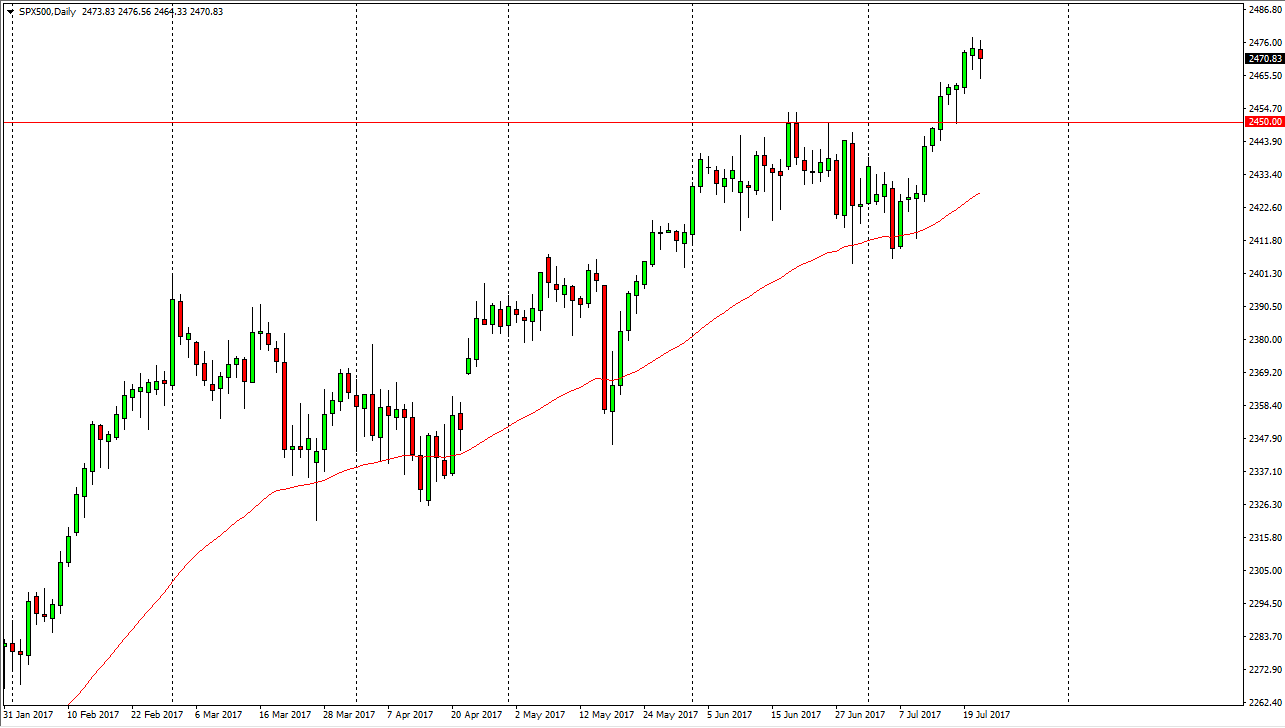

S&P 500

The S&P 500 has initially tried to rally during the session on Friday, but fell significantly to reach towards the 2460 level. However, we turned around to form a hammer and it looks as if the S&P 500 is still ready to continue to go higher. I believe that the market should then go towards the 2500 level given enough time, as it is a large, round, psychologically significant number. The fact that we sold off so drastically and then turned around to show signs of resiliency on Friday suggests that the buyers are still very active in this market, and we should continue to go higher. I believe that the “floor” in the market is close to the 2450 level, and therefore I remain bullish but recognize that we may have bits of resistance occasionally.

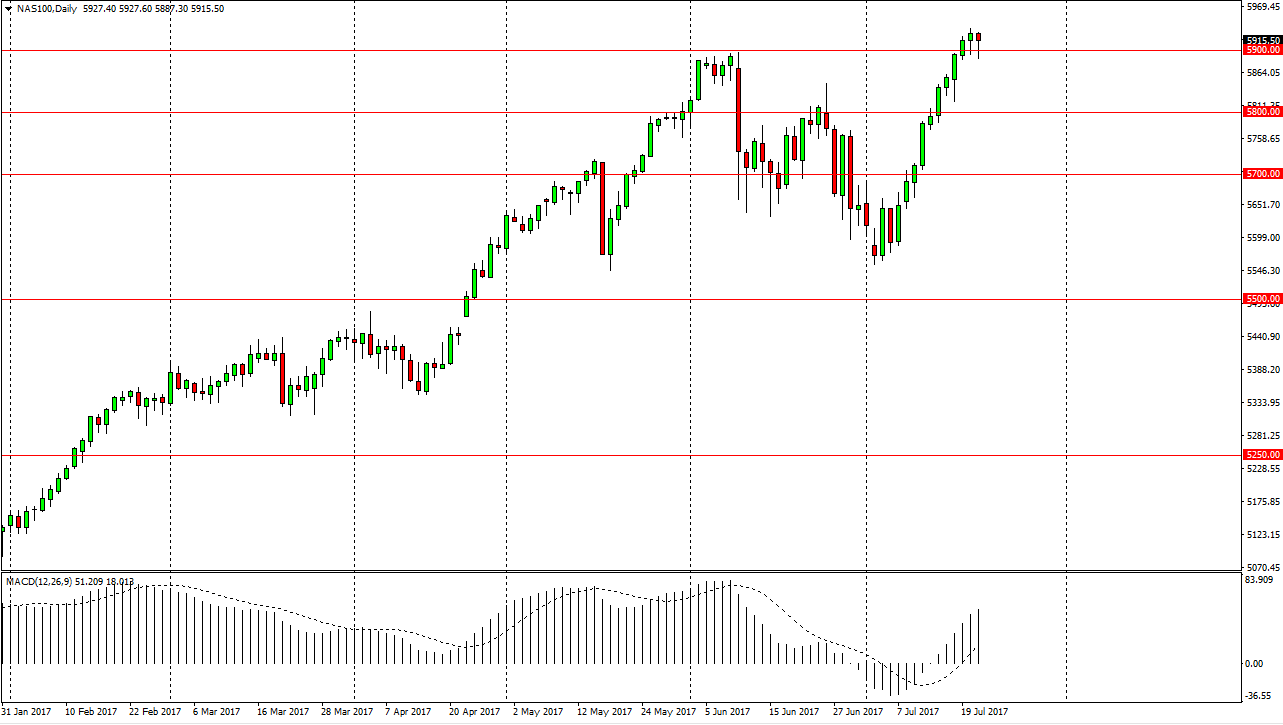

NASDAQ 100

The NASDAQ 100 has pulled back during the day on Friday but turned around to form a hammer as well. The 5900 level seems to be very supportive, and it looks very likely that we will continue to go higher. The 6000 level above is my target and has been for some time. Yes, we are bit overbought, but I think we are going to grind sideways more than anything else as the previous resistance should be support. Ultimately, this hammer suggests that every time we sell, the buyers will turn around to get involved in the market. I believe that the market will continue to see traders get involved in this market as it has generally been a leader, and I think that continues to be the case going forward, and therefore I have no interest in shorting, least not anytime soon. Yes, being overbought is a bit of an issue, and that’s why think we go sideways more than anything else.