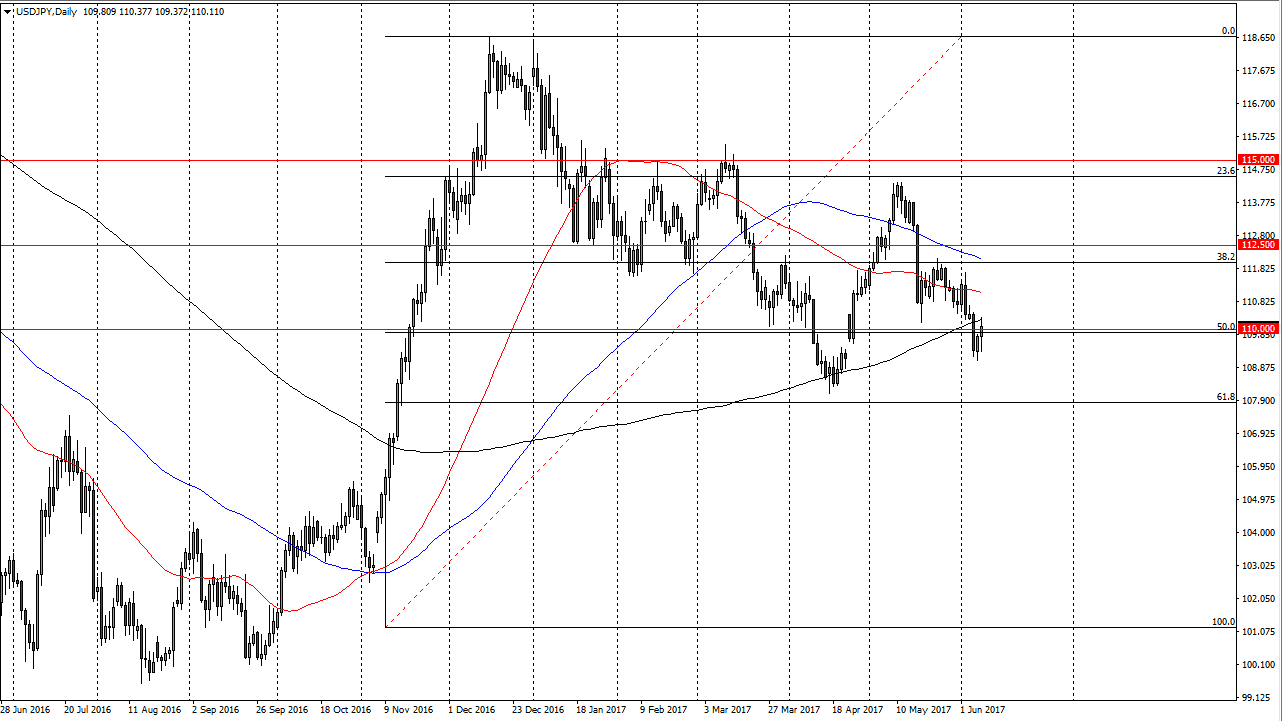

USD/JPY

The US dollar initially fell against the Japanese yen, as we continue to see bearish pressure, but there is a gap that has now been filled from a couple of months ago, and the market has gone to test the 200-exponential moving average. We did not break above it yet, but I think if we can break above the top of the range for the Thursday session, that shows that the market is ready to turn around and continue to go higher. If that happens, I expect that the 112 level will be targeted next, and that we may go even higher than that. Alternately, if we break down below the Wednesday lows, then I think the market goes looking for the 61.8% Fibonacci retracement level just below. Either way, I would expect a bit of volatility and given the fact that we got through Thursday relatively unscathed despite the UK elections, the ECB announcement, and the Congressional hearings, the buyers may be a bit more comfortable now.

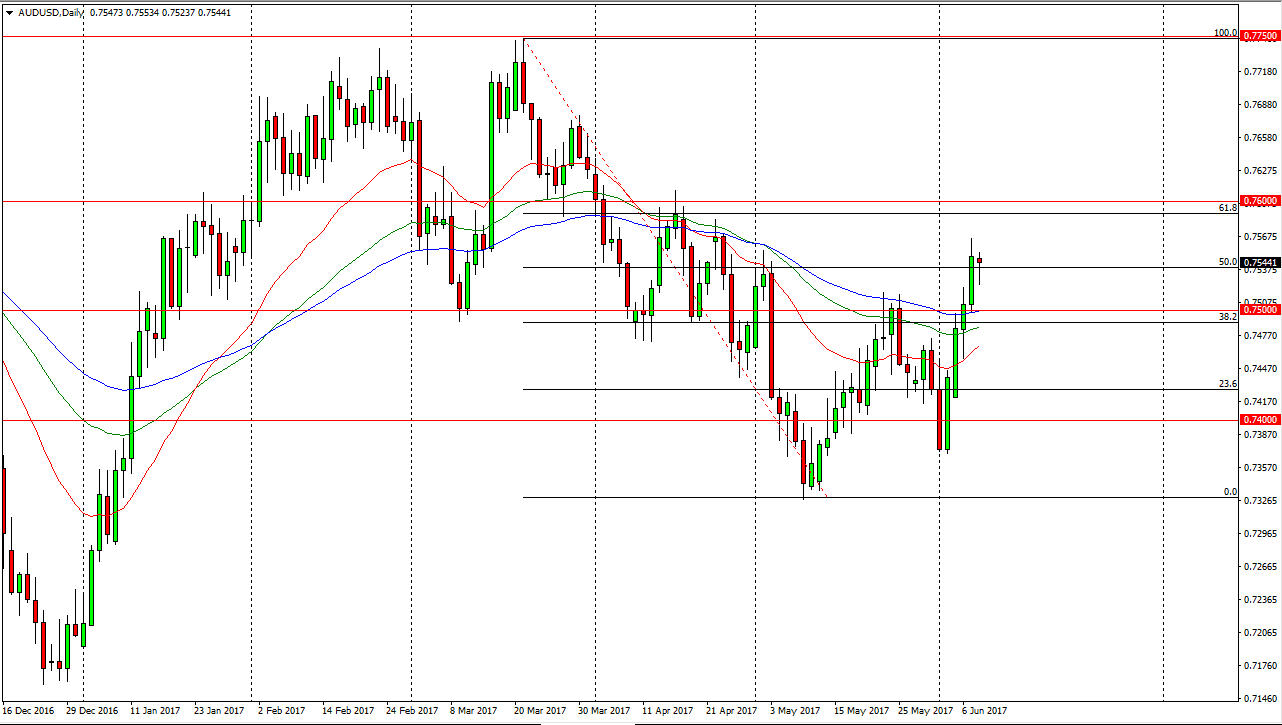

AUD/USD

The Australian dollar initially fell on Thursday but found support at the previous resistance barrier, and turned around to form a hammer. Because of this, it’s likely that the buyers may return, and I believe a break above the top of the range from the session on Thursday sends this market looking for the 61.8% Fibonacci retracement level above, which is just below the 0.76 handle. Ultimately, I think we can break above there as well, and go looking for the 0.7750 level after that. It obviously would take a significant amount of momentum to get up to that level but I think that is where we are going longer term. Most recently, we have made a “higher low”, and that was always a very bullish sign and should send a clear message to traders overall.