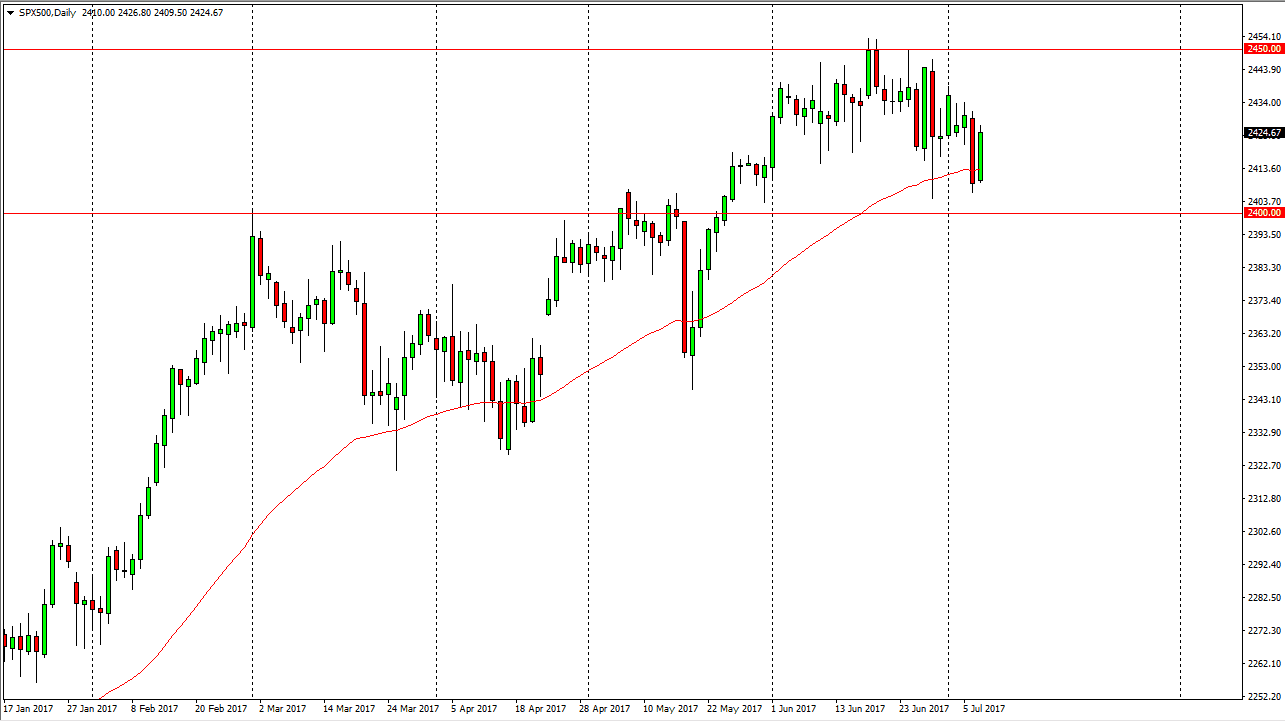

S&P 500

The S&P 500 rallied on Friday, capturing all the losses that it had incurred during the Thursday session. It now looks as if we are ready to continue going higher, and perhaps reaching towards the 2450 level. Eventually, I believe that the 2450 level gets broken and we go to the 2500 level. I also believe that the market should continue to be choppy, but given enough time we should see plenty of buying pressure. The 2400 level underneath should continue to be a “floor” in the market, as the S&P 500 has enjoyed good earnings and of course bullish pressure over the longer term. I believe eventually we will be testing the 2500 level as so many people are aware of its importance.

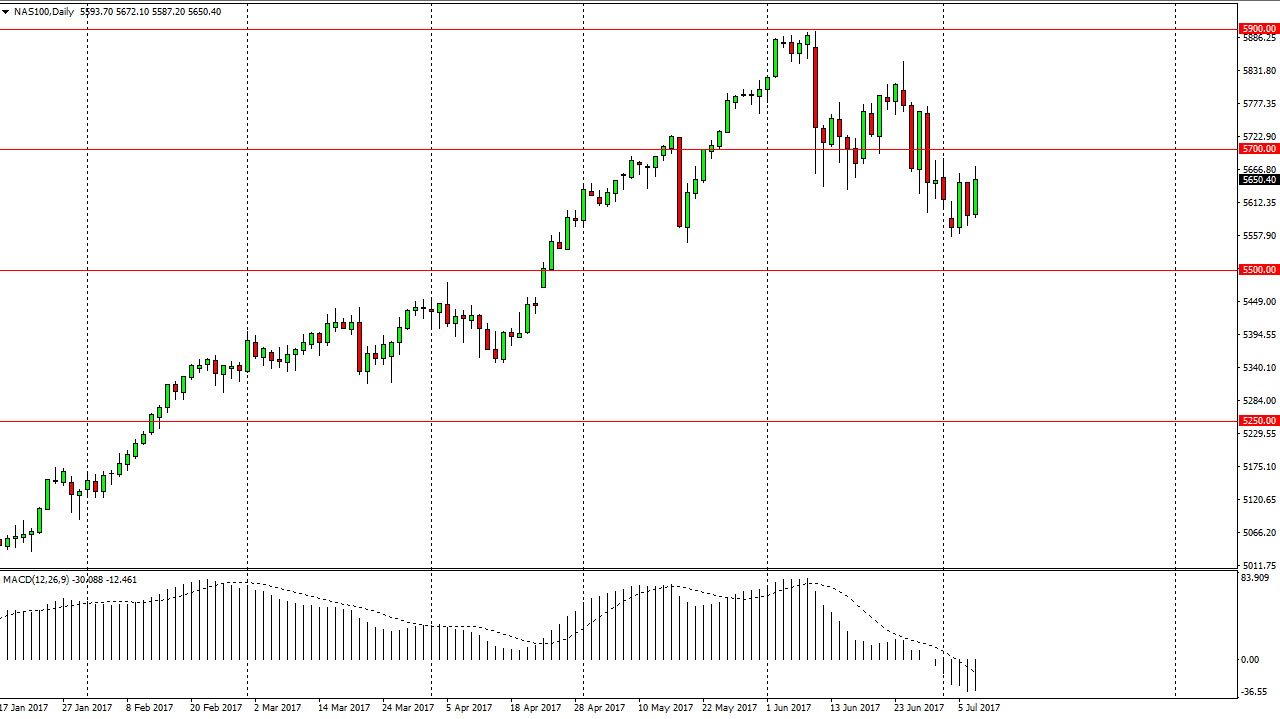

NASDAQ 100

The NASDAQ 100 of course rallied during the day but more importantly, we have formed a hammer on the weekly chart. That’s a very bullish sign, so if we can break above the 5700 level, the market is very likely to continue going higher, perhaps reaching towards the 5900 level and then after that, the 6000 level which is a psychologically important level. If we can break above 6000, then we start the next leg higher in the longer-term uptrend. Having said that, I am very cautious about buying this market until we break above the 5700 level, as it becomes a longer-term signal, and therefore much more relevant on this chart as well. Ultimately, I believe that the NASDAQ 100 rallying will not only show strength here, but it will drag the Dow Jones 30 and the S&P 500 higher with it.

The alternate scenario is if we break down below the 5500 level, the market could then drop to the 5325 level, but I don’t anticipate that happening. It looks to me as if the buyers are starting to return.