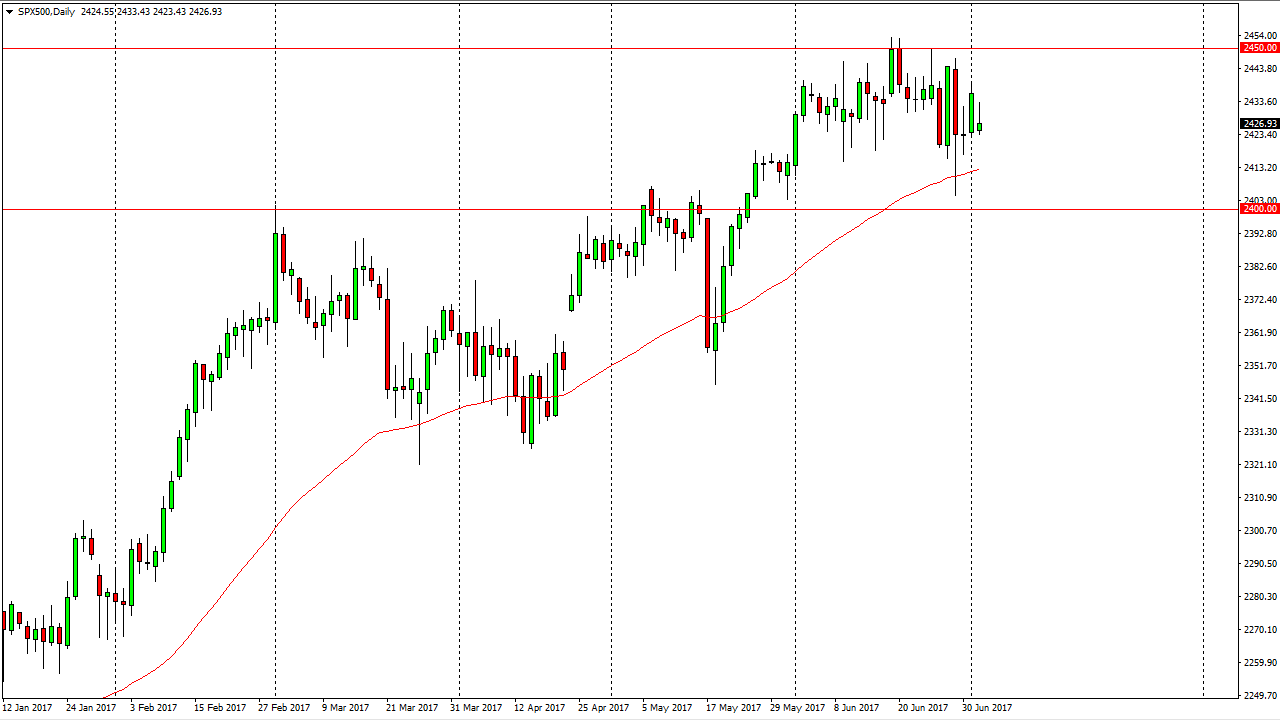

S&P 500

The S&P 500 initially tried to rally during the session on Tuesday, but gave back most of the gains in the CFD markets. However, this is a market that continues to be very choppy, and I believe that the overall attitude is still bullish. I believe that the 2425 level should attract buyers, perhaps reaching towards the 2450 handle. If we can break above there, the market should then go to the 2500 level which I believe is much more important. That is an area that is massively important due to the large, round, psychologically significant number. However, I believe that pullbacks offer value as we have seen so much in the way of buying pressure. The CFD markets are not indicative of anything at this point, because the underlying of course was closed.

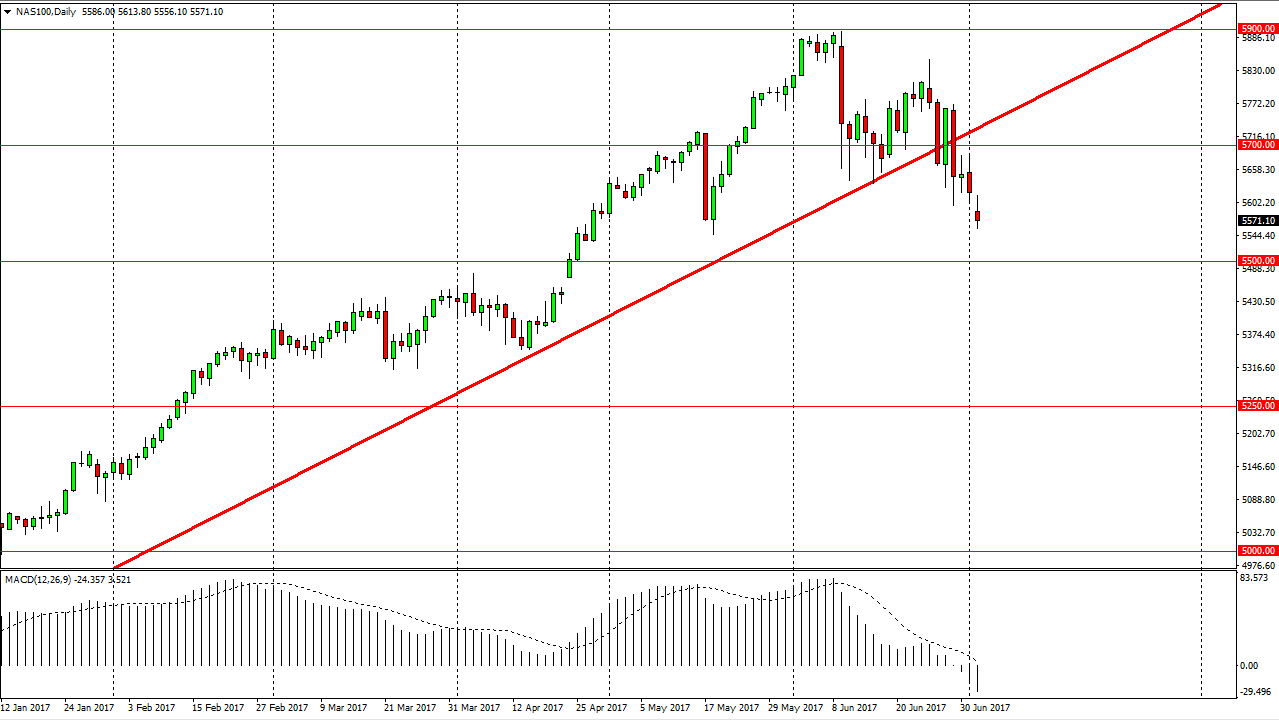

NASDAQ 100

The NASDAQ 100 gapped lower in the CFD markets, but turned around to find the market reaching towards the top of the gap. The market of course is very negative in general, and the market should then go down to the 5500 level. If we can break down below there, the market then goes much lower. Alternately, we could reach towards the 5700 level above. A break above that is bullish but I think that the technology stocks in general are going to continue to be very negative. The market should continue to go higher in general, as long as the other indices can. However, if the NASDAQ 100 falls apart, they can drag the rest of them down. Pay a lot of attention to this market, as the NASDAQ 100 could be a harbinger of what’s to come for US stock markets in general. Currently, I believe that the S&P 500 is preferred over the NASDAQ 100.