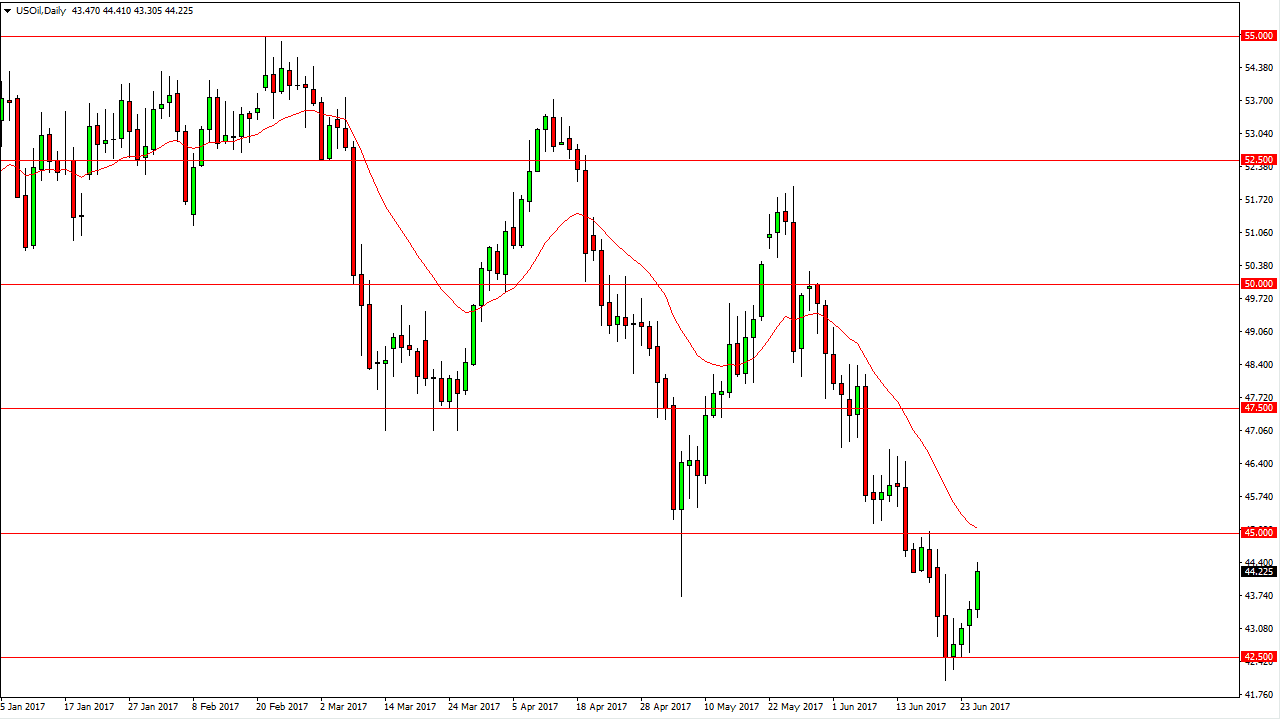

WTI Crude Oil

The WTI Crude Oil market had a positive session on Tuesday, as we continue to grind higher. I think this is more or less going to be a bit of a “dead cat bounce”, so having said that I’m waiting to see some type of exhaustive candle to start selling. The 50-day exponential moving average is near the $45 level, which has previously been supportive. That being the case, I think that we will have selling pressure there. The Crude Oil Inventories announcement comes out today, and that will have an effect on the market. Absently waiting for some type of exhaustion that I can start selling. The higher this market goes, the more interest I have in shorting this market.

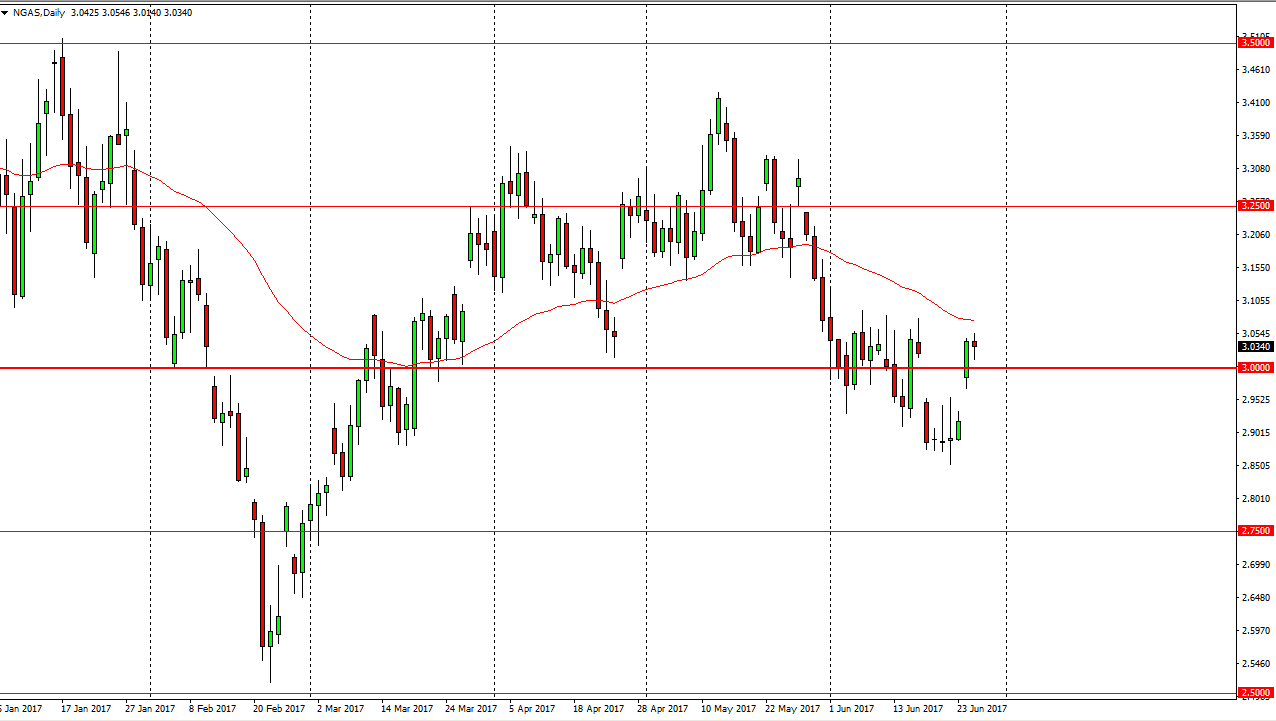

Natural Gas

Natural gas markets went sideways during the day on Tuesday, testing the $3.00 level. That’s an area that has a lot of psychological importance, and because of this I feel that it makes a lot of sense that the markets should continue to find sellers in this general vicinity. If we can break down below the $3.00 level, I feel that the market then goes to the $2.89 level. A breakdown below there send this market looking for the $2.75 level. I don’t have any interest in buying natural gas, because quite frankly we have a massive oversupply. The 50-day exponential moving average is just above current pricing, so it makes sense that the market continues to go lower, and with this being the case I feel that the market should continue to find plenty of reasons to fall, and because of this I have no hesitation in shorting this market. I believe ultimately will go to the $2.50 level, but it may be several months before we get there.