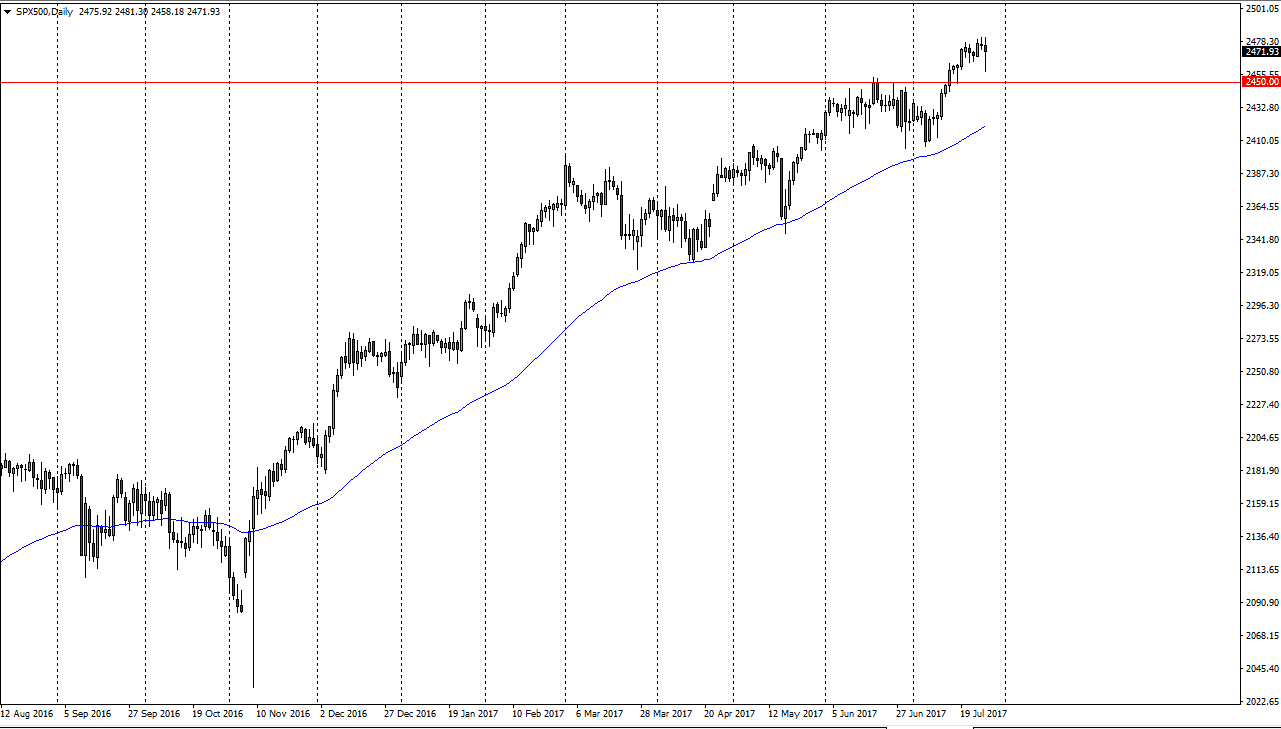

S&P 500

The S&P 500 initially fell during the session on Thursday as we continue to see volatility in the marketplace. However, the 2450 level has held as support, and by forming a hammer for the daily candle, it suggests that the buyers are still very much in control this market and willing to get long yet again. We had a very scary situation during the day in America as the volatility picked up and we suddenly found the market selling off drastically, but buyers came back after the dust settled and show signs of willing to jump back into the market on dips yet again. Because of this, I remain bullish and I think we will test the 2500 level after all.

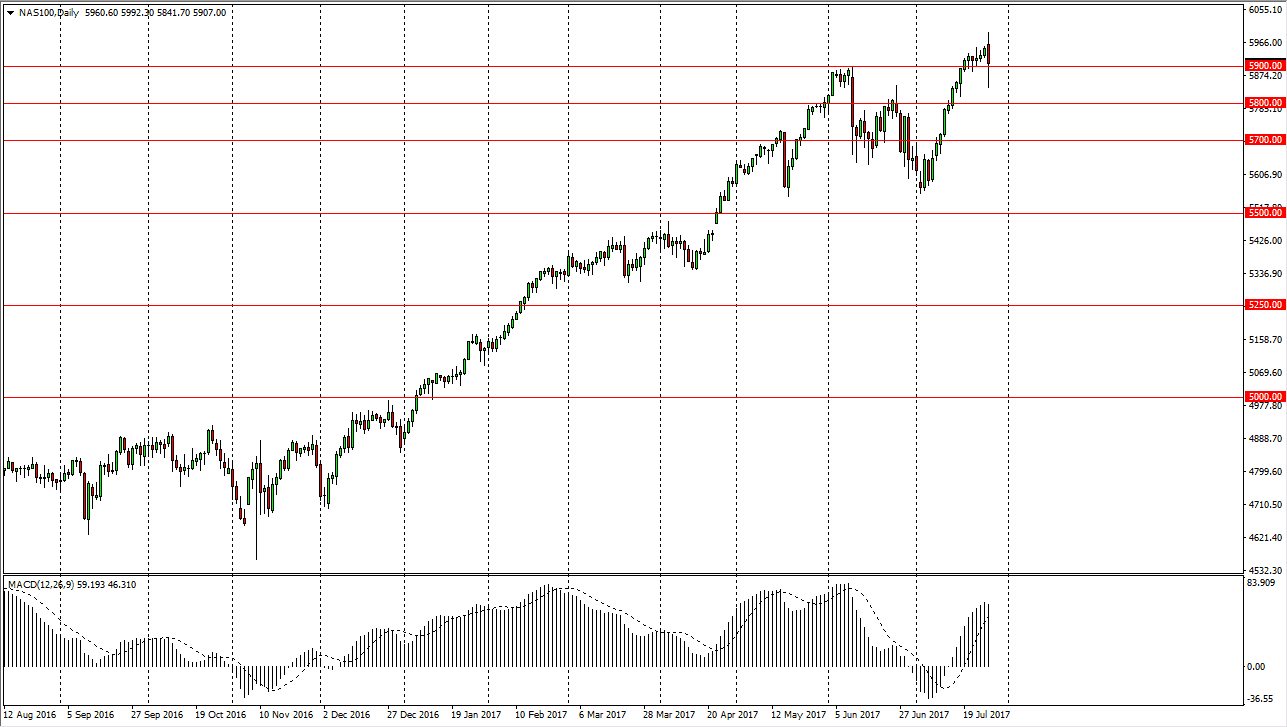

NASDAQ 100

A large position was placed in the futures market to the downside, and this started the algorithmic trading around the world. However, the NASDAQ 100 recovered those losses and we have now turned around and broke above the 5900 level. That’s a very bullish sign, and it now looks as if we are going to continue to see buyers jump into this market place and continue to push this market higher. The 6000 level has been my longer-term target for some time, and after today’s ridiculous action, I realized just how hell-bent the market seems to be on getting there. I am a buyer of dips going forward, and have no interest in shorting this market, and have reinitiated long positions after the washout during the day. I believe 6000 might be stringent resistance, but it’s too juicy of a target for traders to ignore. Because of this, I remain bullish and I think that the buyers will continue to press the issue going forward.