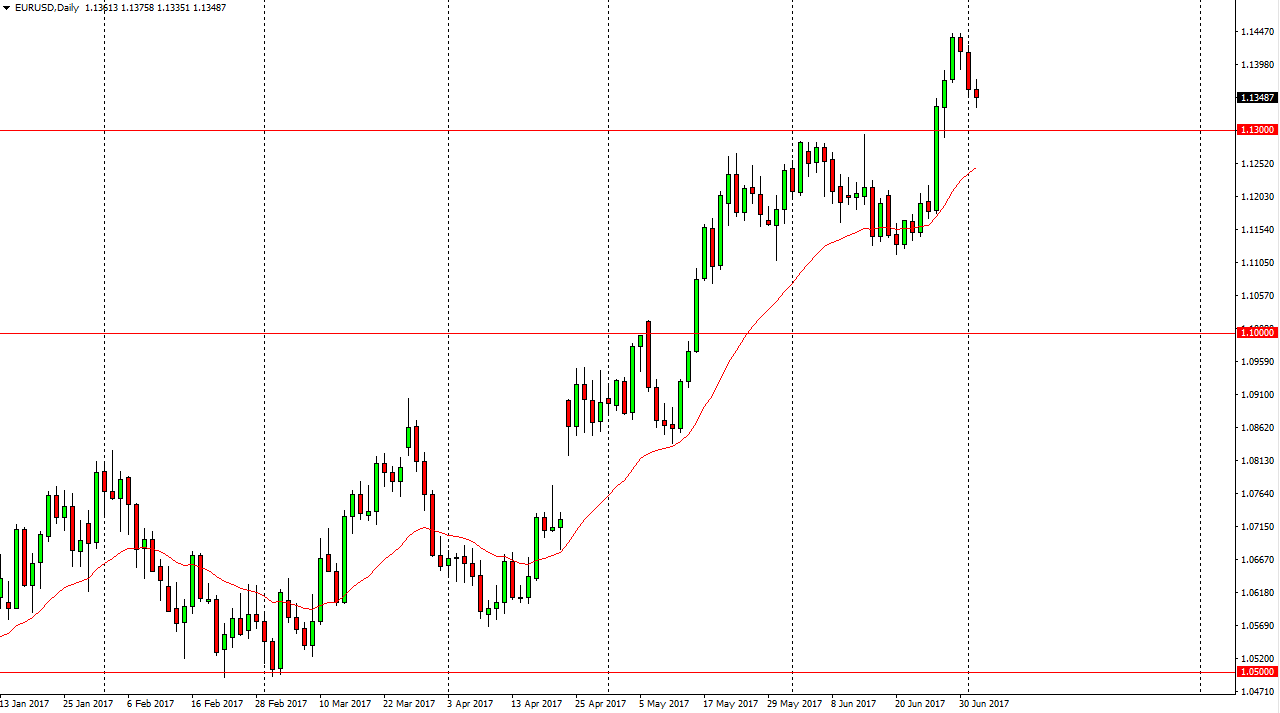

EUR/USD

The EUR/USD pair did very little during the day on Tuesday as Americans would have been gone for Independence Day holiday celebrations. This of course works against liquidity, and therefore the markets didn’t move much. I believe that the 1.13 level underneath should be supportive, as it was previously resistive. I think that a supportive candle could be a nice buying opportunity, perhaps reaching towards the 1.15 level above which is the top of the three-year consolidation that the market has been stuck in. A breakdown below the 1.13 level could send this market looking towards the 1.12 level after that. With this, the market looks likely to continue to be volatile, but I think they’re still a significant amount of bullish pressure underneath.

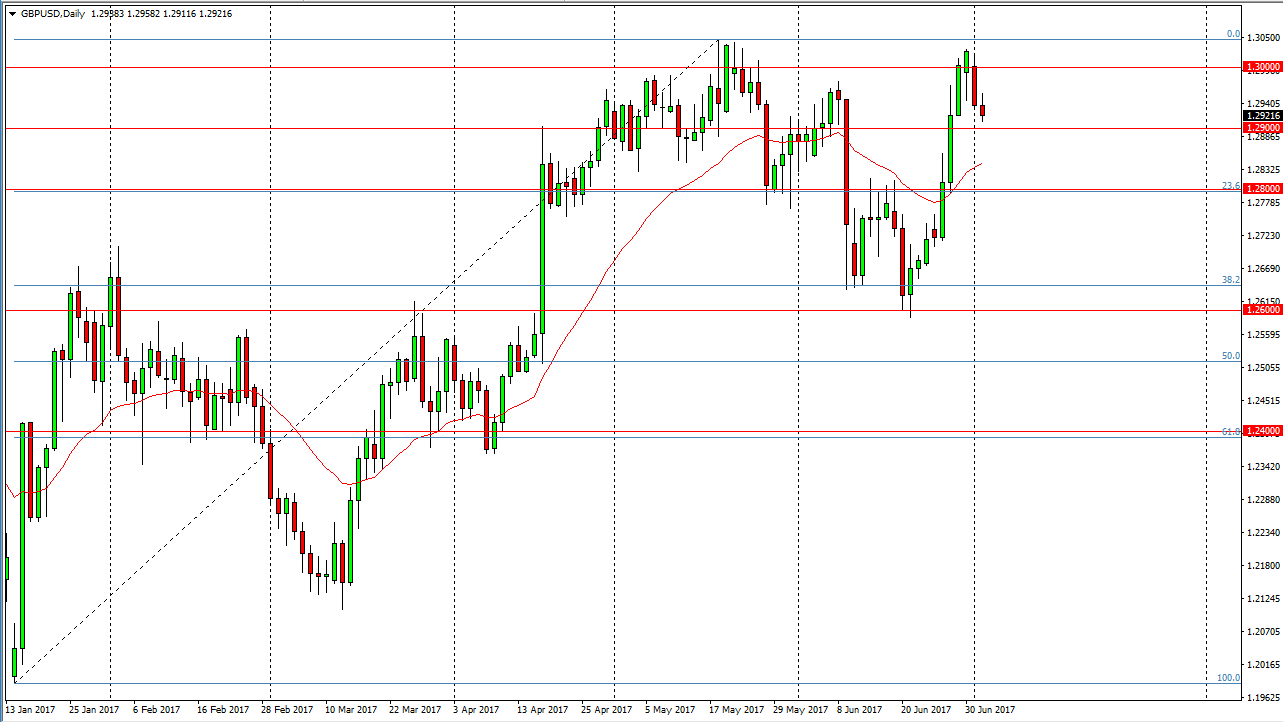

GBP/USD

The British pound of course has been volatile as well, as we have gone back and forth near the 1.29 handle. The 1.29 handle should be supportive, and since we have seen such a massive surge to the upside, it’s likely that the pullback should be a nice buying opportunity as it offers value in a market that has been very strong. Even if we break down from here, the market should then go down to the 1.28 level. That’s an area where buyers would be especially strengthen, so I’m waiting to see if we can get a supportive candle that we can take advantage of, or perhaps some type of bullish candle or even more importantly impulsive candles that show signs of this market continuing to go higher, perhaps breaking above the 1.3050 level. Once we do that, the longer-term target is the 1.3450 level after that. Keep in mind that the headlines crossing the wires from the negotiations between London and Brussels will influence this market as well, making it very volatile.