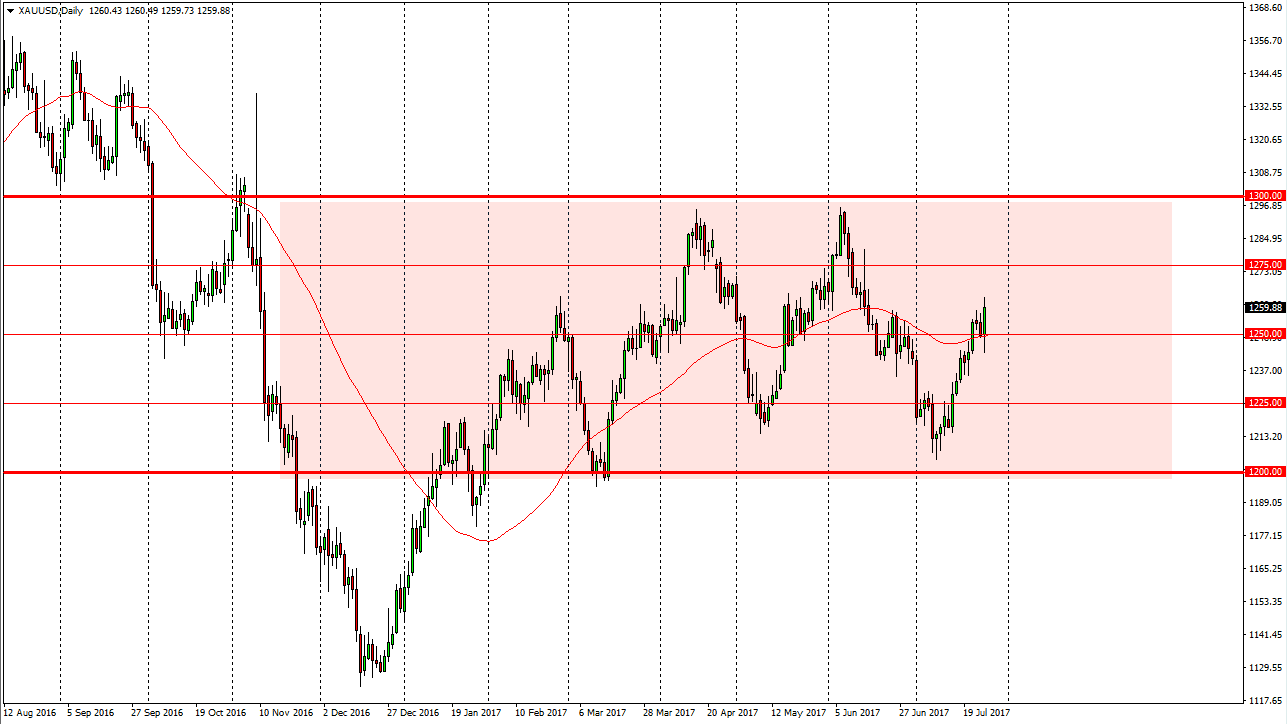

Gold markets have been very choppy and volatile as of late, and of course the Wednesday session was always going to be interesting as the FOMC released an interest rate announcement and of course statement. Now that we have had that, and it has been a bit dovish, the gold markets turned around and rallied to reach towards the $1260 level. Currently, I look at this is a market that is consolidating between $1200 on the bottom, and the $1300 level on the top. Because we have bounced from the “middle point” of the overall consolidation, I think that buying will continue. The US dollar has been on its back foot all day, especially considering that the statement was a less than hawkish, and now I believe the gold and silver both will benefit from this relationship.

Buying dips

I believe that short-term charts will continue to be a nice opportunity to get involved in this market on short-term debts. I believe that we are going to reach towards the $1275 level, and then eventually the $1300 level. I don’t know if we can break above there though, because quite frankly there wasn’t much in the statement that was earth shattering, it just suggested that the Federal Reserve was at least open to holding off on raising interest rates. At this point, I think that longer-term traders continue to push this market back and forth in a $100 range. Ultimately, we are above the “middle point”, and that means that in theory we should see buyers getting interested in this market. If we can break down below the bottom of the range from the session on Wednesday, that would be a very negative sign, but I don’t suspect that will happen anytime soon as the buyers have certainly been aggressive as of late.