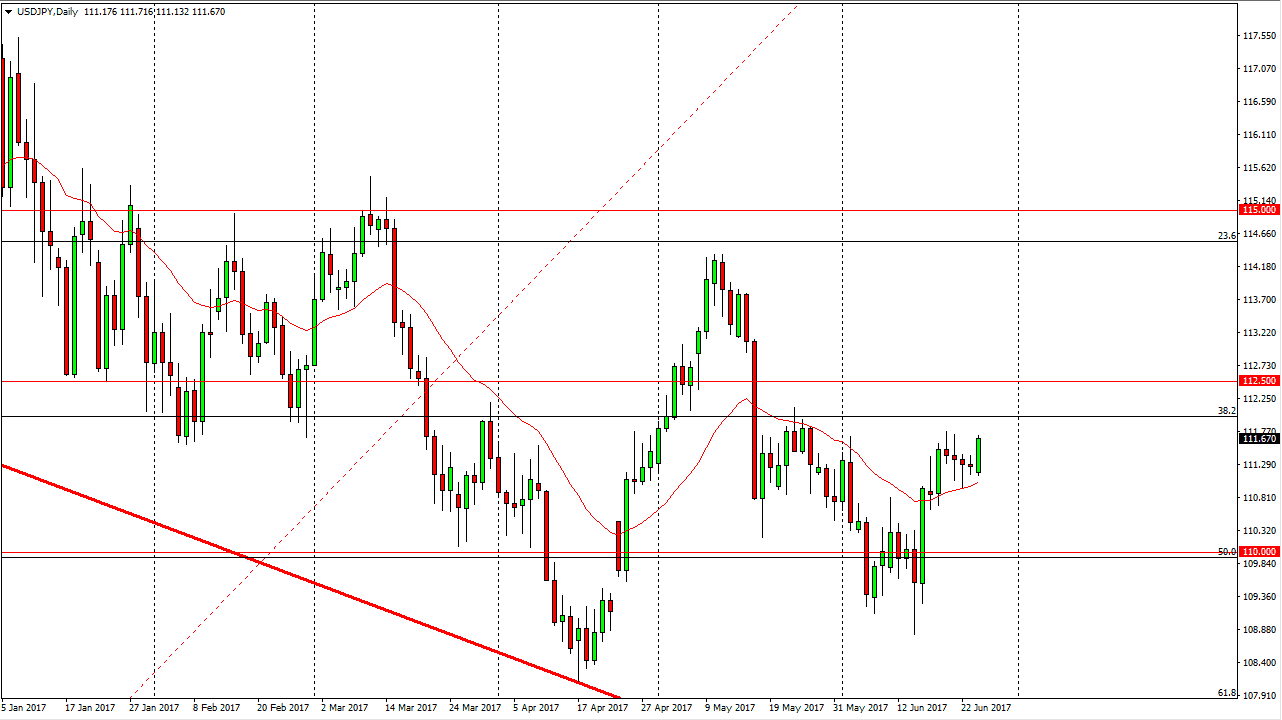

USD/JPY

The US dollar rallied significantly during the day on Monday, reaching towards the 111.75 level. I think we are going to try to grind and break above the 112 handle, sending this market looking for 112.50 and beyond. My longer-term target is the 114 handle, and I think the given enough time we will reach there. It looks as if the market is trying to form enough support and bullish momentum to send this market to the upside. I think that a short-term pullback should be looked at as value, as we have been forming quite a bit of support over the last several sessions. Given enough time, I believe that the market will continue to attract buyers as the Bank of Japan is light years away from doing anything even remotely looking like tightening.

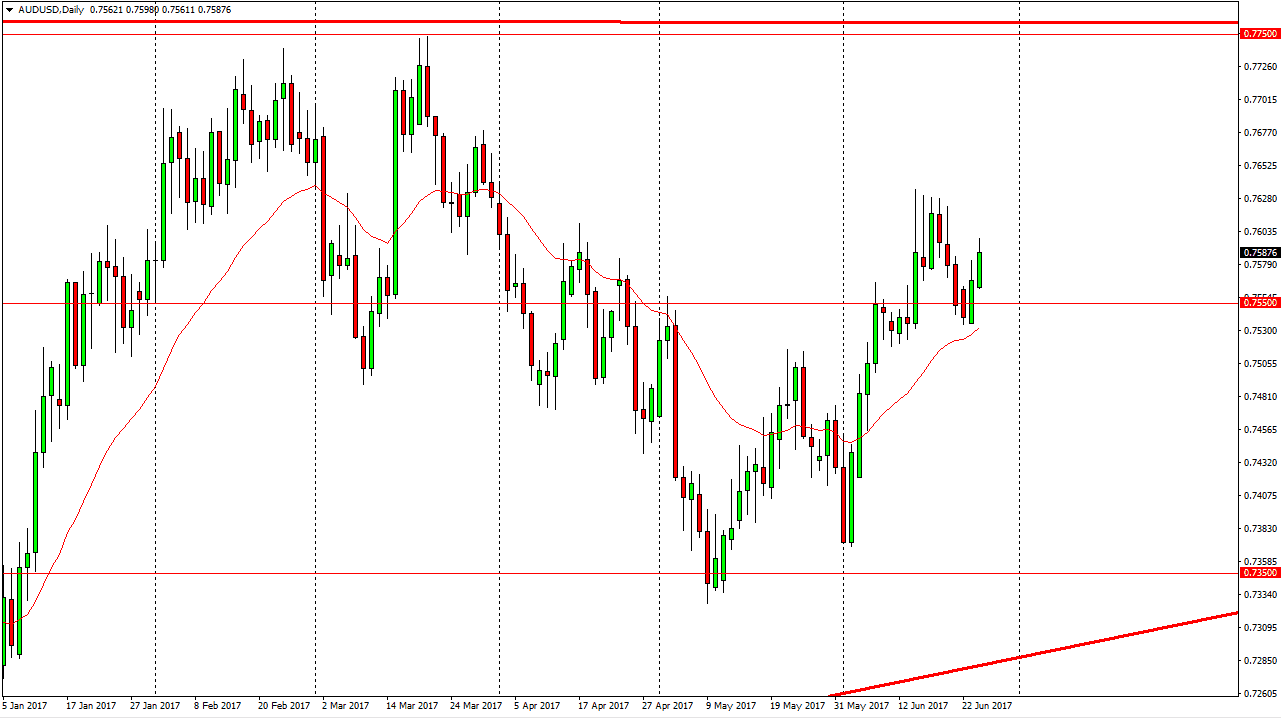

AUD/USD

The Australian dollar rallied during the day on Monday, reaching towards the 0.7650 level. We have not broken above there yet though, so when we do I think at that point it’s a nice buying opportunity. The market should then go looking for the 0.7750 level, and if we can get some help from the gold market, that should be expedited. I don’t like selling, I think there is more than enough support below at the 0.7525 handle to keep the market afloat. Given enough time, the market should continue to reach towards the upside and I look at value as an opportunity to get involved. The market shouldn’t have too many selling opportunities, as the momentum has shifted decidedly to the upside. I think that it will be choppy, but have more of an upward bias than anything else. This keeps me on the long side of the trade in the short term, and perhaps even the longer term.