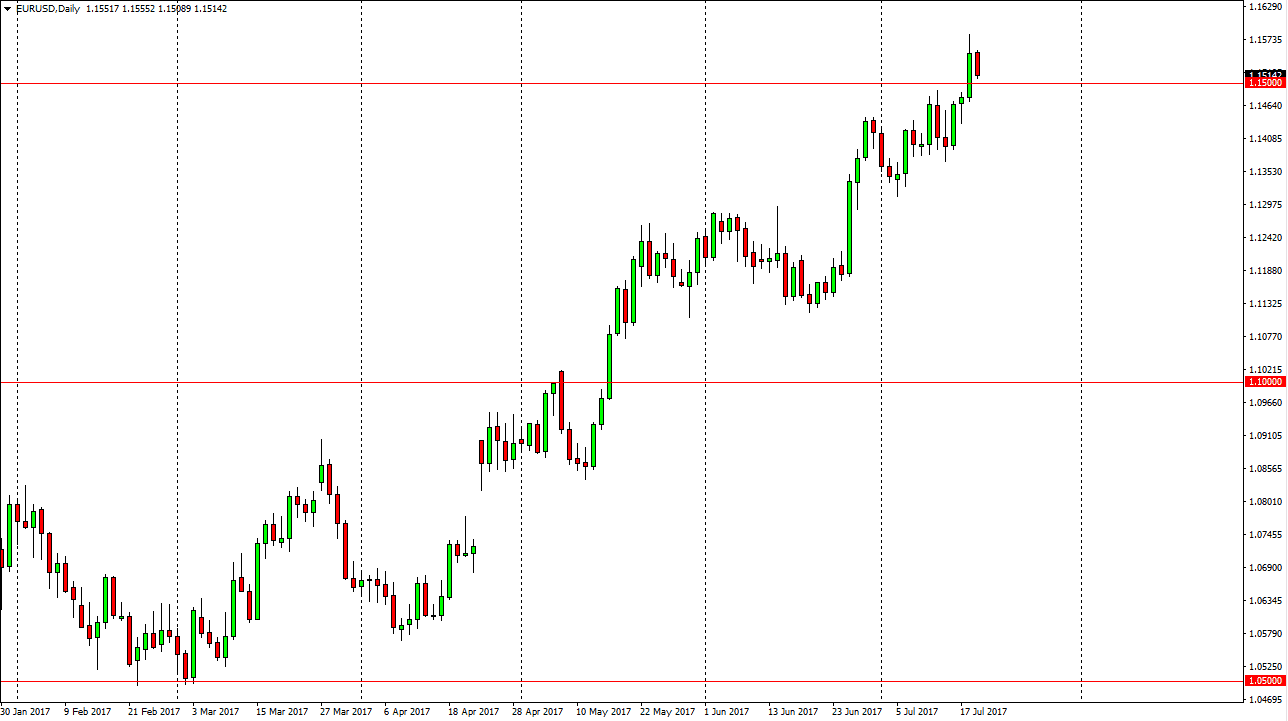

EUR/USD

The EUR/USD pair fell during the trading session on Wednesday, testing the 1.15 level. We have seen a bit of support there, as one would expect. This is a bullish sign, but I don’t have a bounce or supportive candle to start buying quite yet. I believe that if we can continue the move higher, the market will eventually go to the 1.18 level, but it will take a long time to get there. After all, this market does tend to have a lot of volatility attached to it due to high-frequency trading, and of course the headline news that continues to cause issues around the world. Currently, it appears that the bond situation favors the Europeans, and of course should continue to push this pair higher over the longer term.

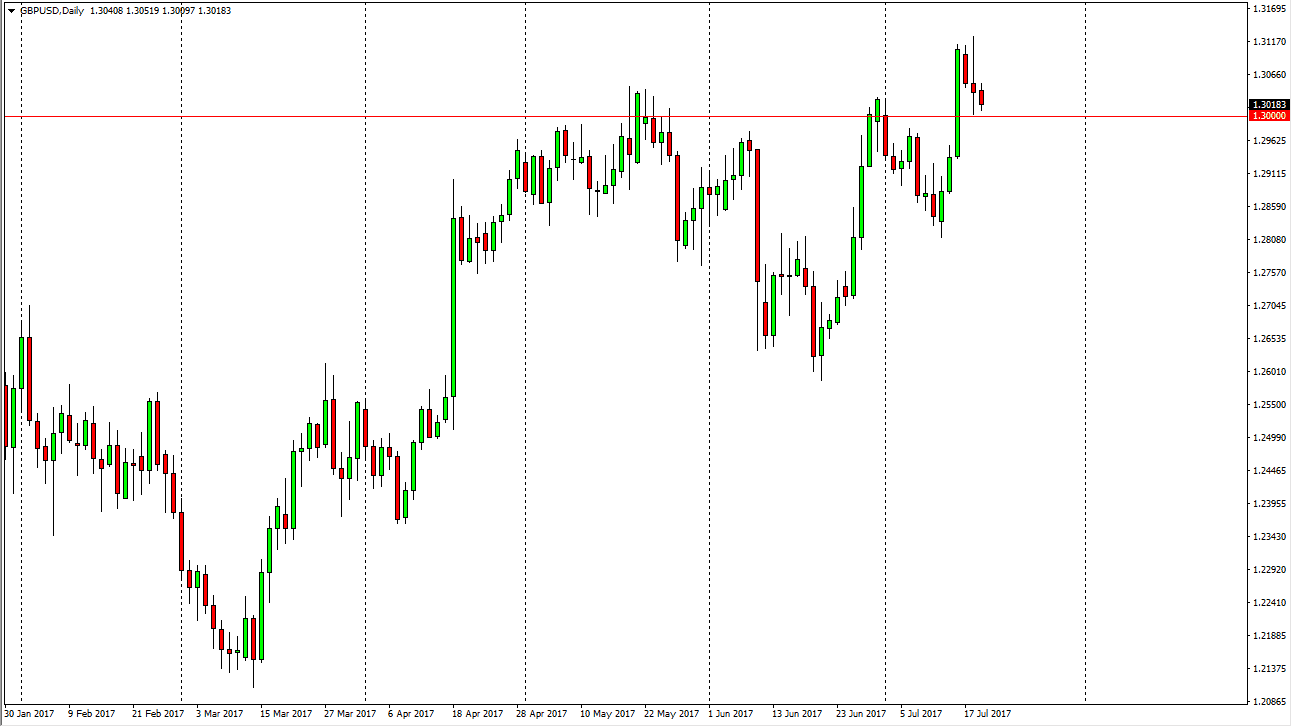

GBP/USD

The British pound fell slightly during the day on Wednesday, testing the 1.30 level. This was a psychological barrier that was very difficult to overcome, so I would suspect the buyers may be looking to get involved. However, and the short-term I believe that it will be very choppy and volatile, so it’s very difficult to imagine that it’s going to be easy trading this pair going forward. On a supportive candle or a bounce, I am willing to buy but won’t be convinced until we break above the top of the range for the session on Tuesday. If we did breakdown, I wouldn’t be a seller until we got below the 1.29 handle, which would show a significant shift in attitude.

It appears that currently the CPI numbers coming out of the United Kingdom are weighing upon the British pound, so traders are starting to question whether the Bank of England can raise interest rates, despite what they have thought previously. The question now is whether the US dollar weakness will translate into a higher level here.