EUR/USD

The Euro rallied during the day after initially falling on Wednesday, mainly in reaction to the FOMC statement the came out. It was a bit dovish, and it appears that the market is going to be treated 2 very slow tightening coming out of the Federal Reserve. This works against the value of the US dollar, and now sets this market looking towards the 1.1850 level, which has been a longer-term target for me for some time. I believe the dips continue to offer buying opportunities, and there’s pretty much no way that you can sell this market. I believe that there is a hard “floor” somewhere near the 1.1650 level. Longer-term, I think we’re going to go even higher, perhaps the 1.20 level given enough momentum and patience.

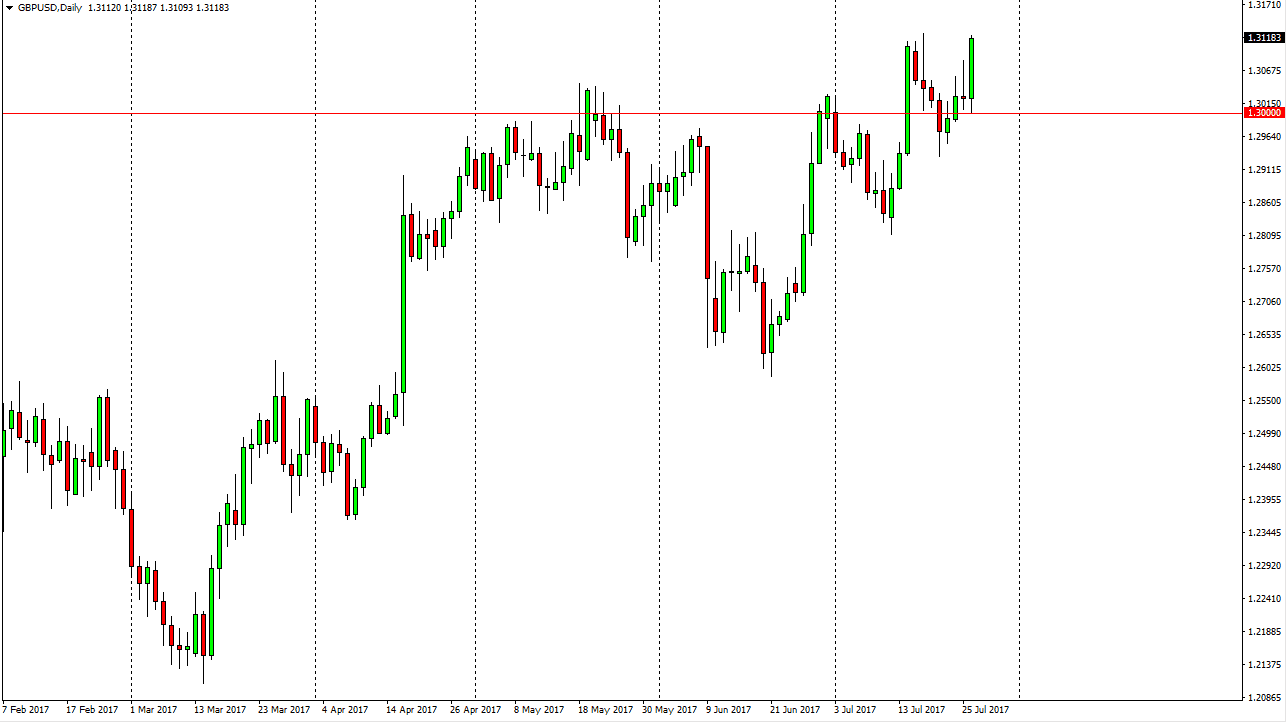

GBP/USD

The British pound fell a bit initially on Wednesday, testing the 1.30 level. That level has held as support, and it now looks as if the British pound is probably going to go towards the 1.3450 level. The market has a significant amount of resistance above, so I think that every time we pull back it will be an opportunity to build up enough momentum to go higher. I think that the 1.30 level now offers the “floor” in the market, and therefore I believe that selling is all but impossible. The 1.3450 level offers resistance going towards the 1.35 handle above, so I think that it’s all but impossible to think of this market other than a “buy the dips” situation. I don’t know if it will perform as well as the EUR/USD, but I certainly see the British pound rallying from here on out. It is not until we were to break down below the 1.29 level, something that I don’t think very likely, that I would consider selling this market.