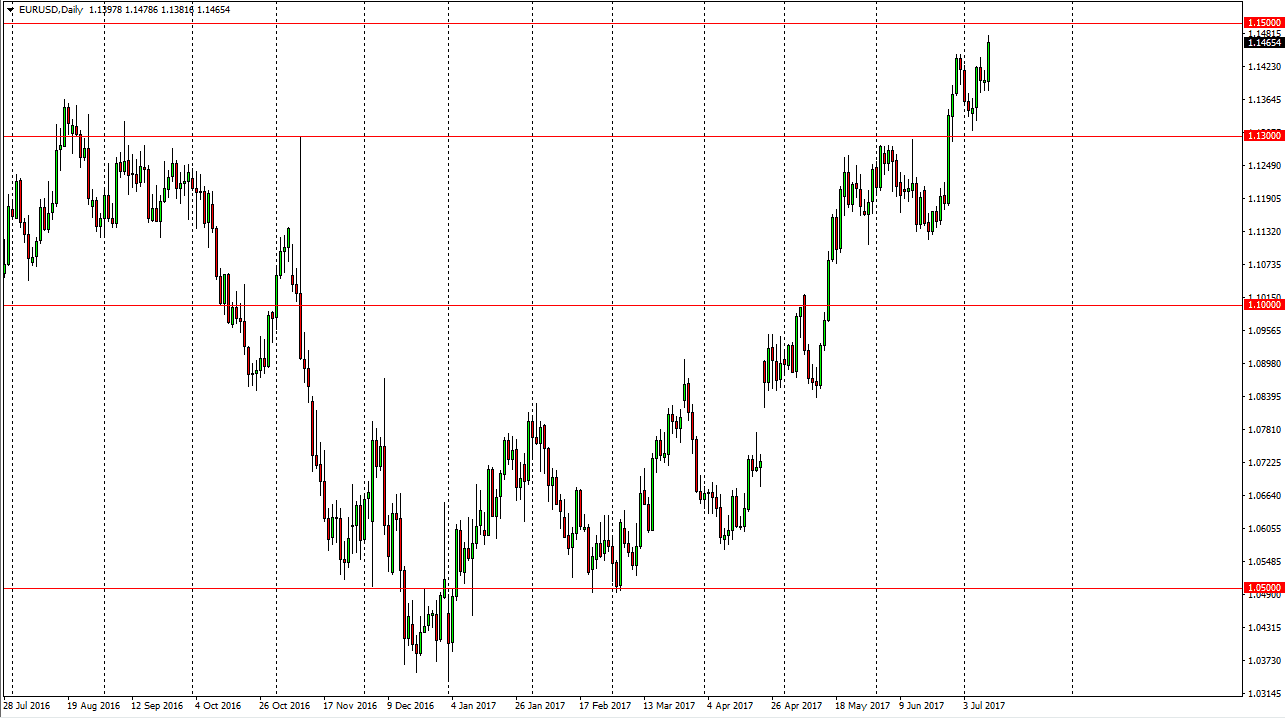

EUR/USD

The EUR/USD pair rallied on Tuesday, breaking towards the 1.15 level. If we can break above there, and more importantly, stay above there, the market should continue to go even farther. Ultimately, this is a market that I think that we will see a lot of reaction in during the session today as Janet Yellen is speaking before Congress, and that of course will give us an idea as to the Federal Reserve and its direction. This obviously will move the value of the dollar, and therefore move the value of this pair. I think if we close well above the 1.15 level, the market will go looking for the 1.18 level over the longer term. Alternately, if we break down from here, the market could go down to the 1.13 level, and then eventually the 1.11 level. I think today is going to be a very important session, and with this I think that you may be best served to waiting until the market closes for the day.

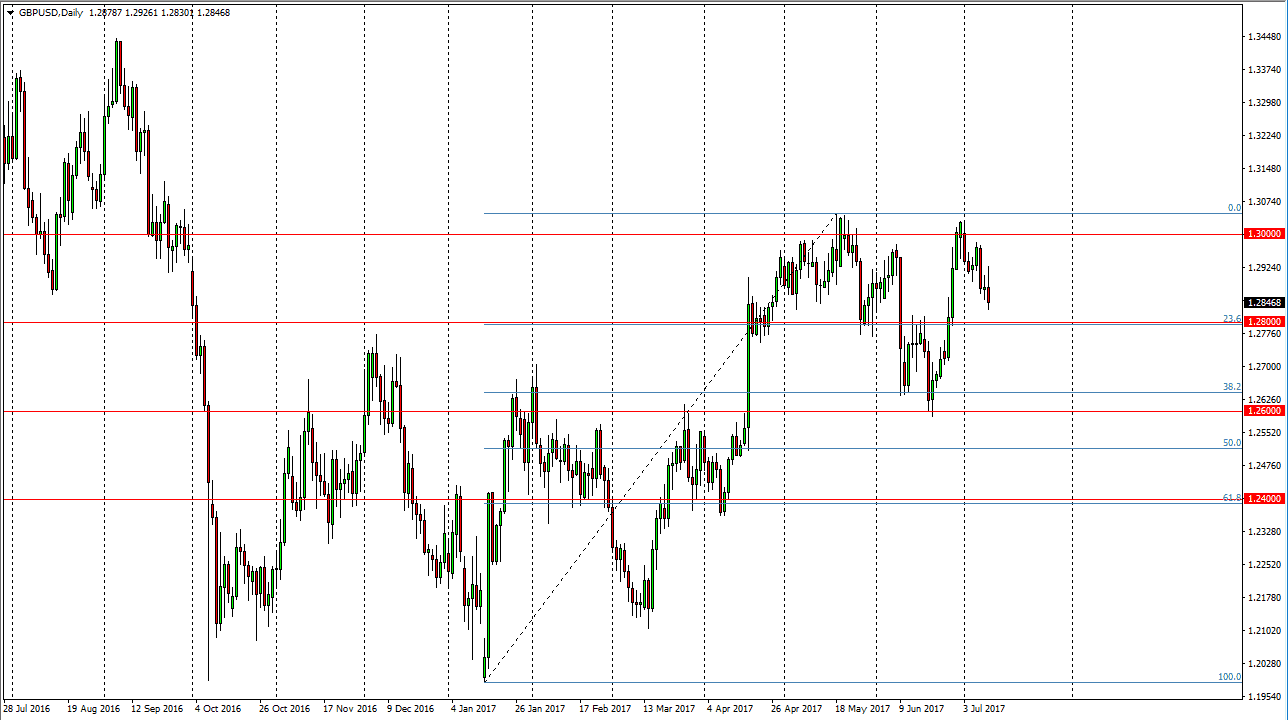

GBP/USD

The British pound initially tried to rally, but turned around after Broadbent failed to mention anything about monetary policy. This spoke to the market a bit, as the Bank of England was expected to be very bullish. Alternately, I think that there should be support below, so the 1.28 level below could be an area where buyers stepped back into the market. However, if we break down below the 1.28 level, the market should then go looking for the 1.26 level. This is a market that is going to be very volatile, and of course Janet Yellen speaking during the session will course have some of you say about this market. Ultimately, I think the market may try to rally, but the next couple of sessions could be rather difficult.