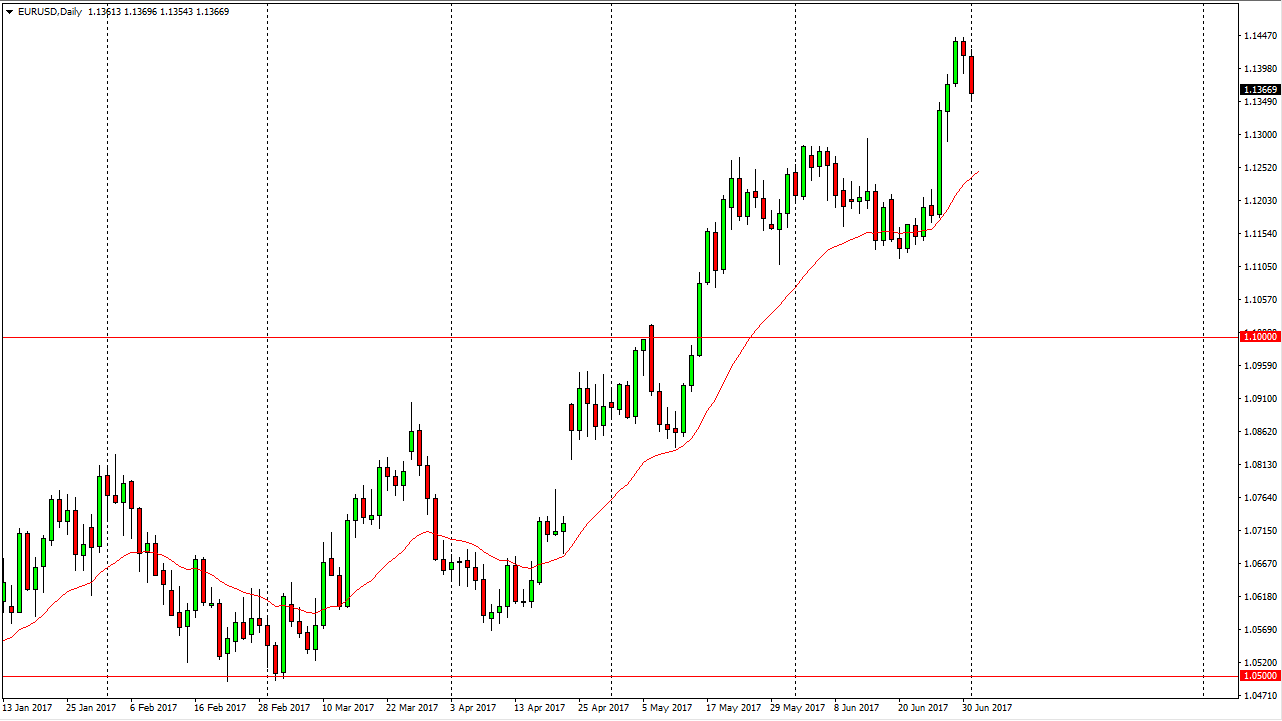

EUR/USD

The EUR/USD pair fell on Monday, retreating from the 1.1450 level. There is a significant barrier in the form of the 1.15 level above, so I believe that the markets may continue to drop. After all, that is the top of a three-year consolidation area, and I believe it is going to take something rather special to break out to the upside. If we do, the market should go much higher, perhaps the 1.18 level over the next several weeks. Currently, I do not believe that the market has a momentum to finally break above this area, but if it does obviously that would change everything else. A pull back to the 1.11 level is possible, but I also recognize that the most likely scenario is going to be choppiness.

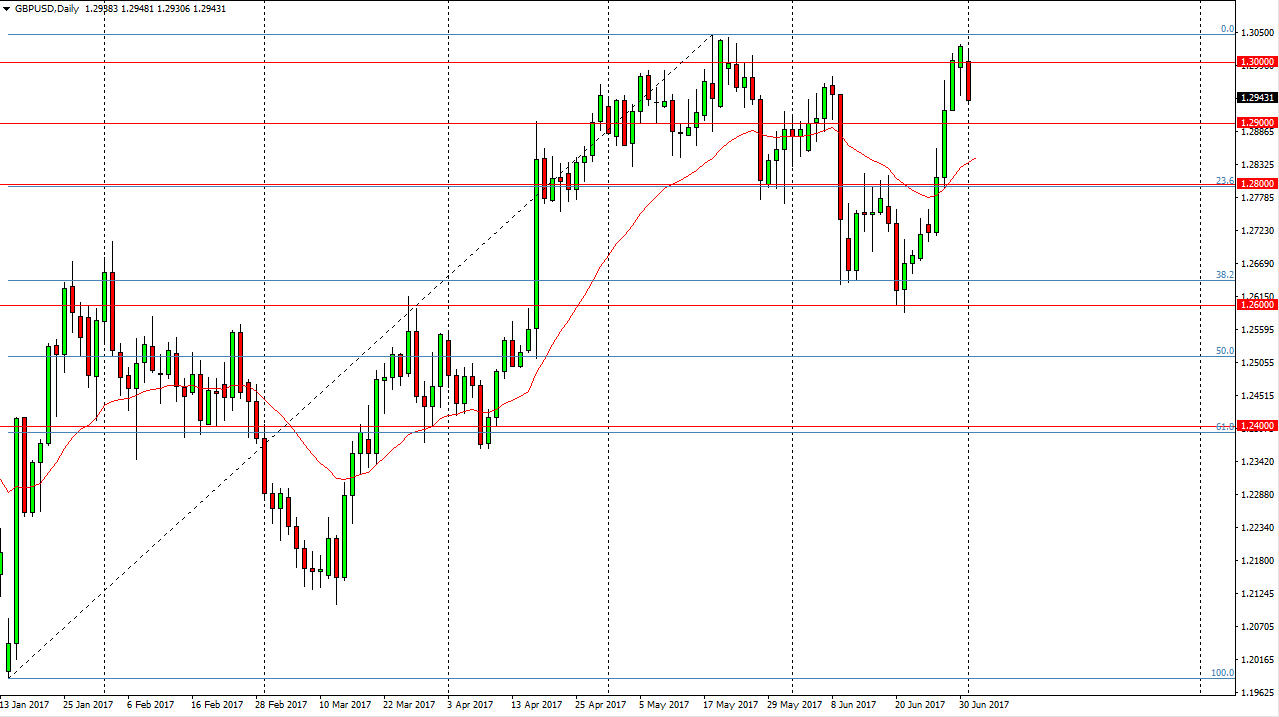

GBP/USD

The British pound fell as well, as the 1.30 level has offered resistance. The fact that we closed towards the bottom of the range tells me that the market will probably continue to go lower and the short-term, and I think the 1.29 level will be the next support level. Once we break down below there, I believe that the market would probably go looking for the 1.28 handle underneath. Alternately, if we can break above the 1.3050 level, the market should then go to the 1.3450 level after that. The market has been very bullish as of late, so a pullback makes quite a bit of sense, especially considering the impulsivity of the move over the last several sessions.

We will have to keep an eye out on the market, and unfortunately the headlines coming out, as Brexit negotiations continue. This of course will add volatility to this pair, and could make trading difficult over the next several months. In the short term though, it looks as if the market is concentrating on the fact that the Bank of England may have to raise interest rates sooner rather than later.