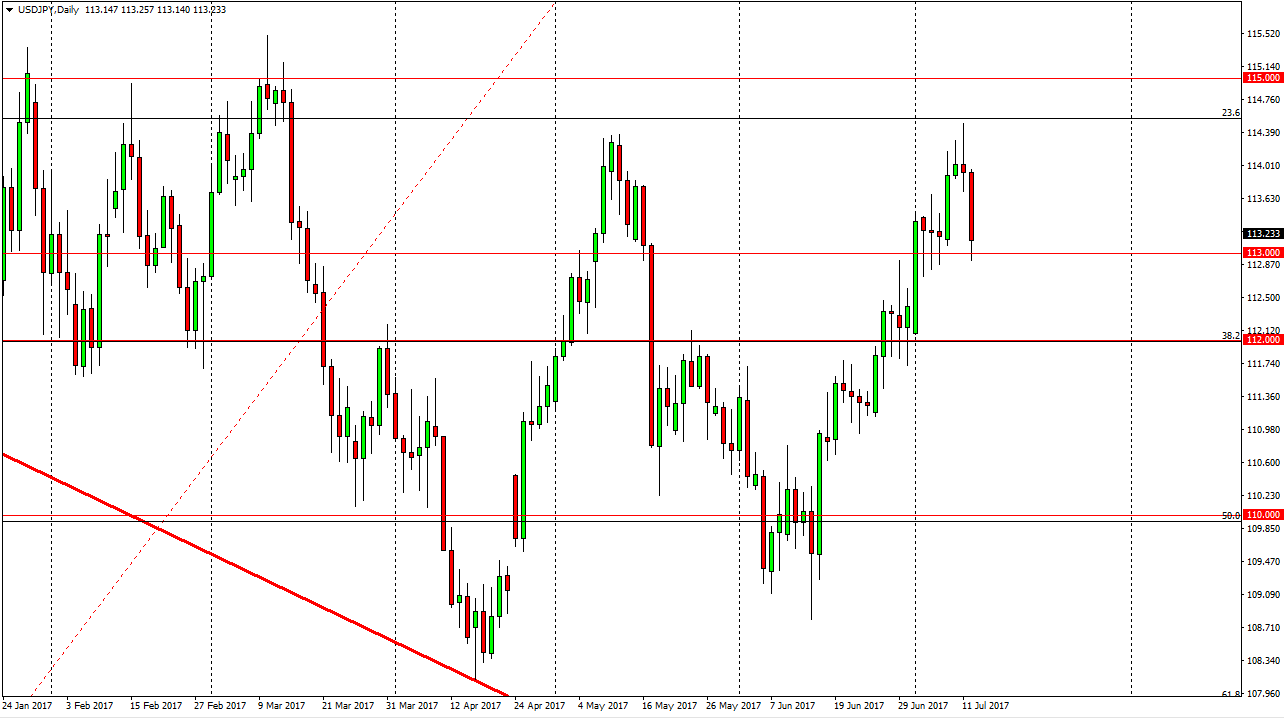

USD/JPY

The US dollar fell significantly against the Japanese yen during the Wednesday session as Janet Yellen spoke in front of Congress. She suggested that yes, there would be interest rate hikes, but they may be more gradual and market participants believed. Because of this, the US dollar fell against the Japanese yen, as we crashed into the 113 level. I believe that this market is still somewhat bullish, but we may need to pull back to build up enough momentum to finally break above the 115 handle. I think that there is probably a bit of downside risk now, and it move below the 113 level almost certainly sets up a return to the 112 level. If we did break above the 115 handle, that would be a very bullish sign, but I suspect it’s going to take a bit of momentum building to happen.

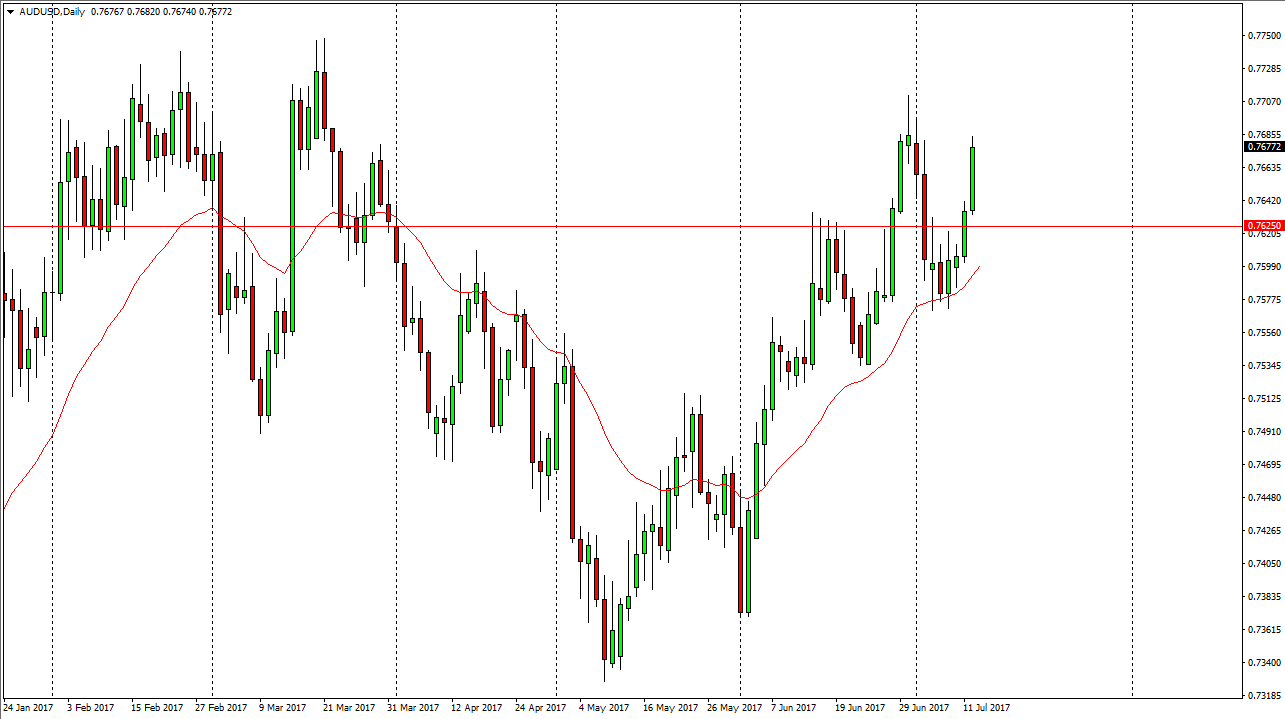

AUD/USD

The Australian dollar had a good session, reaching the 0.7675 handle. That was the high from last month, and it looks as if we are going to make a serious attempt to break above it. However, I think in the short term we may need a little bit of a pullback to build up the momentum necessary to finally make that break out. Gold markets are not helping, because quite frankly even though they gained initially during the day, the move higher was not impressive, as we struggled near previous resistance. With this being the case, it’s likely that the market will continue to be volatile, and I think that a pullback is simply going to be a momentum building exercise that buyers are going to try to accomplish so that they can finally break above significant resistance. Pay attention to the gold markets, they lead the way typically, so if they do breakout to the upside that could be very good for this market.