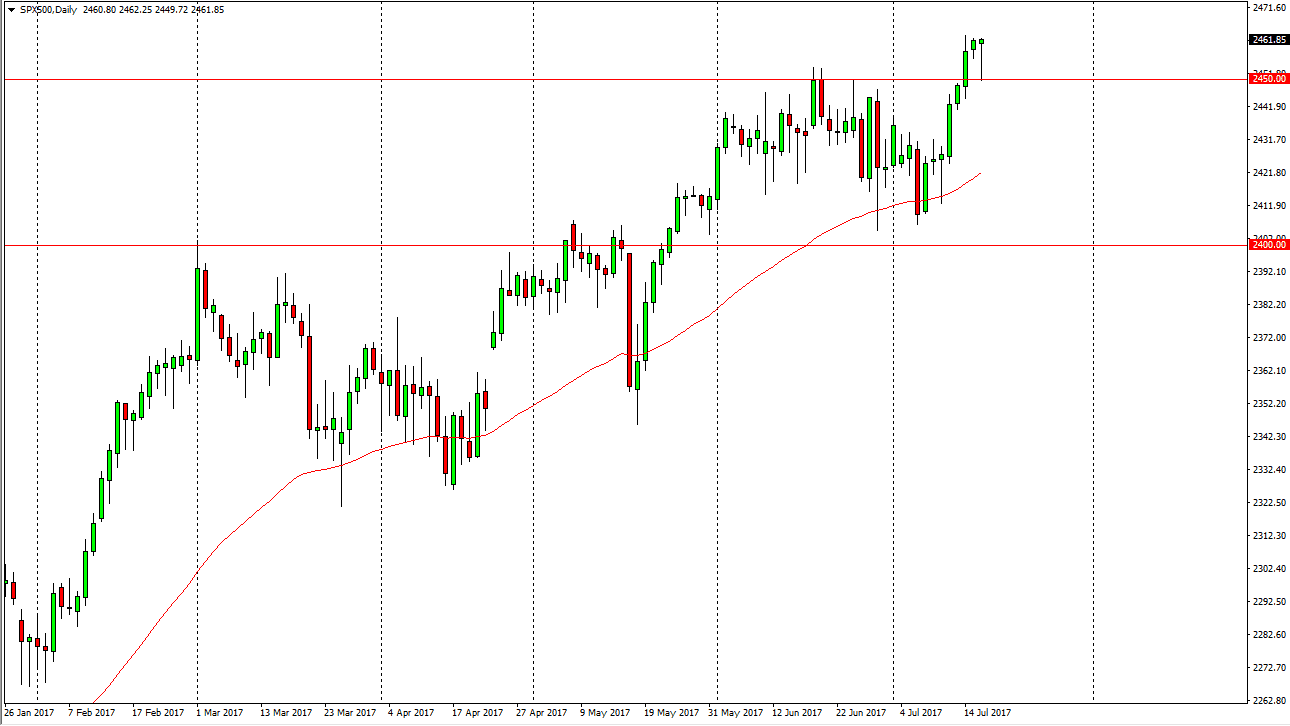

S&P 500

The S&P 500 initially fell during the session on Tuesday, crashing into the 2450 handle. However, the market is well supported at that area and we bounced enough to form a massive hammer. This tells me that the S&P 500 is ready to go higher and I think we are going to go looking for the 2500 level given enough time. I don’t have any interest in shorting, and I believe that buying on the dips should continue to be the theme going forward. I don’t think we will be able to break down below the 2450 handle, it looks like US stock markets are going to continue to outperform the rest of the world. The 2500 level of course will be massively resistive so it may take several attempts to break out.

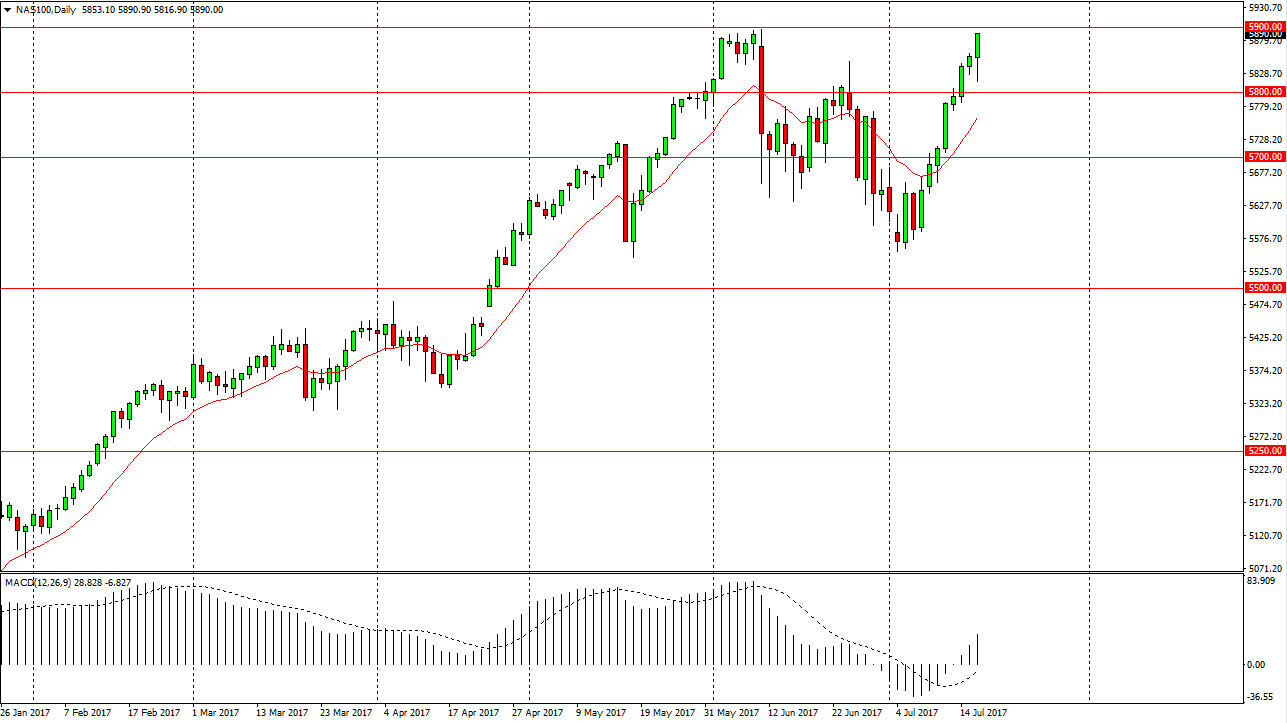

NASDAQ 100

The NASDAQ 100 initially fell as well, but found enough support near the 5810 level to turn around and reach towards the 5900 level. In fact, we are closing near the 5900 level which was the recent high. I think if we can break above 5900, it’s time to start buying again. This is a market that’s very bullish, and therefore I think that we will continue to see buyers jump into this market every time it pulls back as technology stocks have outperformed everything else. Shorting is all but impossible, least not until we break down below the 5700 level, which seems to be very unlikely at the moment. I still believe that the market is can the go looking for the 6000 level over the longer term, which has been my longer-term target for some time now. Quite forward, I think that the buyers will most certainly have a massive advantage over the sellers as we continue to see algorithmic trading favor the upside.