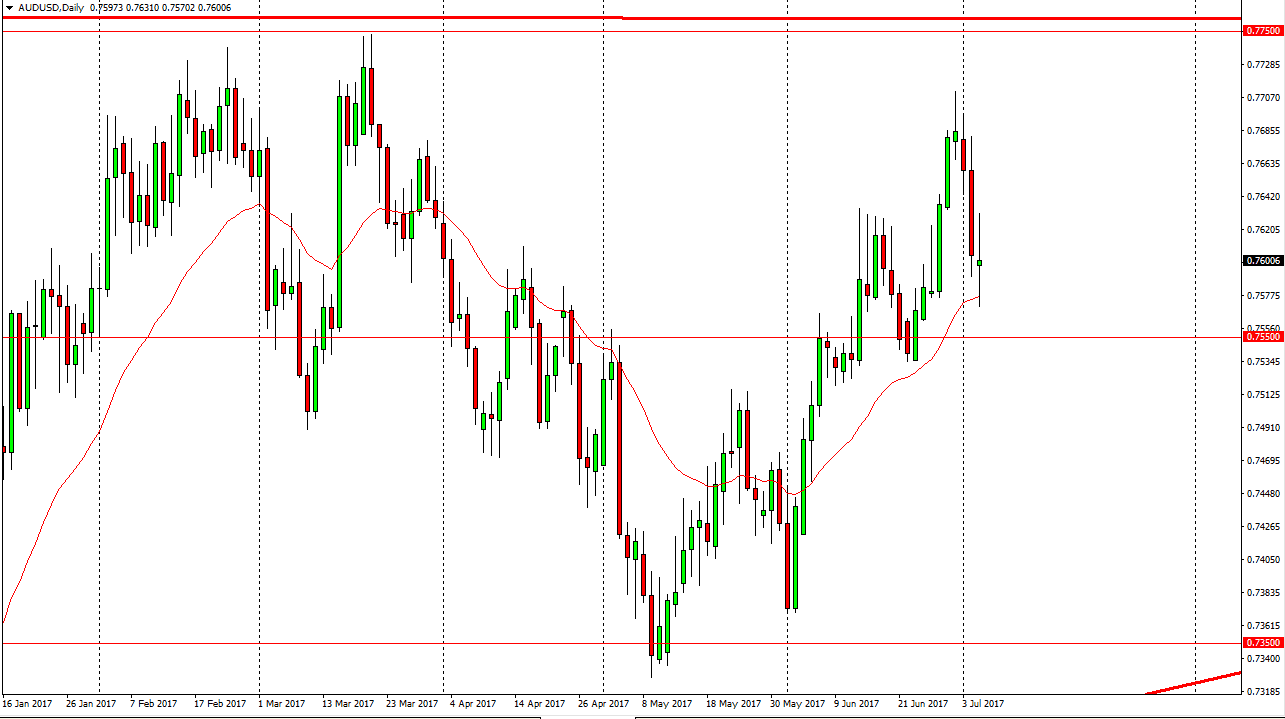

AUD/USD

The Australian dollar also was very volatile during the day as gold slammed around. Ultimately, we ended up forming a very neutral candle and that shows a lot of letdown in the market as far as I can see. Quite frankly, the FOMC was a nonevent, and therefore we are closing the day at essentially the same place we started. The 0.76 level is a large, round, psychologically significant number, but I also recognize that the 0.7550 level underneath should be supportive. Given enough time, then we should go to the 0.7750 level. I have no interest in shorting this market as we are so close to support, but if we did breakdown below the 0.75 level or of gold fell apart, and then I think we could short the Aussie. There is a lot of volatility just waiting to happen, but I think this market is going to be very difficult to deal with, so I have the proclivity to sit on the sidelines and wait for clarity.