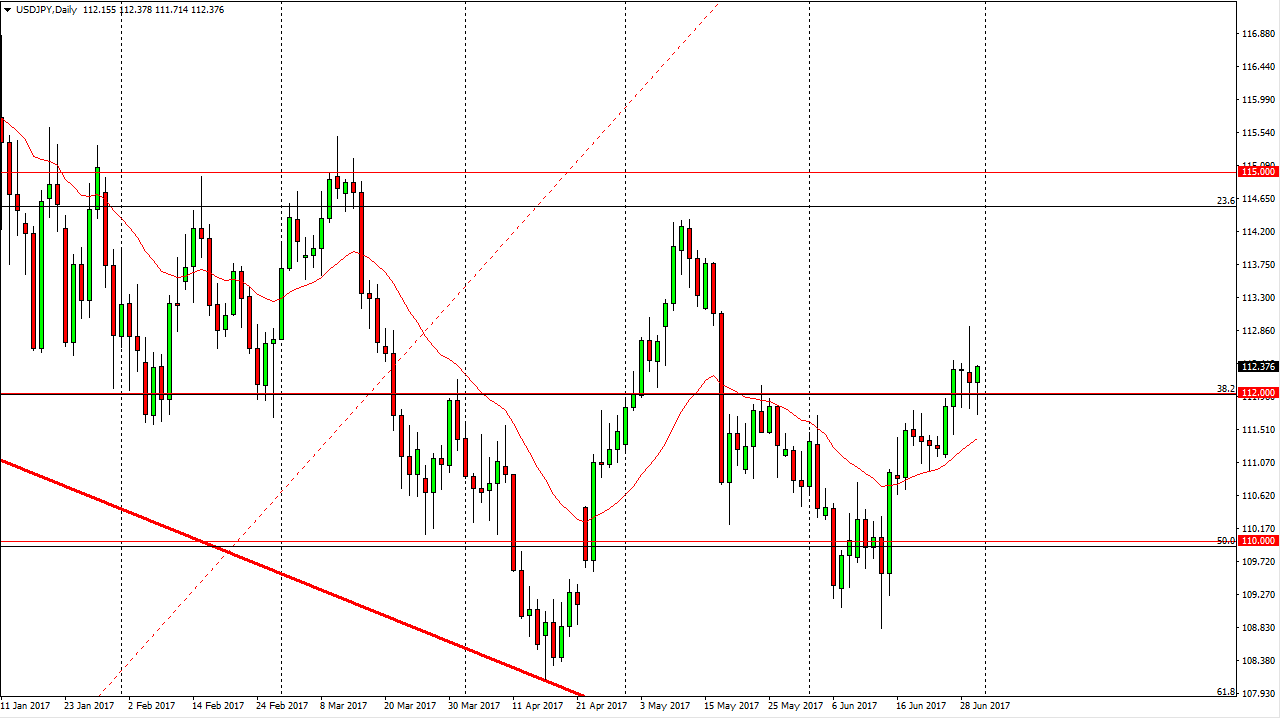

USD/JPY

The US dollar rallied after initially dipping below the 112 level against the Japanese yen on Friday. This is a market that continues to grind sideways in general, and this area that was once resistance now looks as if it is offering support. However, we are not ready to take off yet, so I think that the market continues to grind over the next several sessions. Ultimately though, I am a buyer this market and I think we go towards the 114 handle. What I think will come into focus is the interest rate differentials between the United States and Japan. Ultimately, this is a market that I think that the 114 level above signifies a certain amount of resistance to the 115 handle. I have no interest in shorting this pair, it looks very bullish but stubborn.

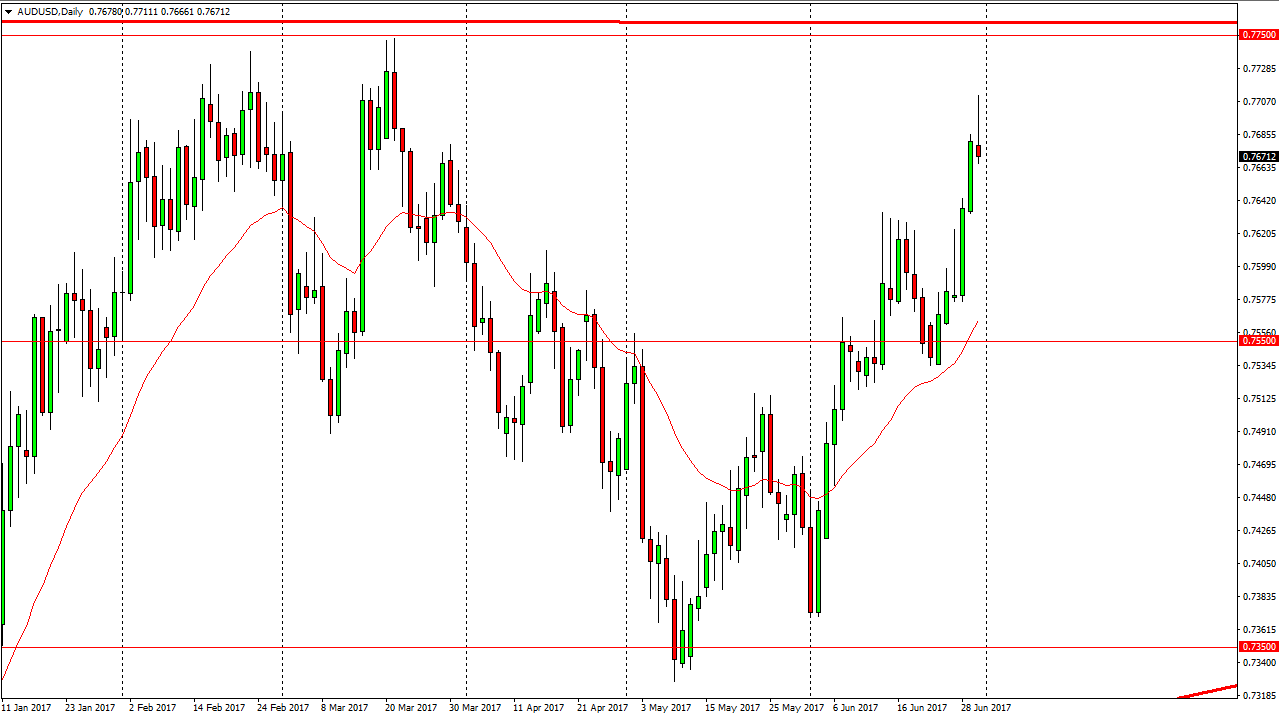

AUD/USD

The Australian dollar initially tried to rally during the session on Friday, but turned right back around at the 0.77 level, to form a shooting star. The shooting star of course is a very negative sign, so I think we may pull back a little bit towards the 0.7625 handle. Alternately, if we break above the top of the shooting star should then go to the 0.7750 level. If we can break above the 0.7750 level, the market should then go to the 0.80 level. The gold markets rallying of course will help as well, and the volatility is going to continue to be choppy, but I think ultimately the buyers should continue to jump back into the Australian dollar. Even enough time, I think that the pullback should offer buying opportunities, and therefore I will personally not be looking to short this market although I understand that extreme high-frequency traders could get involved to the downside.