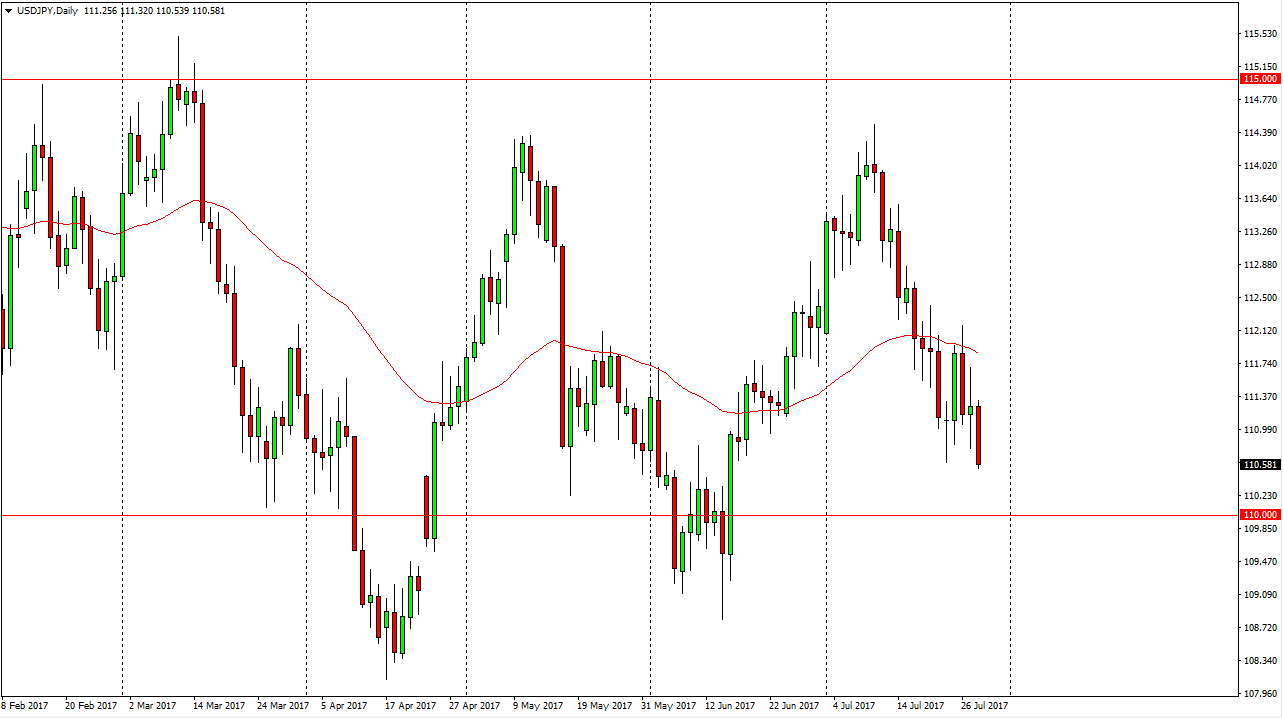

USD/JPY

The US dollar fell against the Japanese yen during the session on Friday, as we continue to see US dollar weakness. It now looks as if were going to go looking for the 110 level below, which should be a significant support barrier. Because of this, I think that short-term traders will continue to push to the downside. Ultimately, the market should continue to find buyers below though, and I believe that we are not collapsing, rather we are simply looking for the bottom of the recent consolidation range. Because of this, I’m short-term bearish but I recognize that we will more than likely find buyers underneath to push this market back towards the 114.25 level.

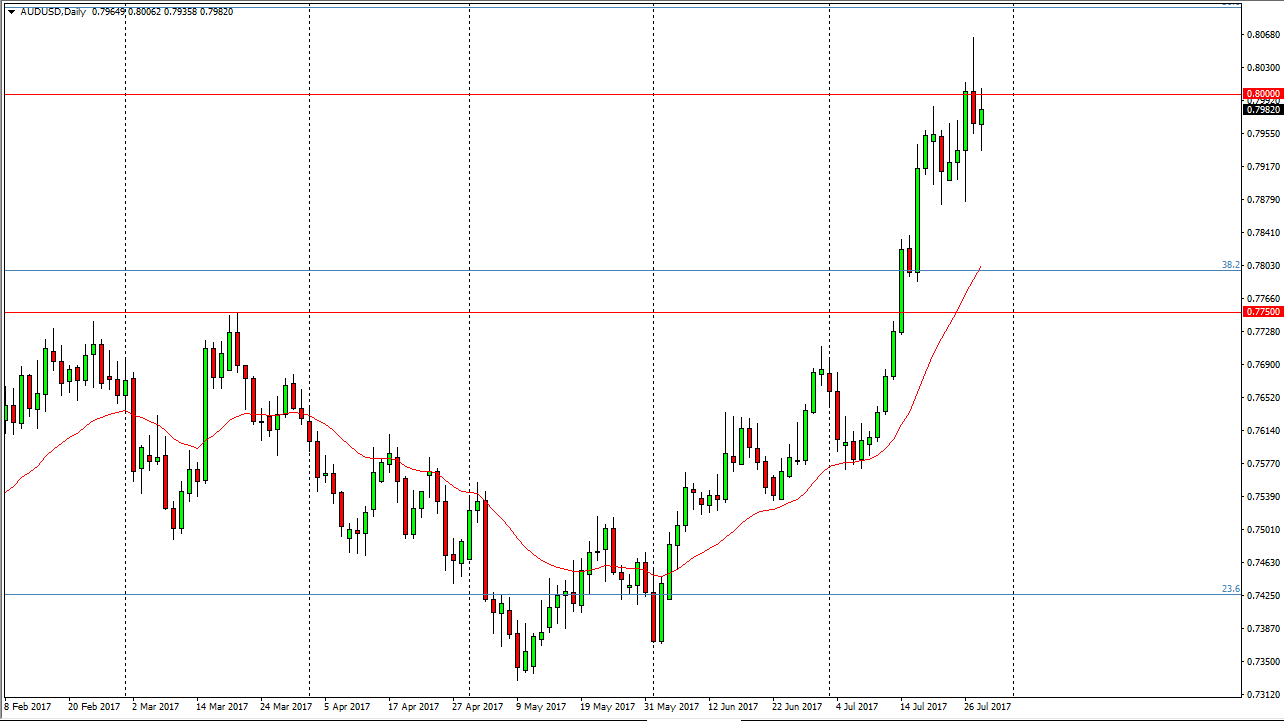

AUD/USD

The Australian dollar had a volatile session on Friday, as we continue to bounce around underneath the 0.80 level. If we can break above that level, then I think the next problem is going to be the shooting star from the Thursday session. If we can break above the top of that shooting star, that’s a very bullish sign. However, I think that pullbacks will probably be thought of as buying opportunities, and pullbacks should be thought of as value. I don’t necessarily want to short this market, I believe there’s an absolute “floor” in the market near the 0.7750 level underneath. I believe that the market looks likely to find plenty of buying pressure there as breaking above it was a very strong sign. We are bit overextended, so I think it’s only a matter of time before the buyers get back involved on what I think is a somewhat impending pullback. Remember, markets cannot go in one direction forever, and I think that this pullback should be a nice opportunity to build up longer-term momentum.