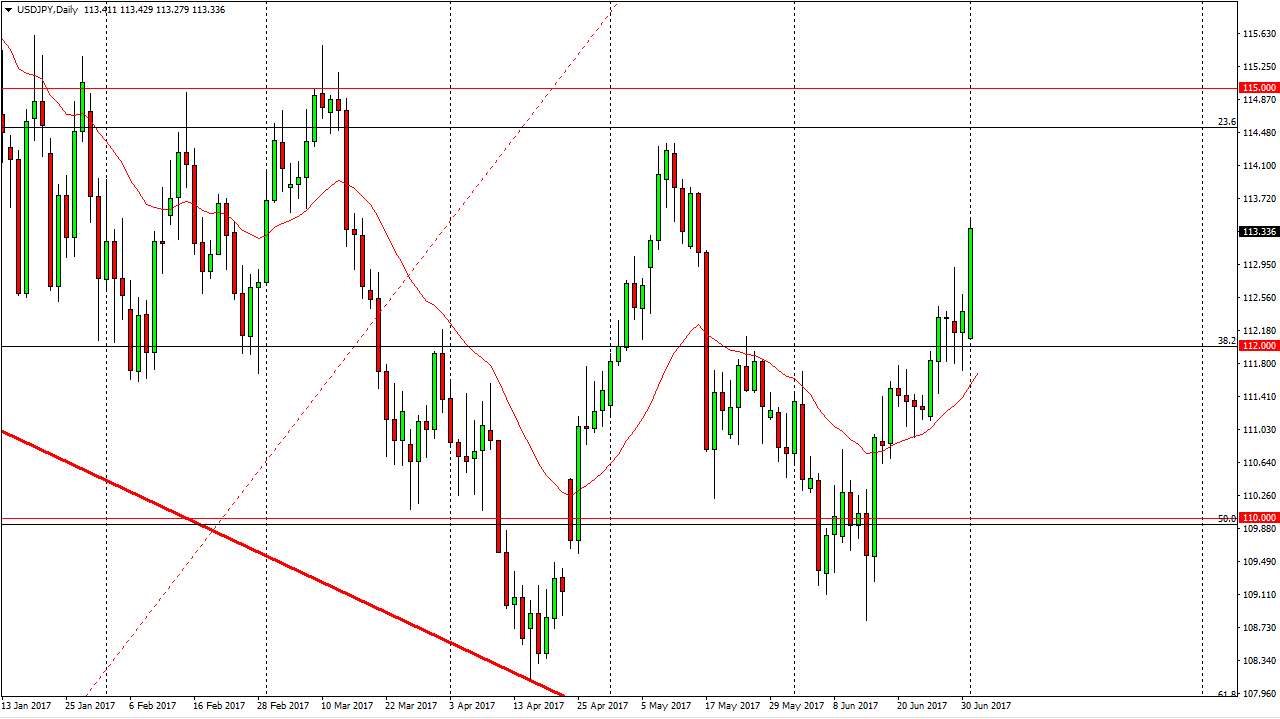

USD/JPY

The US dollar exploded to the upside during the Monday session, breaking above the 113 handle. However, today is the Independence Day holiday in the United States, so liquidity could be a bit of an issue later in the session. Ultimately, the market should continue to favor the US dollar of the Japanese yen, as the interest rate differential should continue to move in that direction. I believe in buying short-term pullbacks, and a break above the 114 handle. I have no interest in trying to short this market, as I believe there is a massive amount of support below at the 112 level. Because of this, I believe it’s only a matter of time before reach towards the 115 handle. I am a buyer, and have no interest in trying to fight the recent move.

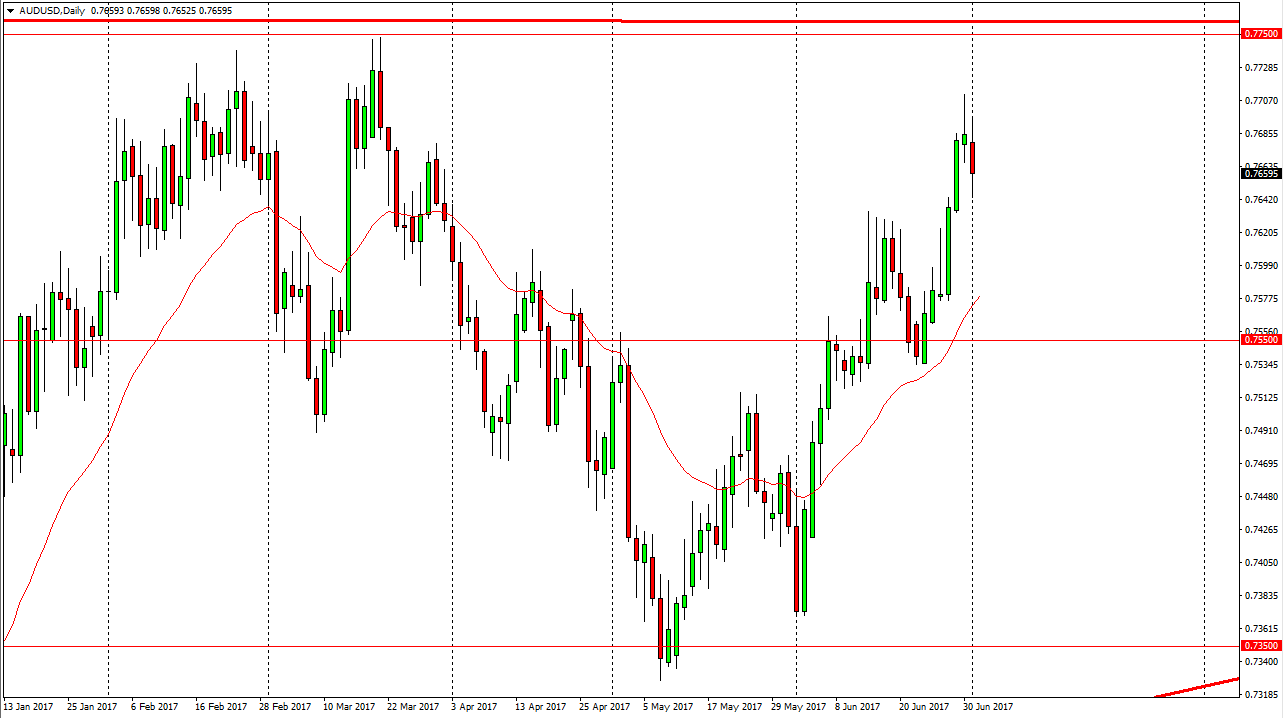

AUD/USD

The Australian dollar had a slightly negative session on Monday, after breaking down below the bottom of the shooting star from Friday. This is a technically negative sign, but I think that there should be a certain amount of support near the 0.7625 handle. Because of this, I’m looking for a supportive candle to start going long again. However, we are starting to see serious trouble in the gold markets, as interest rates should be set to rise worldwide, and that of course works against the value of gold. Because of this, the bearish pressure may remain longer than originally anticipated. With that being the case, I need to see a supportive daily candle to start buying. If we do get that candle, I think the market will then go looking towards the 0.7750 level above, which had been such a massive resistance barrier.

Alternately, if we break down below the 0.7550 level, the market should show signs of weakness and continue to go towards the 0.75 handle, and then perhaps the 0.7350 level after that.