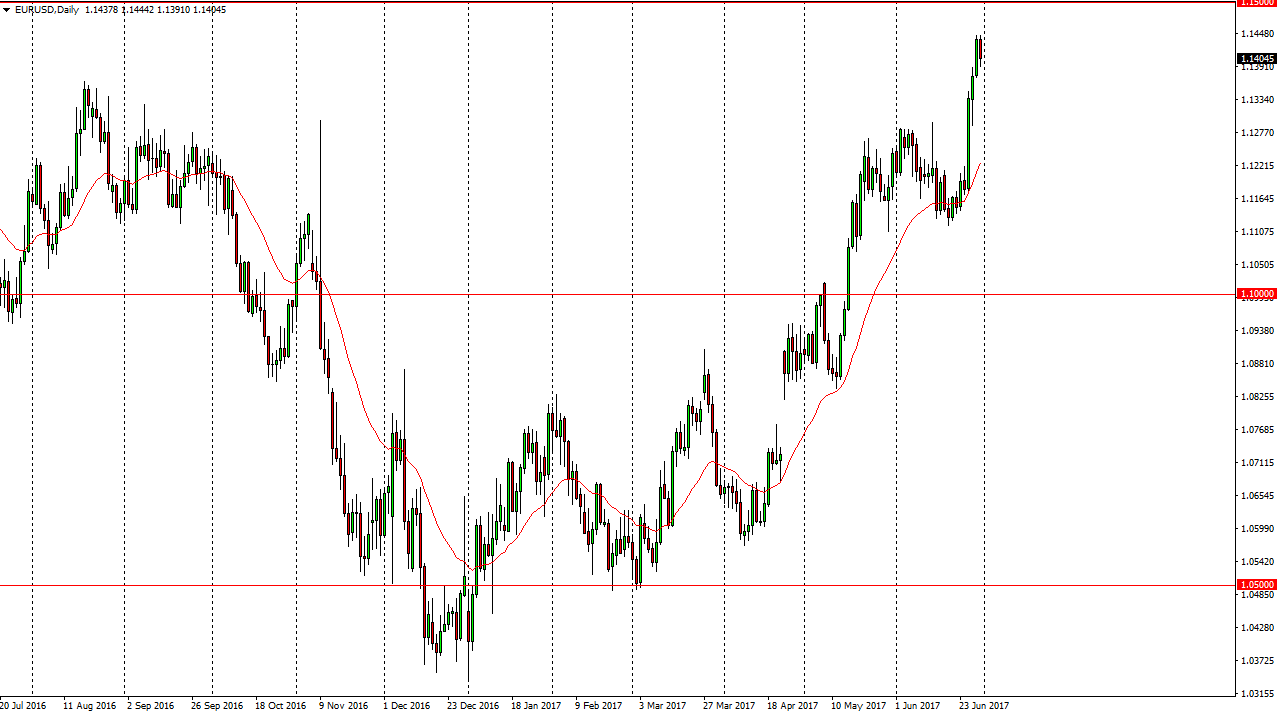

EUR/USD

The EUR/USD pair has been impulsive of the last several sessions, but we turned around to form a slightly negative candle. The 1.14 level underneath should be supportive, but quite frankly I think that if we break down below there, the 1.13 level is even more supportive. Longer-term, the market has been consolidating over the last 3 years, with the 1.05 level underneath being the floor, while the 1.15 level above being resistive. A break above there could send this market into a fringy to the upside on the longer-term, but I think that more than likely we will have to try to break out several times, as it is a massive barrier. With this being the case, I am looking at a pullback as a short-term buying opportunity, with perhaps an exhaustive candle near the 1.15 level as a longer-term short opportunity, which would be a continuation of the longer-term consolidation.

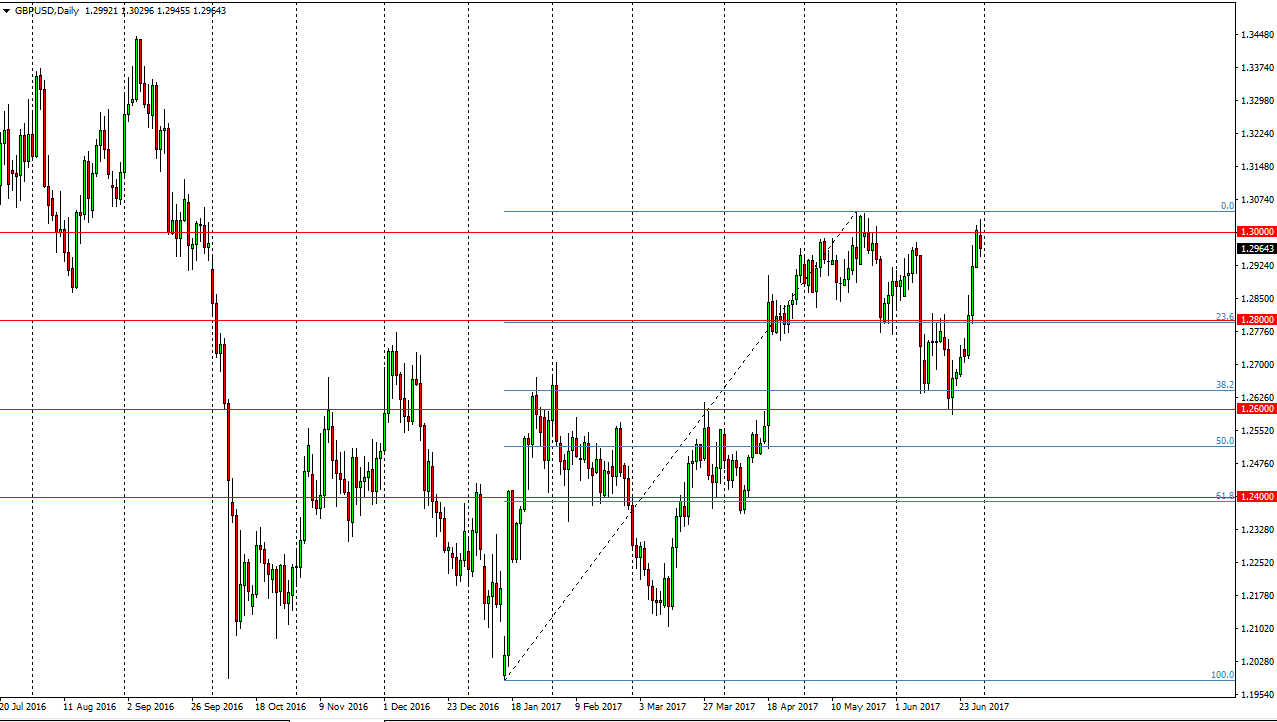

GBP/USD

The GBP/USD pair tried to rally during the day on Friday, breaking above the 1.30 level. There is a significant amount of resistance above there to keep this market somewhat lower. The 1.3050 level above being broken to the upside should send this market looking to the 1.3450 level. However, we are a bit overextended, so short-term pullback would make quite a bit of sense. The 1.28 level underneath should be massively supportive, and that could be a nice buying opportunity as this market continues to look bullish, but is a little bit overdone currently. Ultimately, I have no interest in shorting this market, because quite frankly shorting this market is going against what has been a very impulsive move recently. With Mark Carney suggesting that the Bank of England may have to raise interest rates quicker than people thought, this of course is a very bullish sign.