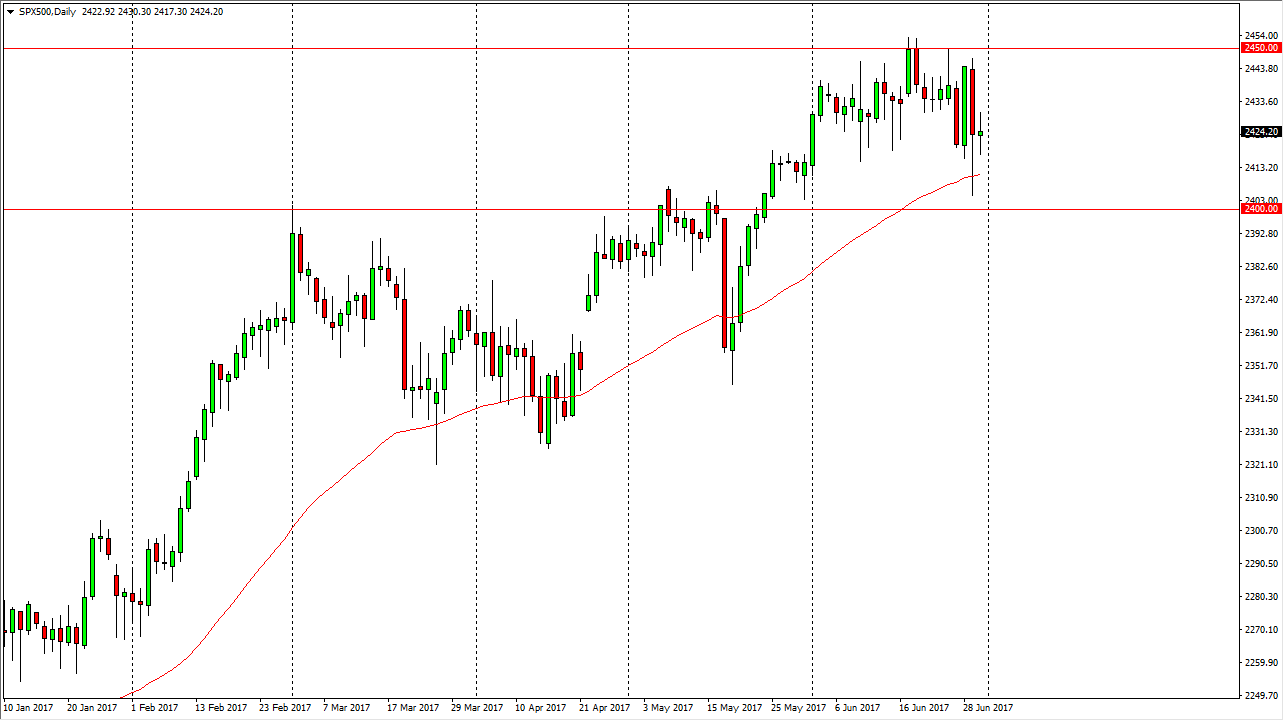

S&P 500

The S&P 500 went back and forth during the day on Friday, as traders were probably focusing more on the upcoming Independence Day holiday. The 2425 level seems to be a bit of support, and the 50-day exponential moving average below continues to be supportive. I believe that eventually we will try to reach towards the 2450 handle, but if we were to break down below the 2400 level, then things get very negative. The S&P 500 has had a strong earnings season, and perhaps the rebalancing is just about done, and we could continue to go much higher over the longer term but we have been choppy recently, and I think that will continue. I have more of an upward bias, but I recognize that there is a lot of trouble.

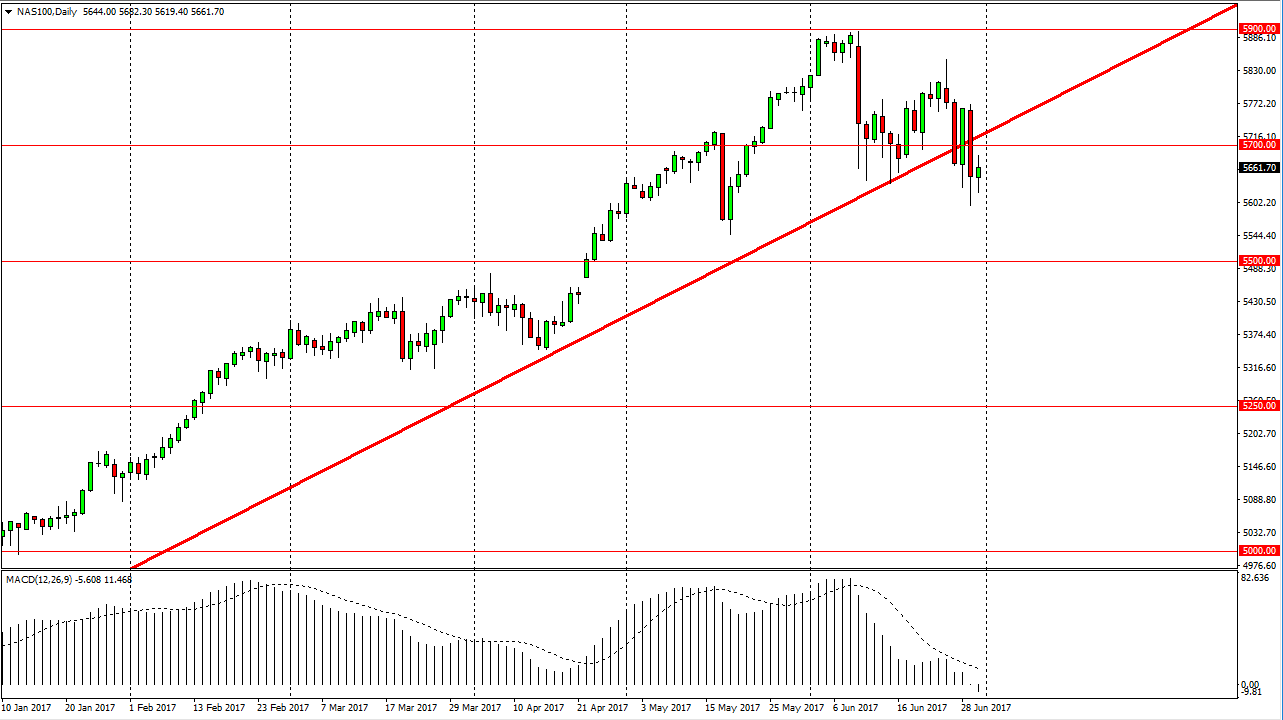

NASDAQ 100

Now if the S&P 500 looks a little shaky, the NASDAQ 100 is even worse. If the trouble starts, the market breaking down below the lows from the Thursday session should send this market looking towards the 5500 level. The NASDAQ 100 could be the canary in the coal mine so to speak, but given enough time I think that the buyers could try to break above the 5700 level. We have just broken down below an uptrend line longer-term, and that of course is a very negative sign. The market looks likely to reach towards the 5800 level, and then eventually the 5900 level. The 5500-level underneath continues to be a potential target to the downside, and a breakdown below there would accelerate the downside. I believe that this week will be a bit illiquid though, because Tuesday is of course Independence Day in the United States. With this, we could have a choppy set of conditions when it comes to the stock markets.