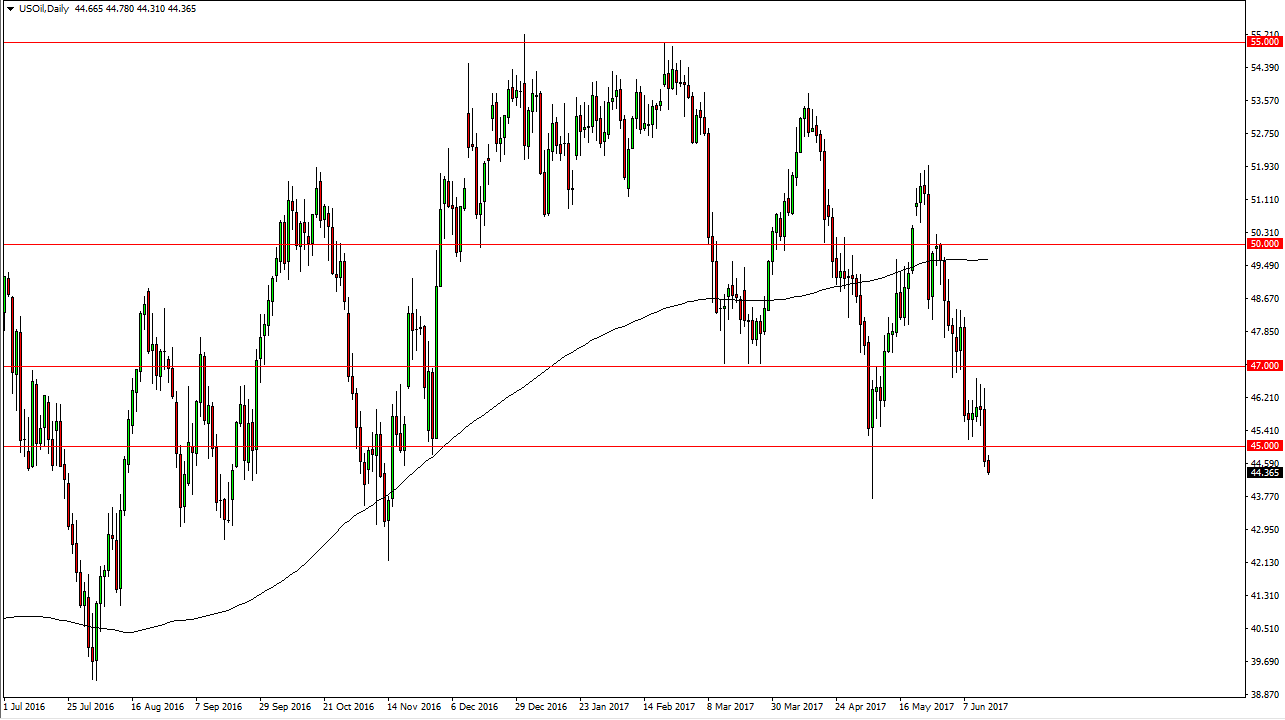

WTI Crude Oil

The WTI Crude Oil market fell again during the day on Thursday, reaching towards the $44 level. I think that given enough time, the sellers will return on any rally’s, and the $45 level above should be resistance. Ultimately, the market continues to be volatile but with a pressure. I think that the $43.50 level underneath is probably where we are heading, and I believe that the oversupply issue in the oil market continues to be a major issue when it comes to this. Given enough time, I expect the market to sell off yet again as we continue to struggle. I think that the market is a long way away from turning around, so therefore I don’t really have a scenario in which a willing to buy, and I believe that the absolute “ceiling” is the $47 level.

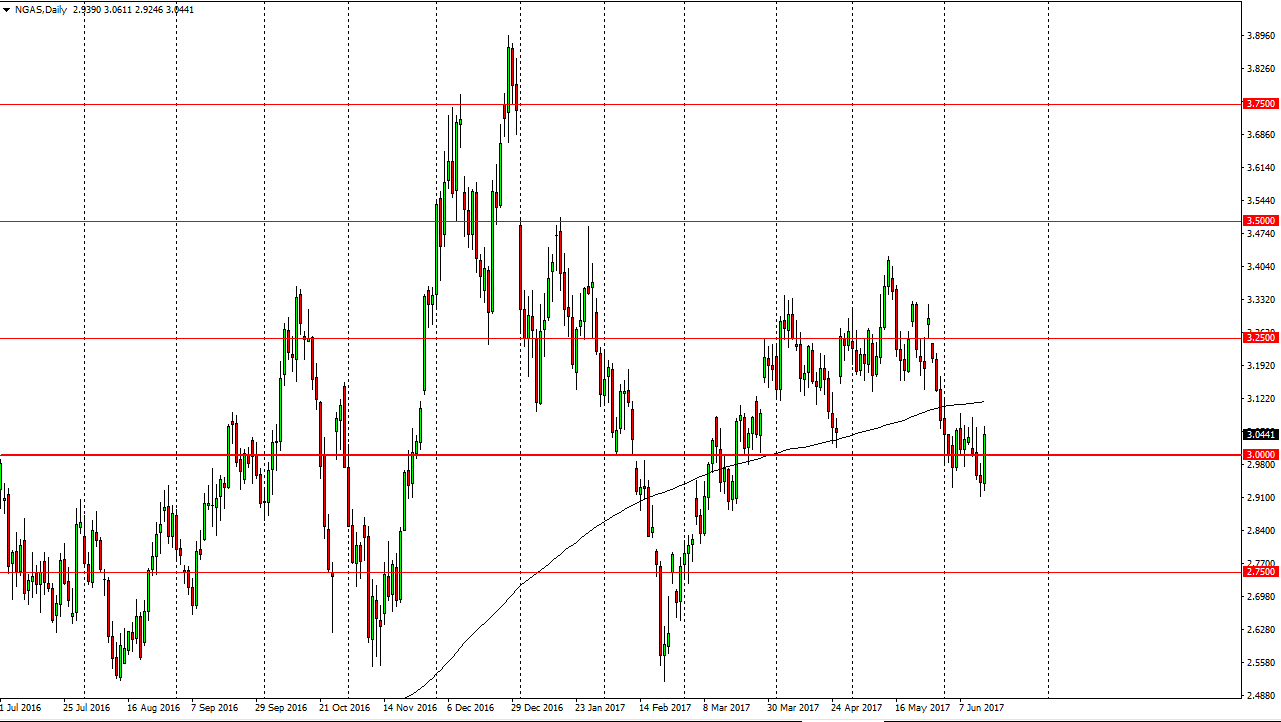

Natural Gas

The natural gas markets broke higher during the day on Thursday, slicing through the $3.00 level. That’s a very bullish sign, but I still see a significant amount of resistance is the bow, especially near the $3.10 level. Because of this, I’m looking for some type of exhaustive candles to start selling again, as a natural gas markets have been oversupplied for some time. Yes, the build in the inventory number was less than originally anticipated, but quite frankly “less bad” is hardly ever a reason to own an asset. Because of this, I feel that it’s only a matter of time before we start selling off again and the first signs of exhaustion will have me shorting this market and aiming for the $2.90 level underneath, and the $2.75 level after that. Buying isn’t even a thought and I believe that the 200-day exponential moving average will continue to offer dynamic resistance as well.