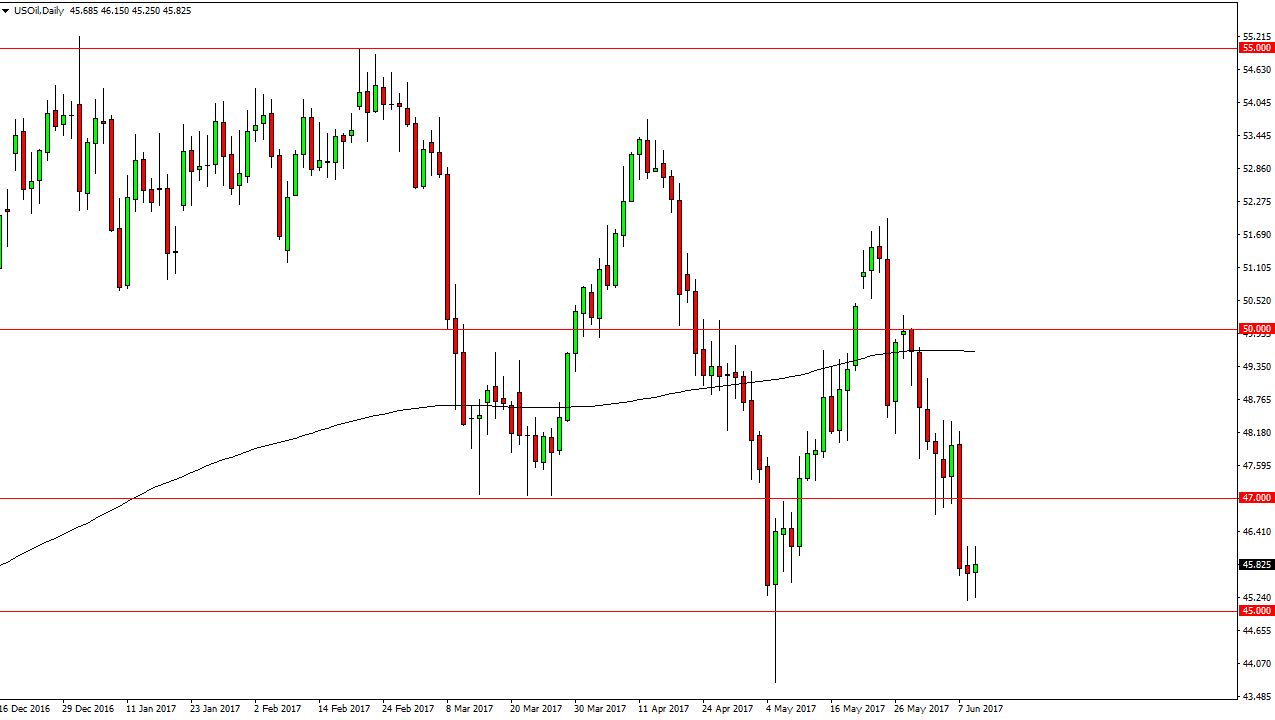

WTI Crude Oil

The WTI Crude Oil market went back and forth during the day on Friday, as we continue to test the $45 level underneath. That’s an area that has offered significant support in the past, so it’s not a surprise that we bounced. We formed a hammer on Friday, just as we formed during the Thursday session. Because of this, I believe that we could rally from here, perhaps reaching towards the $47 level above. Any rally at this point to me would be a selling opportunity, and exhaustive candle near the $47 level could be a nice opportunity to start shorting yet again. Alternately, if we can break down below the $45 level, I think at that point the market will break down to the $43 level relatively quickly. Either way, I don’t have any interest in buying this market.

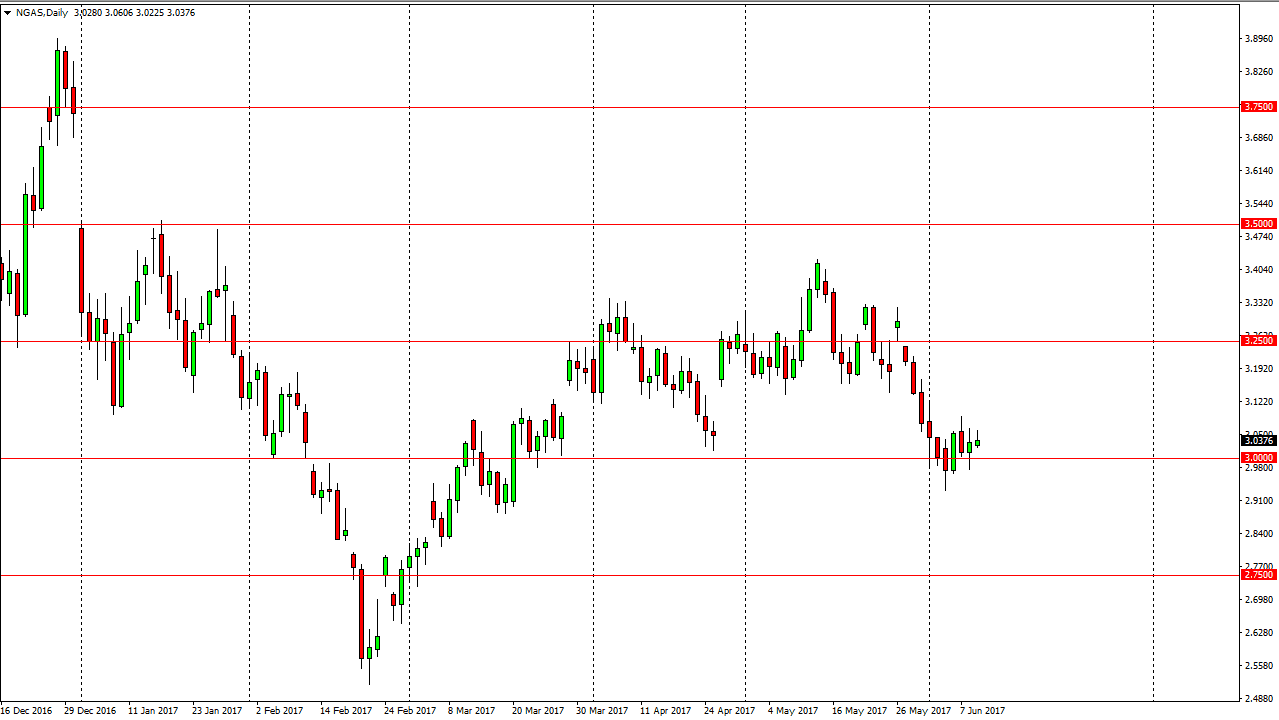

Natural Gas

Natural gas markets did very little during the day on Friday, initially tried to rally but then turning around to show signs of resistance. By forming the exhaustive candle, looks as if we’re going to continue to bounce around the $3 level, and I think that it’s only a matter of time before we would have sellers jump into the market on signs of exhaustion using short-term charts. If we can break down below the $2.95 level, the market will break down to the $2.75 level underneath. Either way, I have no interest whatsoever in buying this market at the moment, but I also recognize that a bounce could happen, and for that matter could offer an opportunity to sell this extraordinarily bearish market from even higher levels. With that being the case, I’m looking for selling opportunities going forward, and I believe that the seasonality of natural gas will continue to work against the price of it.