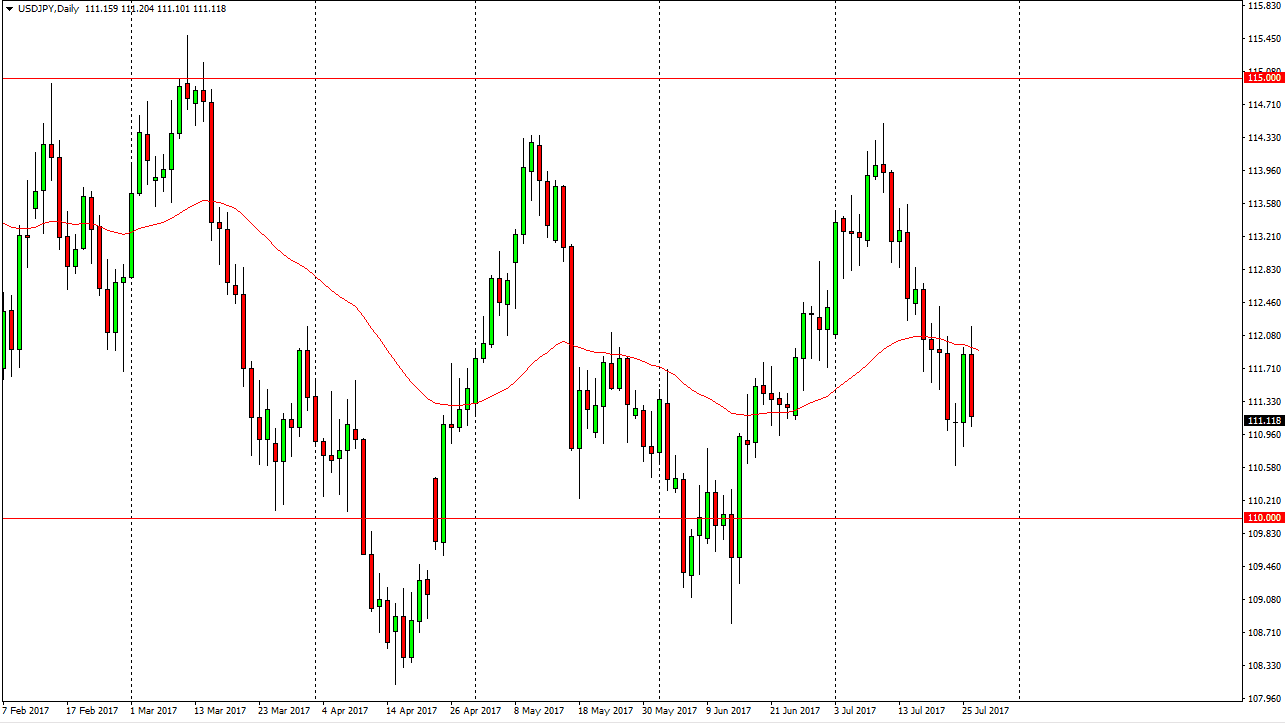

USD/JPY

The US dollar fell significantly during the session on Wednesday as the Federal Reserve released a dovish statement. Because of this, the US dollar will continue to be sold off, and I think we could go looking towards the 110 handle. I don’t believe that the 111 level will hold, so I believe it’s only a matter of time before the sellers take control. We are seeing the US dollar being sold off against most currencies around the world, and that will continue to be the case against the Japanese yen. Given enough time, I think that we will see buyers in that general vicinity, but right now it certainly looks as if the market is going to fall.

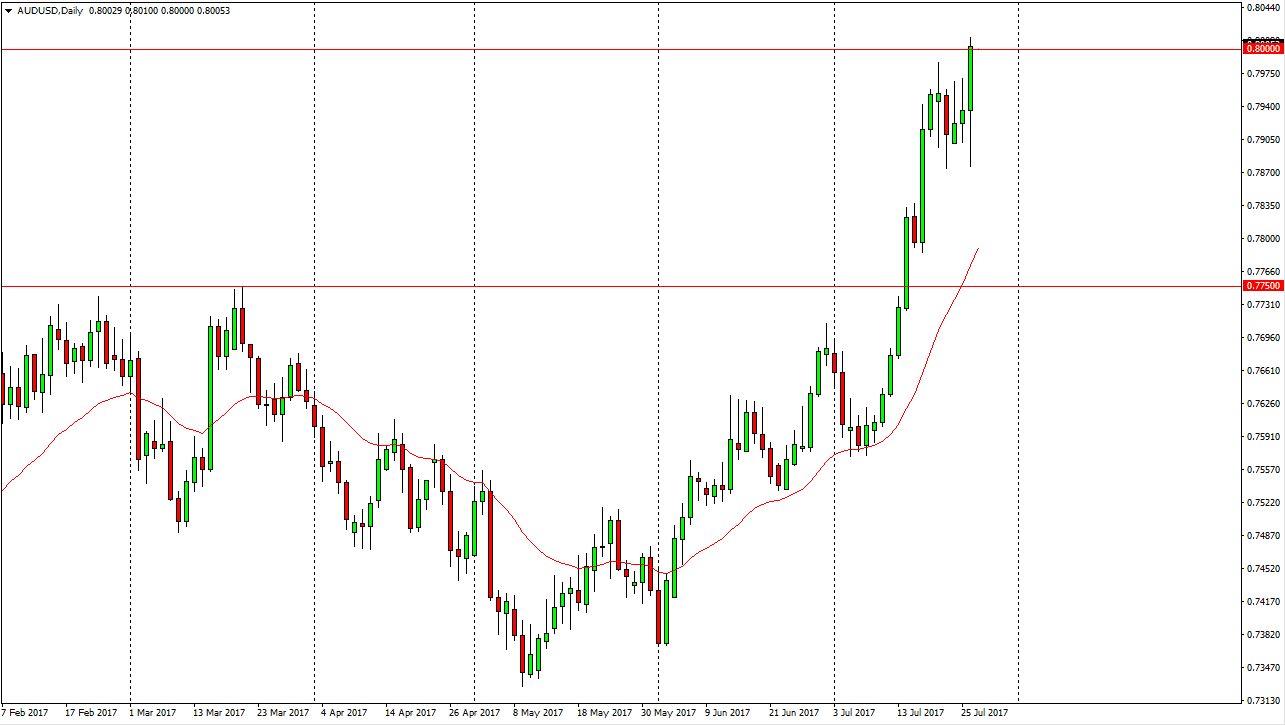

AUD/USD

The Australian dollar initially fell during the day on Wednesday, but found enough bullish pressure after the FOMC statement a break above the 0.80 level. If we can break above the 0.8020 level, I feel that this becomes more of a “buy-and-hold” scenario as the Australian dollar breaking above that level is a major sign of strength. This is an area that is massive in its implication, as it is a level that is seen on charts going back several decades. If the gold markets can continue to rally, I believe that the Australian dollar will do the same. I have no interest in shorting, and I believe that the 0.79 level below is massively supportive as well, so as long as we can stay above there, I think that the buyers will continue to run this market to the upside. The US dollar itself is in a lot of trouble, so it isn’t necessarily that I love the Australian dollar, it’s more like the US dollar is being sold off against everything, so this market of course will be any different.