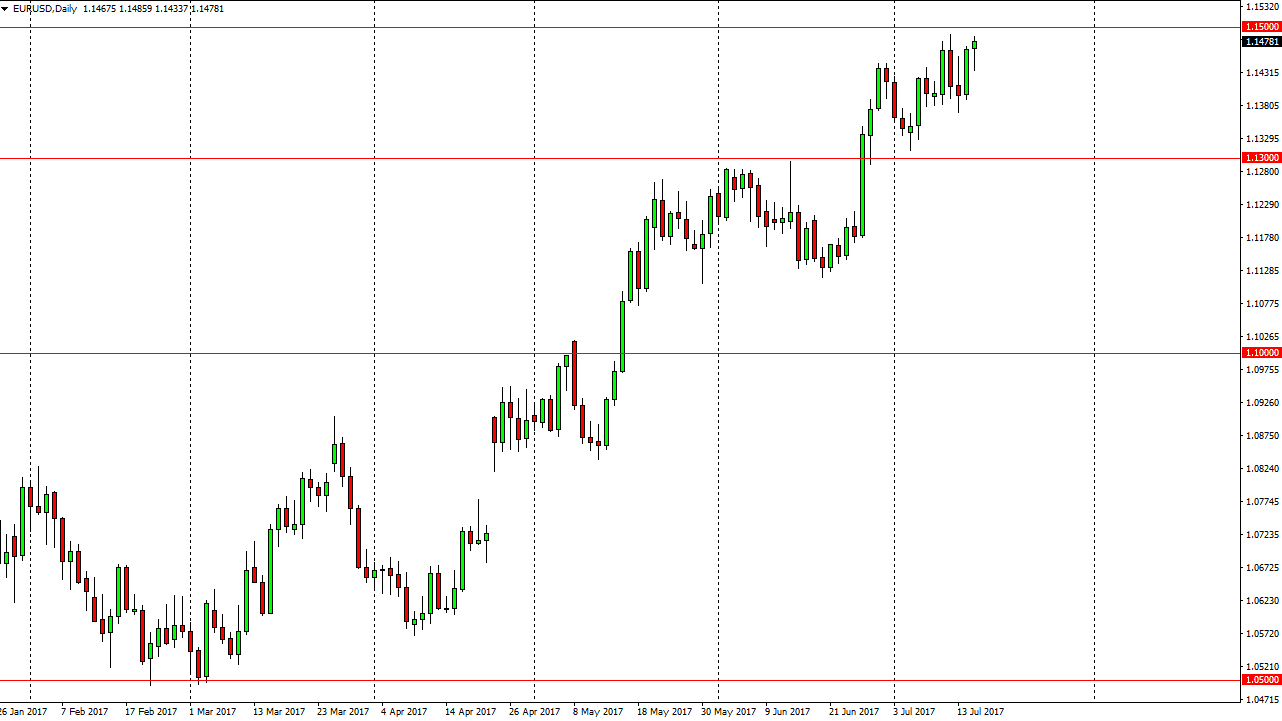

EUR/USD

The EUR/USD pair initially fell on Monday, but found enough support to turn around and form a hammer. The hammer suggests that we are going to break out to the upside, and they move above the 1.15 level would have me going long of this market as I think it would be a signal that we are breaking out of 2 ½ years’ worth of consolidation, and that of course is important. If we can break above the 1.15 level, the market should then go to the 1.18 level above, which was massive resistance in the past. I believe that this market should continue to see quite a bit of volatility, but it looks as if we are trying everything we can to break out to the upside, giving us a buying opportunity longer term. If we break down below the bottom of the candle for the session on Monday, I would be a bit concerned, as it would show the resistance area holding yet again. Stay tuned, this is a very fluid situation.

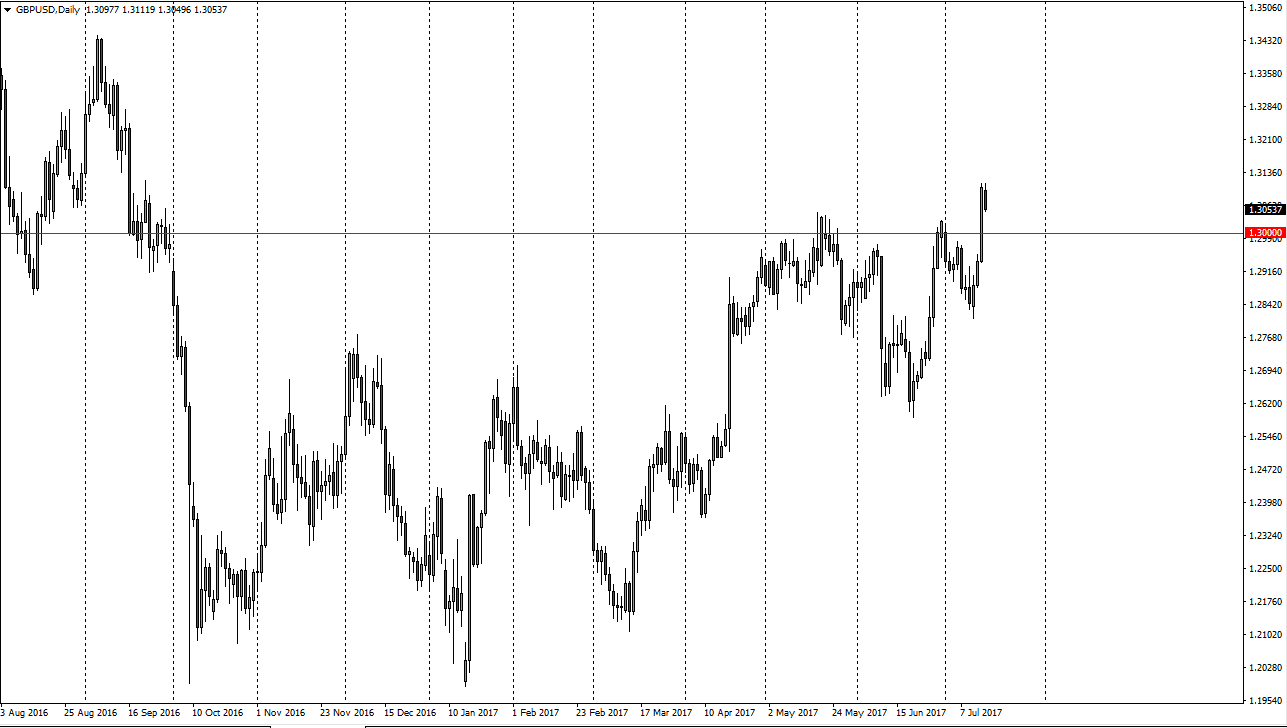

GBP/USD

The GBP/USD pair broke out to the upside on Monday, slicing through the 1.30 level. Now that we are above there, I think that the market should continue to go higher, but we may need to pull back in order to build up enough momentum. Ultimately, the 1.3450 level above should continue to be a target as it was the previous resistance area in the consolidation area that we have just entered. I believe that the British pound is oversold, and this breakout should lead to bigger and better things given enough time. Am a buyer supportive candles and I think that the 1.30 level should offer a floor. If it does not, then that throws this market into a bit of disarray.