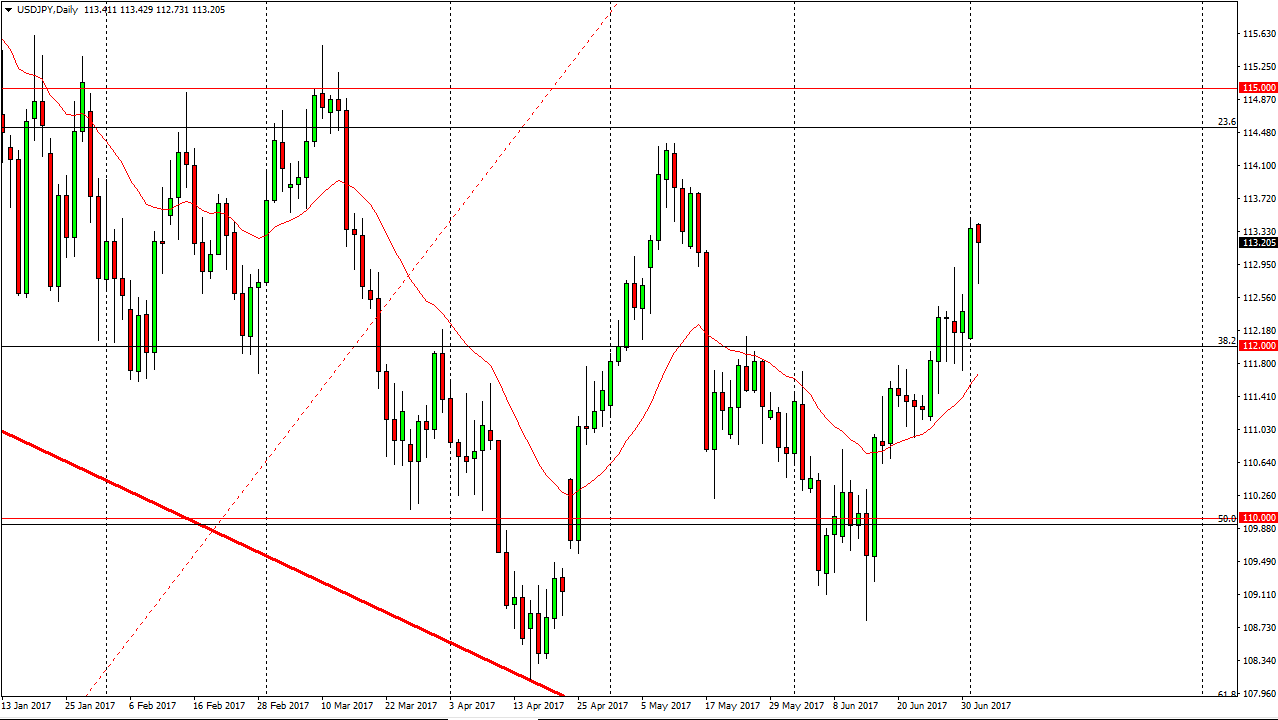

USD/JPY

The US dollar initially fell against the Japanese yen on Tuesday, but found enough support near the 112.50 level to turn things around and form a hammer like candle. The hammer of course is a bullish sign, and if we can break the top of it, that should send this market towards the upside, perhaps reaching towards the 114 handle, and then eventually the 115 level. A break above the 115 level is very bullish, and send this market much higher over the longer term. Alternately, if we do breakdown from here, the market should probably reach towards the 112 level. I think that there is a significant amount of volatility just waiting to happen as the FOMC Meeting Minutes come out today.

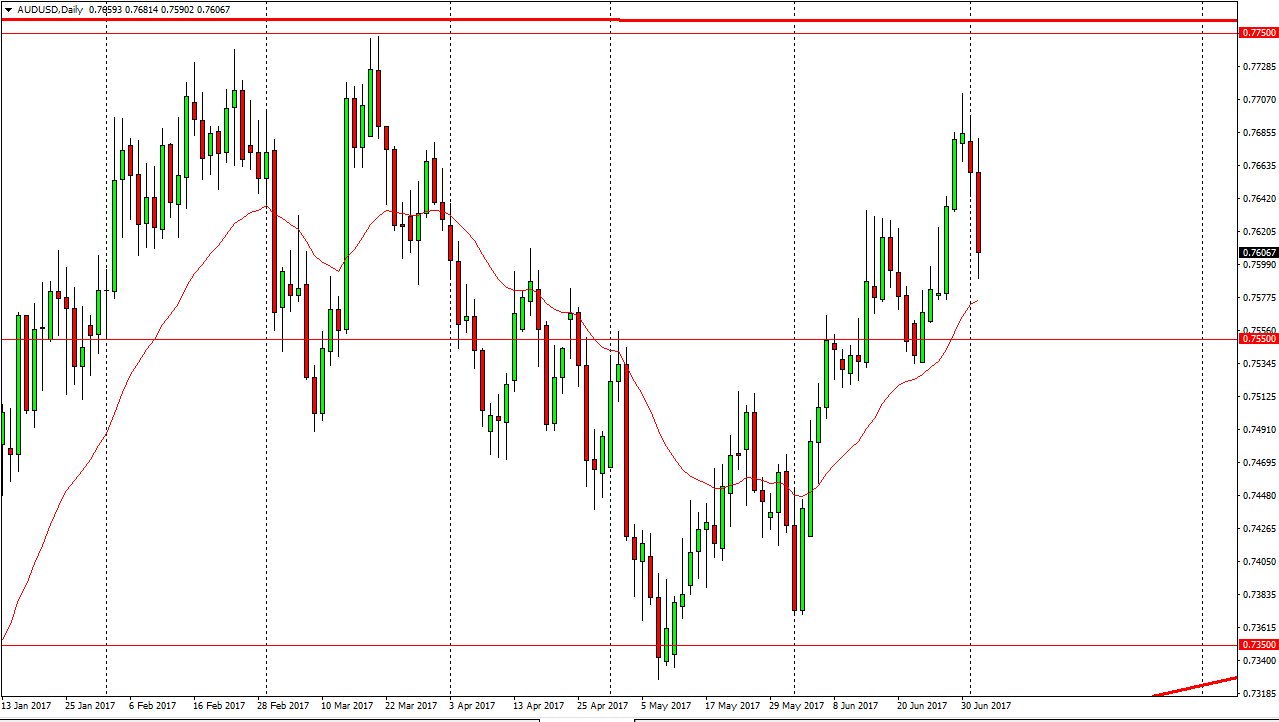

AUD/USD

The Australian dollar initially tried to rally but turned around to form a negative candle during the trading session on Tuesday. The FOMC Meeting Minutes will give us an idea as to how hawkish or dovish the Federal Reserve is going forward, and that could cause a bit of noise in this market. Gold markets continue to fall apart, and that of course offers bearish pressure here as well. If we can break down below the 0.75 level, I think the market continues to roll over and goes much lower, perhaps down to the 0.7350 level. Any type a supportive candle in this area could be a buying opportunity, as we should then go to the 0.7750 level above. A break above there census market much higher, perhaps reaching towards the 0.80 level above. This is a market that is highly influenced by the gold market, so keep an eye on what’s going on in the commodity pits. Either way, I believe that there is going to be a lot of volatility in this market, and that being the case it’s likely that the Australian dollar will be difficult to trade.