The EUR/JPY pair respected the support level at 128.50 for many sessions lately, which supports continuing the upward momentum, the pullback was only due to profit taking. The strong support for the pair after the ECB decisions on Thursday and a more hawkish statements by the governor Mario Draghi, supported the expectations of a close tightening on the bank’s monetary policy, as Draghi didn’t specify a date, and only opened way for expectations during the fall of this year. After the comments, expectations of the adjusting the bank’s policy in September’s meeting rose. This direction pushed the EUR/JPY to move towards the peak at 130.26, which is where the pair started on Friday.

The Euro was the best performing currency against the Yen among other pairs that went downward. Establishing above the resistance at 130 supports the upward momentum for the pair. The US inflation data, which were disappointing, also supported the save heaven status of the Yen.

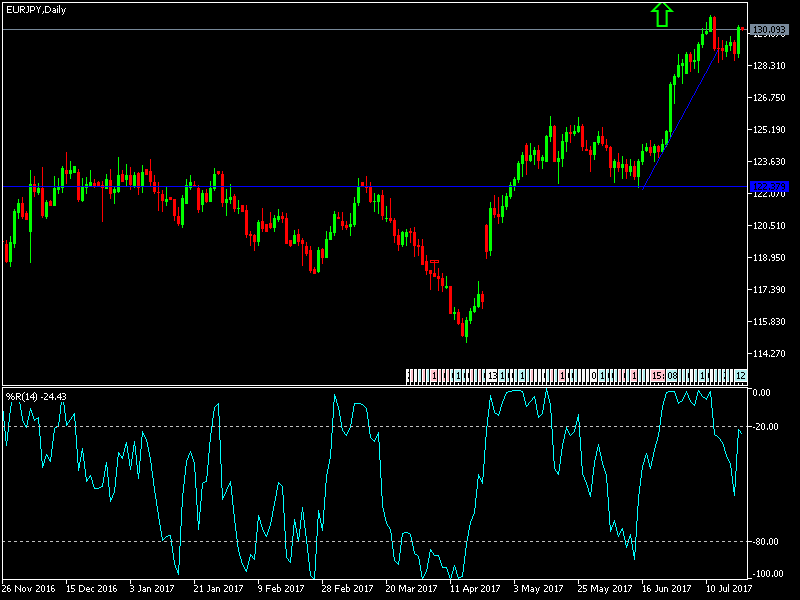

Technically: The EUR/JPY is in an bullish range. Closest resistance areas are currently at 130.00 and 130.60 and 131.55. on the downward side, the nearest support levels are currently at 128.90 and 128.00. We still prefer buying on every downward bounce.

On the economic data front today: The pair is going to be subject to the reactions on the monetary policy announcements of the Bank of Japan and the ECB, with policy variances. This is in addition to any renewed global geopolitical fears at any time, which supports the save heaven assets led by the Japanese Yen.