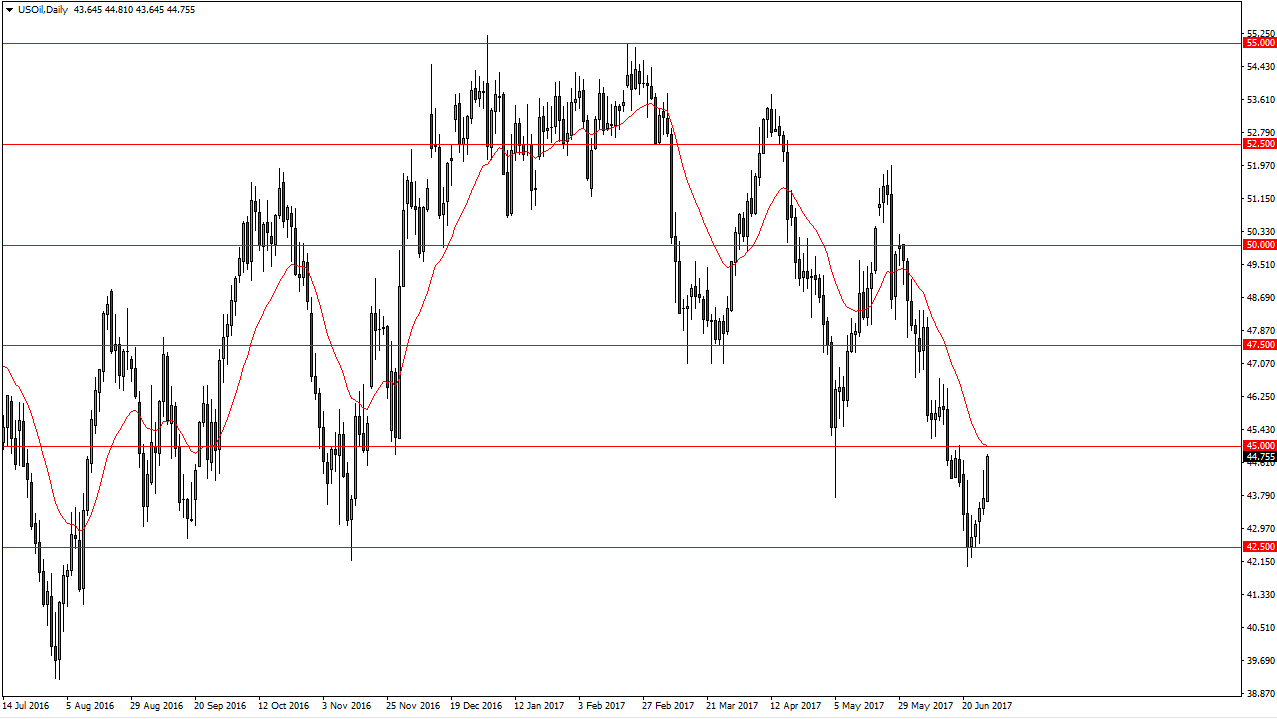

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Wednesday, breaking above the top of the shooting star from the previous session. We are approaching the $45 level, an area that of course has a certain amount of psychological significance, and of course the 50-day exponential moving average. The fact that we close to the very top of the range for the day is a very bullish sign, but we are in a longer-term downtrend. With that in mind, I am a seller only. I’m looking for signs of exhaustion to start taking advantage of, as the oversupply continues to be an issue when it comes to oil. Once I get and exhaustive daily candle, I am short of this market and aiming for the $42.50 level again.

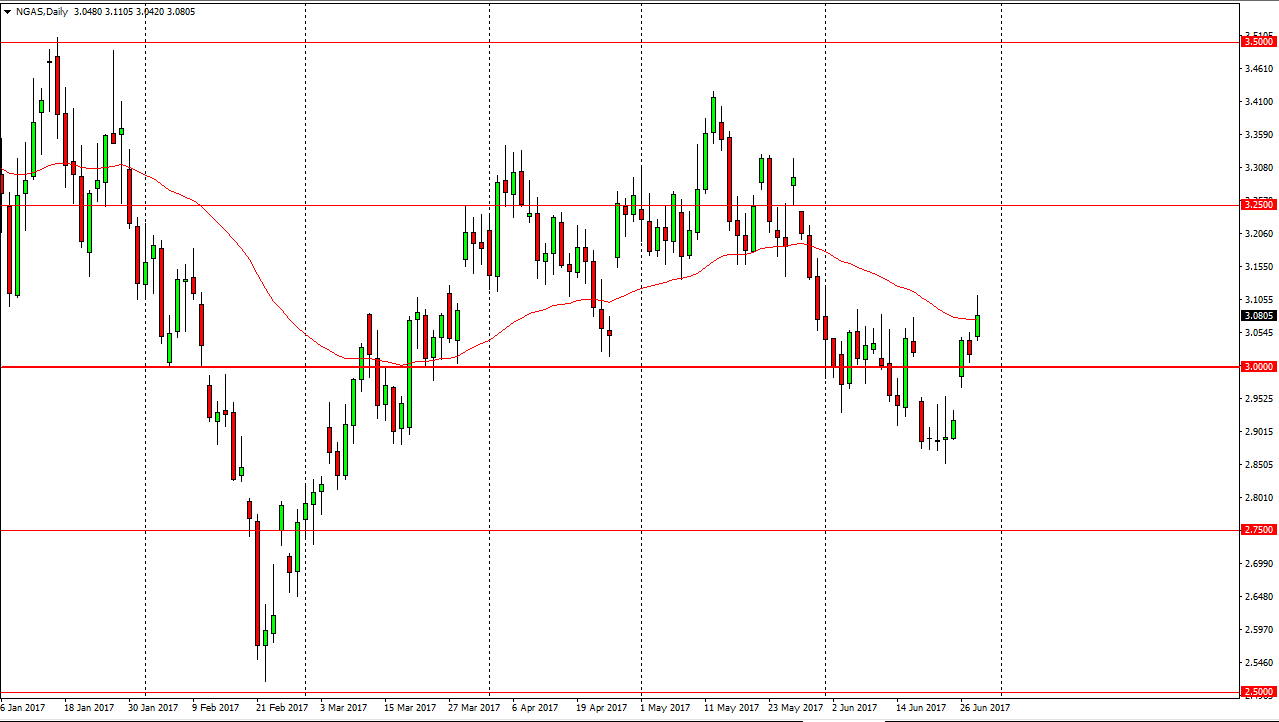

Natural Gas

Natural gas markets rallied during the day, but you can see gave back about half of the candle. By forming a bit of a shooting star, I think that if we can break down below the bottom of the candle for the day, the market should go looking for the $3 level, and then the $2.91 level under that. The longer-term trend is to the downside, and I am still looking to sell as there is a massive oversupply issue when it comes to the natural gas markets. Yes, we do get a little bit of a rally due to the outlook for US temperatures going higher, but in the end, it’s a structural problem that the market is no bullish scenario at all. I believe that selling rallies that show signs of exhaustion will continue to be the way most players in the market approach this situation, and therefore I don’t have any interest in buying and believe that the real money is still going to be made to the downside.