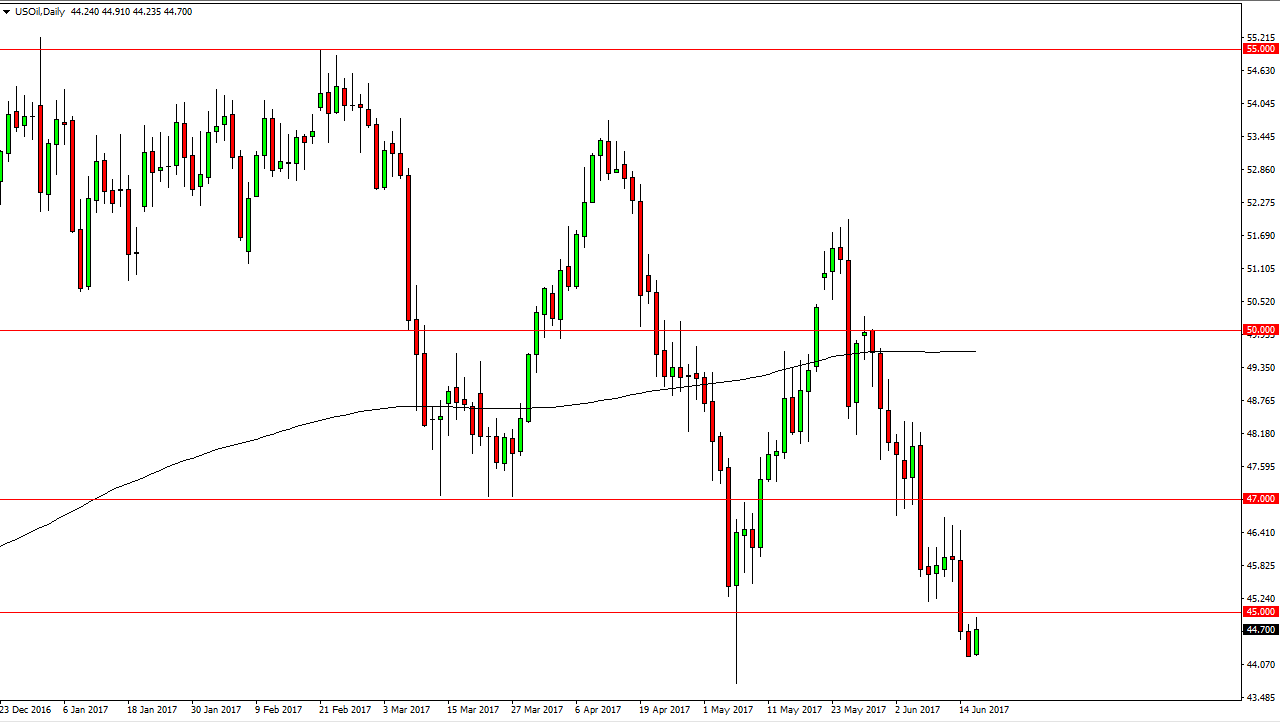

WTI Crude Oil

The WTI Crude Oil market bounced during the session on Friday, reaching towards the $45 level above. That is a level that has a certain amount of psychological significance obviously, as it was supportive in the past and of course it’s a large, round, psychologically significant number. If we rally from here, the market will continue to find sellers above, somewhere near the $47 level. An exhaustive candle is exactly what I’m looking forward to start selling, as the market is most certainly bearish in general. I don’t see any reason to try to return to the bullish side of this trade, as it is so bearish in general. Any bounce at this point must be look at as a nice selling opportunity.

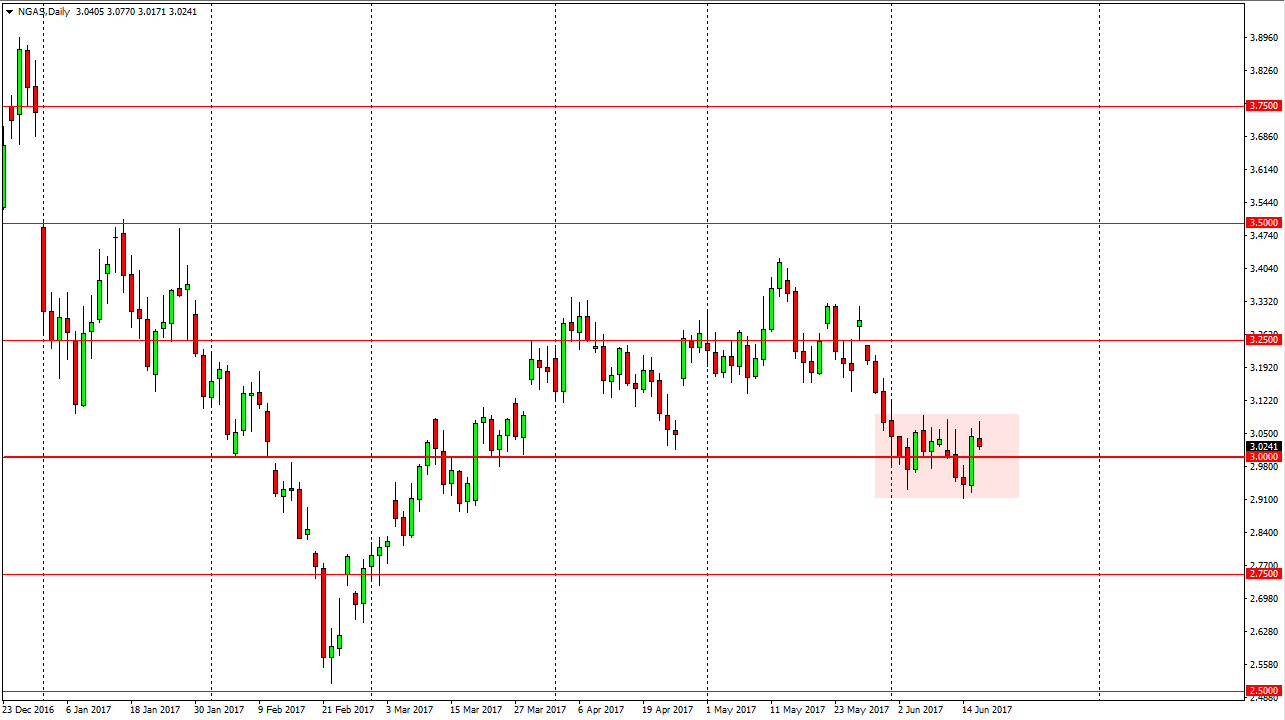

Natural Gas

Natural gas markets tried to rally at the open on Friday, but turned around to form a shooting star. It looks as if we are going to continue the overall consolidation, and therefore could reach towards the $2.90 level below. Ultimately, the market should continue to be relatively choppy, but a breakdown below there should send this market looking to the $2.75 level underneath which is a supportive level, and I think at that point the market would probably drop even further, perhaps reaching towards the $2.50 level after that.

Rallies continue to offer selling opportunities, I have no interest whatsoever and buying this market because there is so much in the way of negative pressure in this market as there is a massive amount of oversupply. The markets continue to struggle with the massive amount of oversupply and trouble lifting value in this commodity. The United States has more than enough natural gas, and although we had a bit of a surprise when the inventory number came out, “less bad” is no investing strategy as far as I can see.