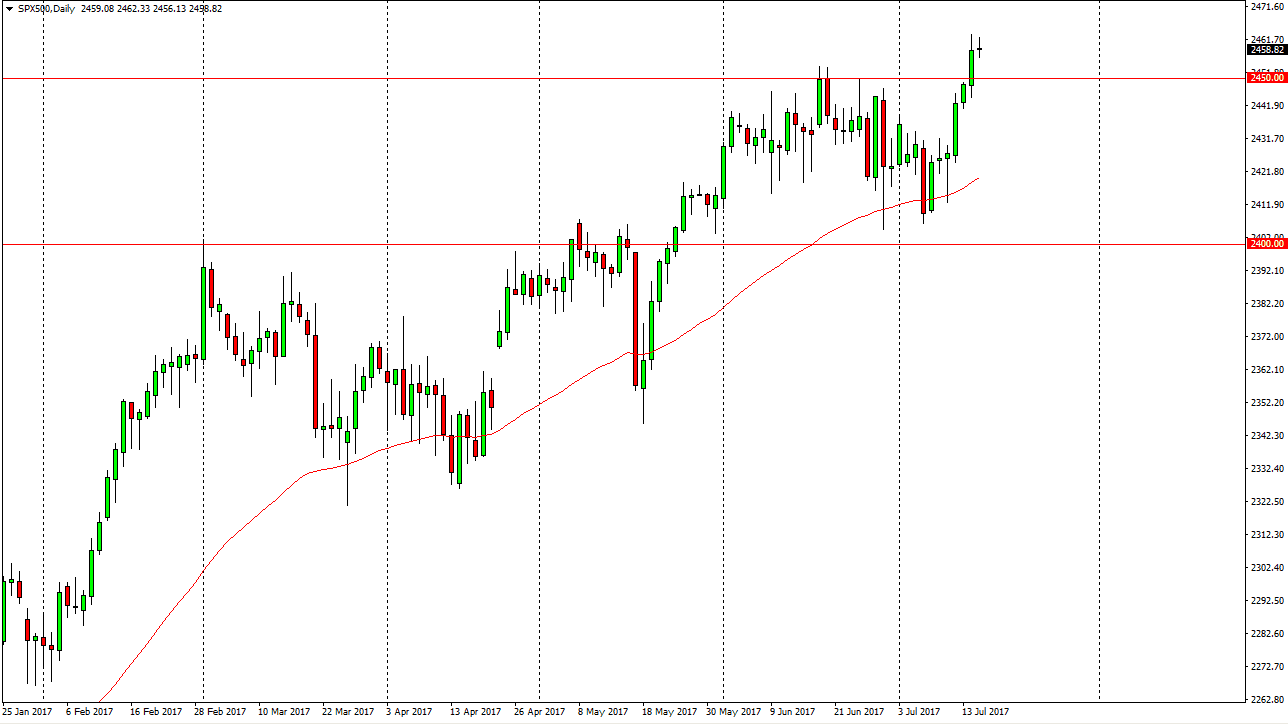

S&P 500

The S&P 500 rallied during the day on Monday, but then pulled back to do almost nothing. I think that the 2450 level underneath is massively supportive, so pullbacks will probably find buyers. We are starting a massive amount of earnings reports coming out from the United States, so it’s likely that the market will be very quiet until this come out. I look at pullbacks as buying opportunities though, and have no interest in shorting. I think that the market will eventually go to the 2500 level, which is massively resistant due to the large, round, psychologically significant aspect of that number. We may need to cool offer a couple of days, but the uptrend is still very much intact, and therefore I have no interest in selling.

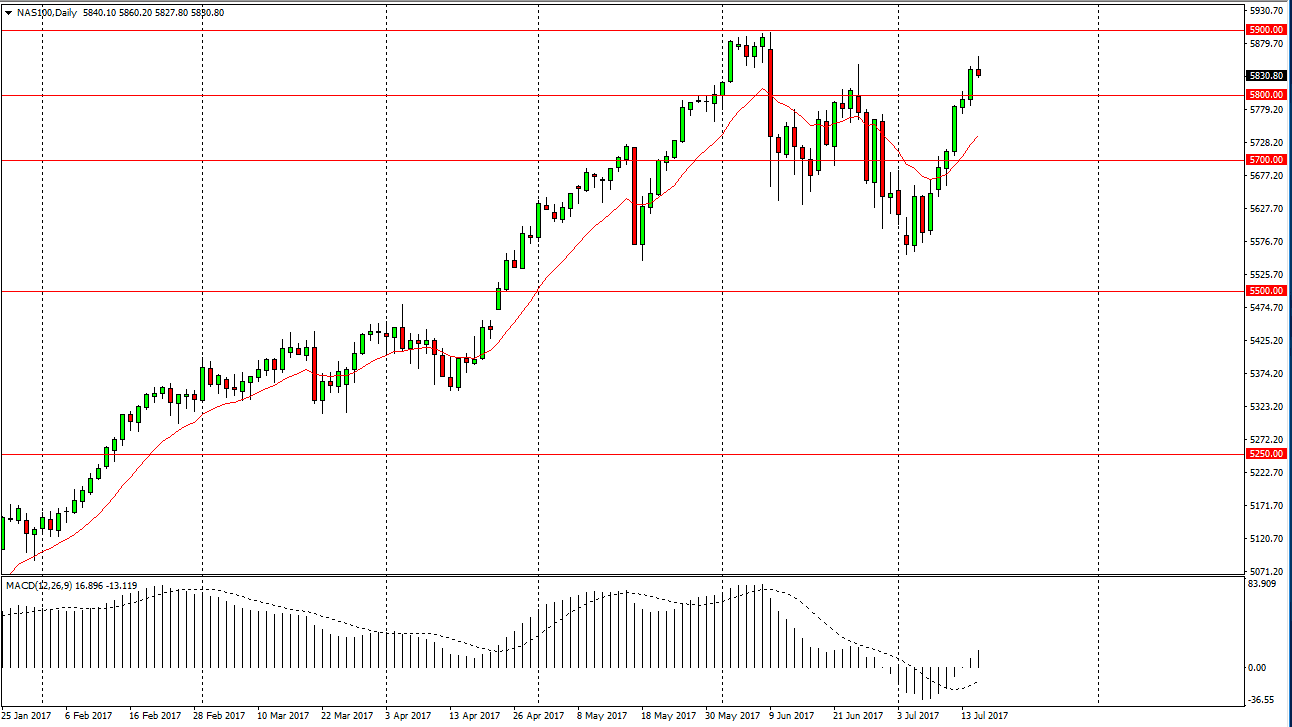

NASDAQ 100

The NASDAQ 100 initially tried to rally during the session on Monday, but turned around to form a shooting star. I believe that the market should fall from here, because quite frankly the market is a bit overextended. The $58 level underneath will be massively supportive, but we could drop below there as well, as the market may need to build up momentum to continue going higher. Alternately, if we break above the top of the shooting star from the session on Monday, that would be a very bullish sign and have us reaching towards the 5900 level. A break above there has the NASDAQ 100 going for 6000, which is my longer-term target anyway. While the market should fall from here based upon the daily candle, I believe that waiting for a buying opportunity is probably the best way to play this market. I have no interest in shorting, we have seen such a bullish run as of late I believe that it would be foolish and possibly even dangerous.