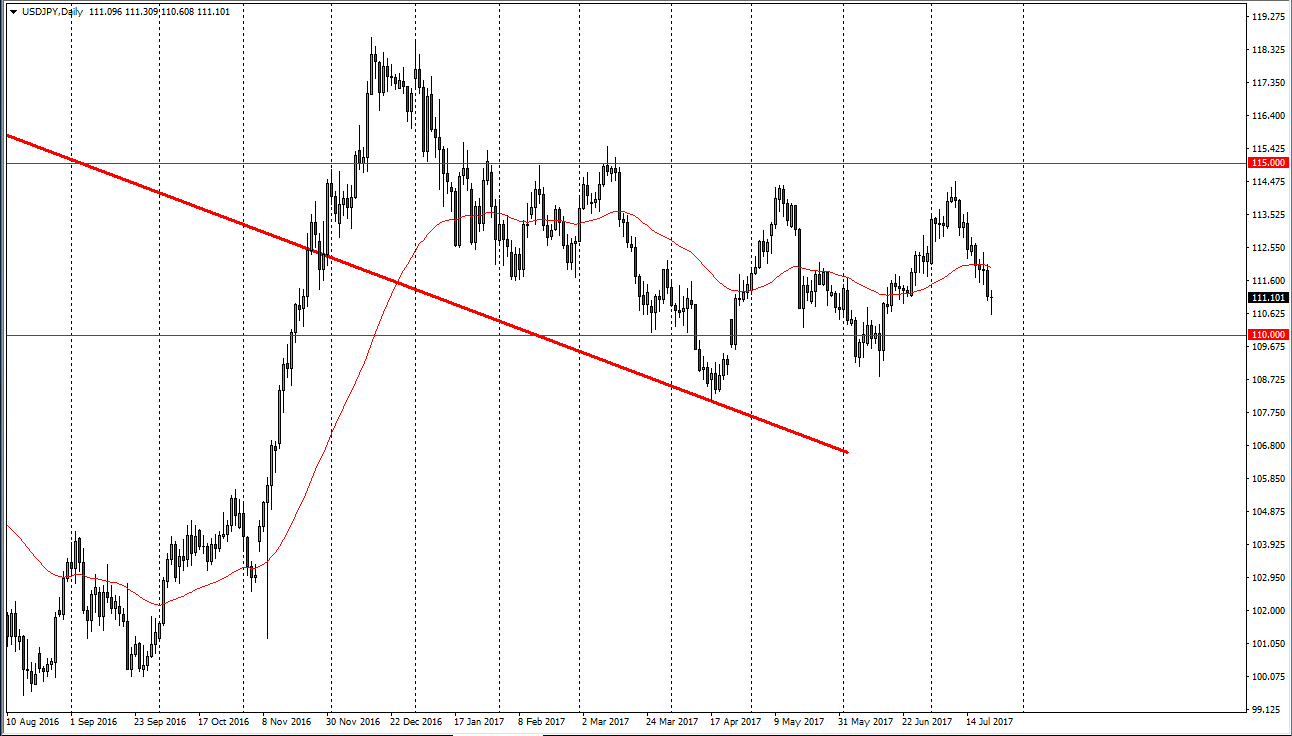

USD/JPY

The US dollar initially fell against the Japanese yen during the day on Monday, but found enough support near the 110.50 level underneath. By doing so, the market turned around to form a hammer and that is a very bullish sign. It looks likely that the 110-level underneath will continue to be supportive, and longer-term it looks as if we are ready to continue the overall grind sideways. The US dollar is a bit oversold against the Japanese yen, so it’s likely that we could get a bounce. A break above the top of the range for the session on Friday is a buying opportunity, as it should send the market looking for the 112-level next. I don’t know that it will be an easy return to bullishness, but the market has gone back and forth for several months, and I don’t see anything changing here.

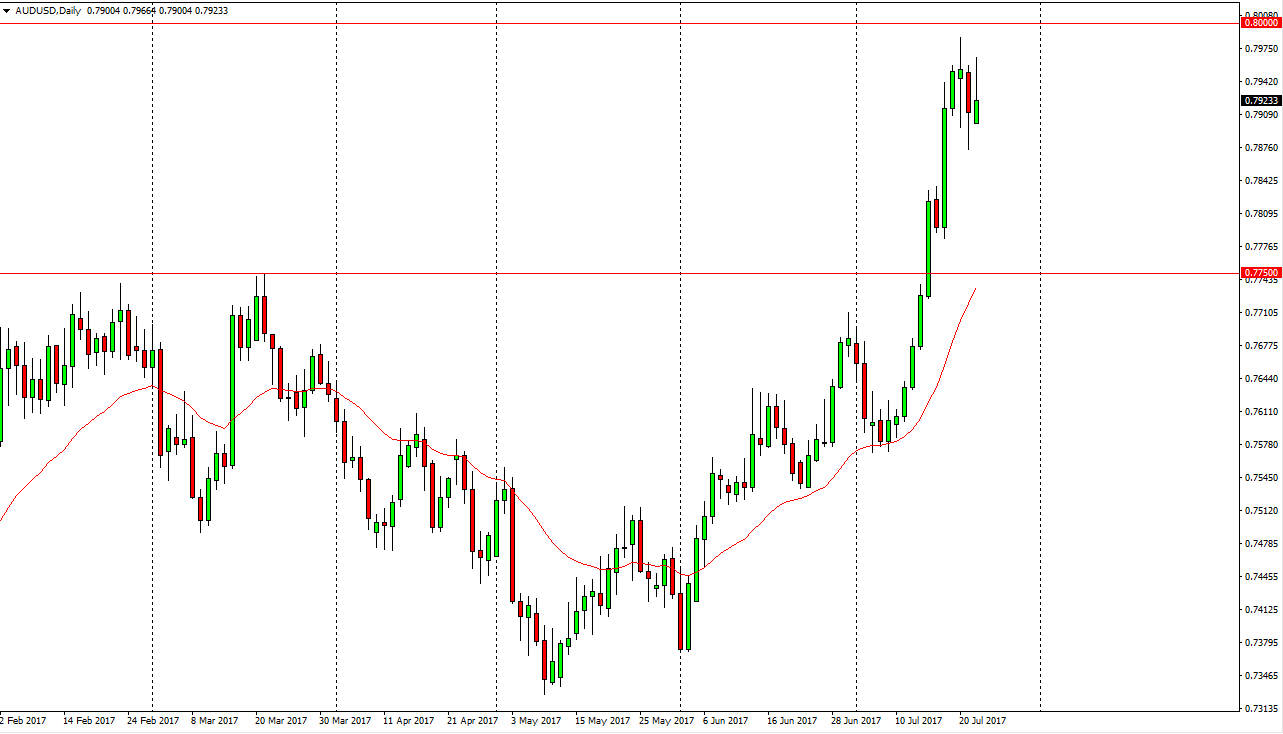

AUD/USD

The Australian dollar initially tried to rally during the day on Monday, but gave back most of the gains. Although we closed positive, it is not overly impressive, and therefore I think that this market may be vulnerable to downside surprises. It is overbought, but I also recognize that the 0.7750 level should now act as a bit of a floor. By doing so, I think that the prudent trade is to sit on the sidelines and wait for a supportive candle that we can take advantage of. This will be especially true if the gold markets can rally, as they tend to have a knock-on effect over in the AUD/USD pair. If we were to break down below the 0.7750 level, that would be very negative sign, but quite frankly I don’t think that’s going to happen anytime soon. I believe the pullbacks offer value in a currency that should continue to go higher.