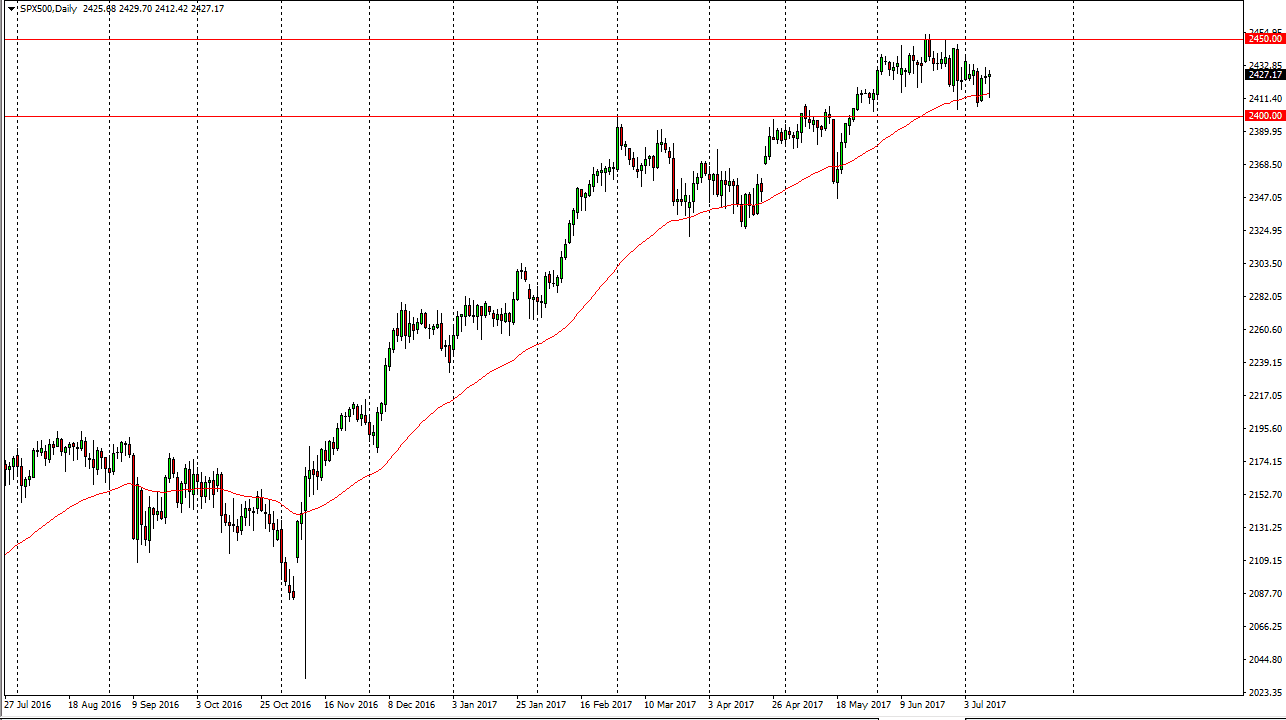

S&P 500

The S&P 500 fell rather dramatically during the day on Tuesday, as word got out that Donald Trump Junior had to release emails involving Russia. However, the market turned right back around and showed its resiliency. By forming a hammer for the daily candle, it’s likely that we will bounce around in this general vicinity, as the 2400 level underneath continues to be supportive, and the 2450 level above continues to be resistance. The market is essentially hanging around the “fair value level”, and it looks likely that the market will continue to find buyers on dips, and therefore I am bullish but I also recognize that with Janet Yellen speaking in front of Congress, anything can happen today.

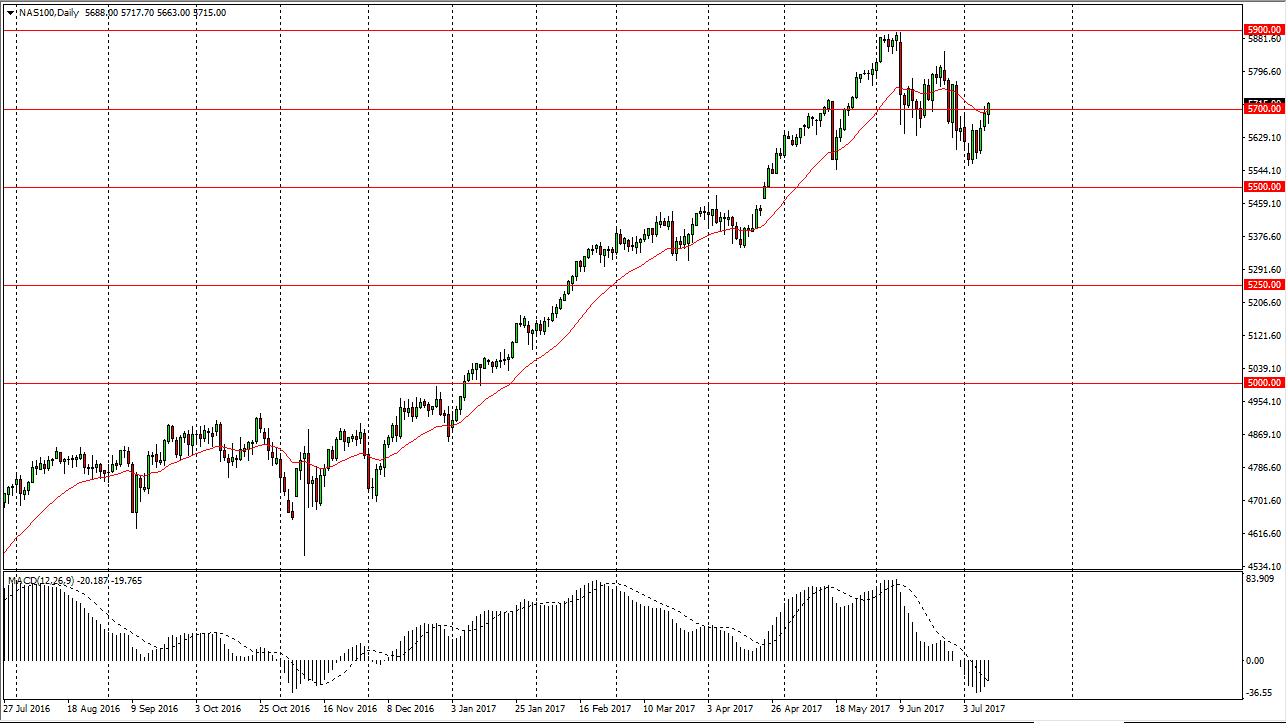

NASDAQ 100

The NASDAQ 100 initially fell during the day but found enough support underneath to turn things around and break above the 5700 level again. That’s a very bullish sign, and a break above there should send this market to the 5800 level, and then eventually the 5900 level. I believe that the market remains bullish, and in fact we may be forming a bit of a bullish flag. It was like of course is a very bullish sign, and therefore think that the buyers are very much in control. After this massive pullback, we have seen quite a bit of buying pressure reenter the marketplace. I think that if the market doesn’t get too much in the way of surprises from Janet Yellen, and should continue the bullish pressure and go towards the highs yet again. A break above the 5900-level census market looking towards the 6000 level which is my longer-term target. I believe that the 5500 level is currently the “floor” in the market, and that should remain the case going forward. It’s not until we break down below that level that I could even remotely consider selling.