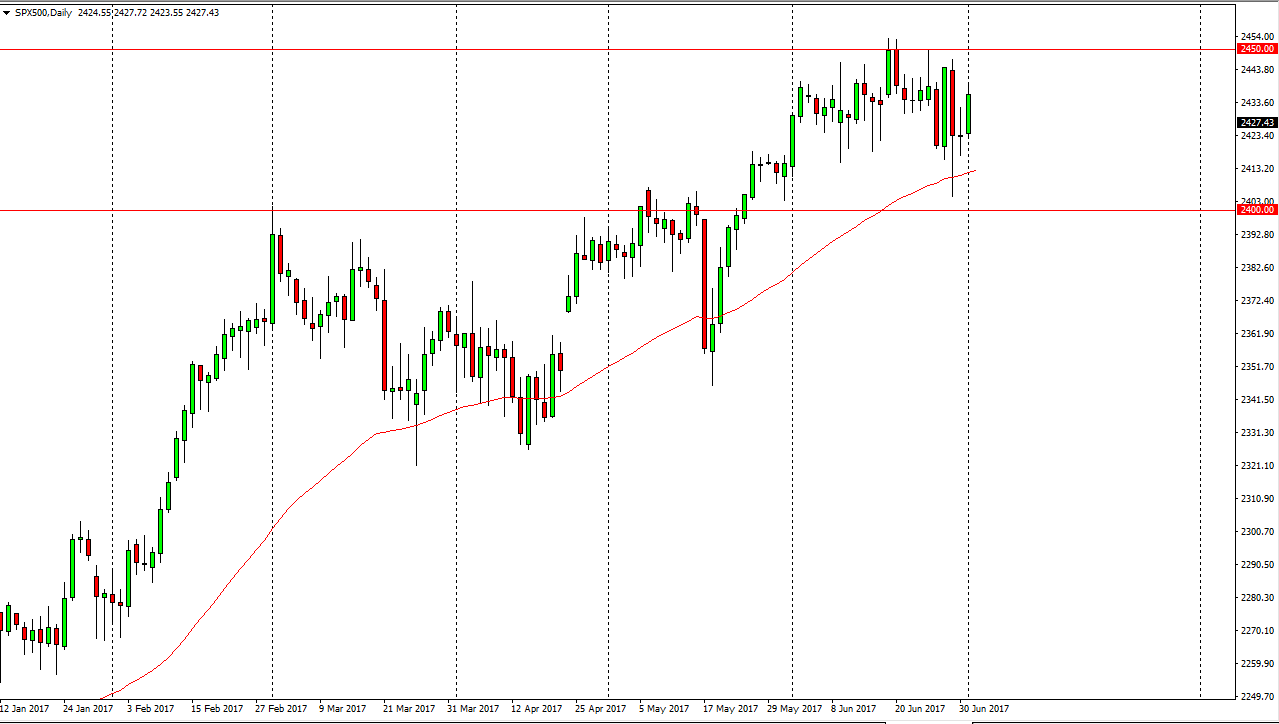

S&P 500

The S&P 500 rallied during the Monday session, but will be closed during the session today. However, the CFD markets will be open so therefore we could get a continuation of the bullish pressure. I think given enough time, the market will go looking for the 2450 handle, and perhaps even break above there and go looking for the 2500 level after that. I think that the market is very interested in trying to do that, so pullbacks should continue to be buying opportunities, with the 2400 level underneath being massively supportive.

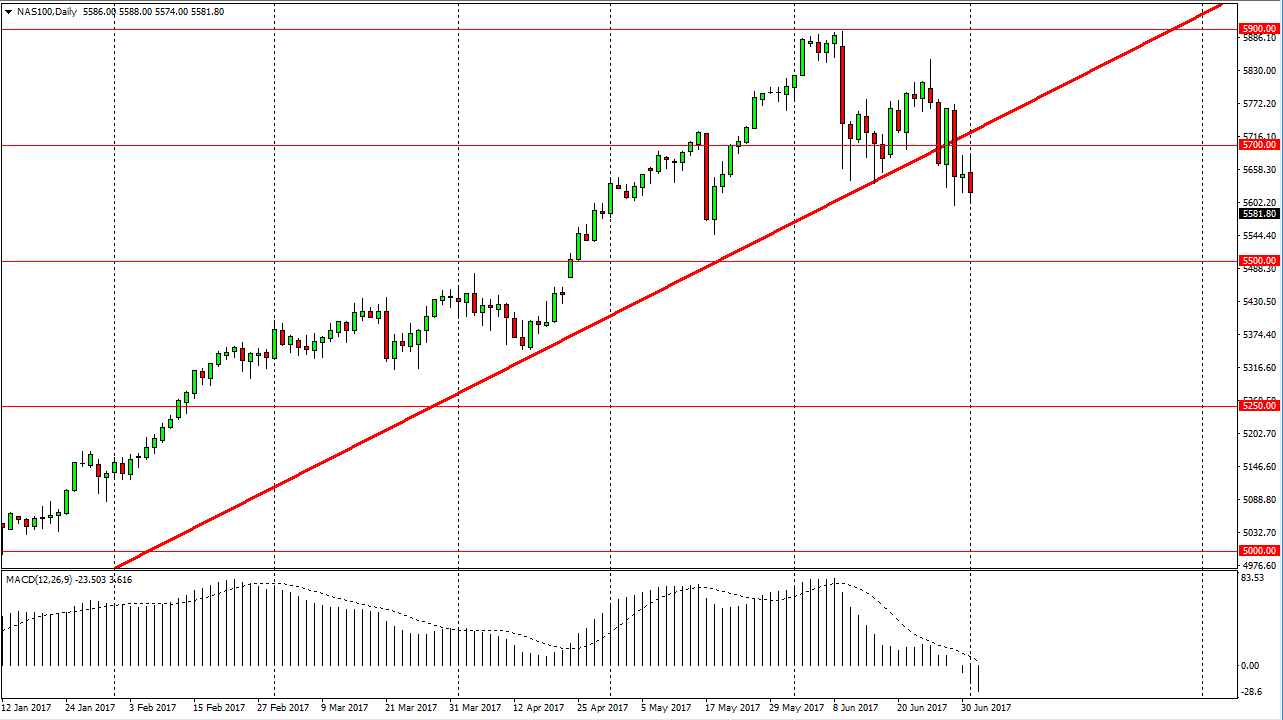

NASDAQ 100

The NASDAQ 100 tried to rally initially during the day but turned around to form a negative candle. It looks as if we’re going to try to break down, if we do the market could go looking for the 5500 level. A breakdown below there would be even more bearish, but I think that there should be a certain amount of psychological support in that general vicinity. Alternately, if we go higher I think that there is significant resistance at the 5700 level, so break above there would be a bullish sign. The MACD continues to roll over to the downside, so I think it’s only a matter of time for breakdown, and I should admit that the technicals are looking very bad for this market. However, if we were to break above the 5700 level, I think we would then see enough momentum shift to the upside that the buyers may take control again. Remember, although the CFD markets are active today, the underlying index is not.